- SMB Deal Hunter

- Posts

- New Deals: An auto transport company, commercial excavation company, and 3 other finds

New Deals: An auto transport company, commercial excavation company, and 3 other finds

Plus, why you shouldn’t get hung up on the purchase multiple

Hello SMB Deal Hunters!

I’m excited to share 5 new businesses for sale worth checking out. First up…

🔥 Community Top Picks from the Last Issue:

#1: Roofing and exterior contracting company with $581K in EBITDA

#2: HVAC company with $500K in EBITDA

#3: Custom wood and millwork business with $2.35M in EBITDA

Today's issue is sponsored by SMB Diligence, the platform I helped start for matching business buyers with vetted legal counsel and Quality of Earnings providers.

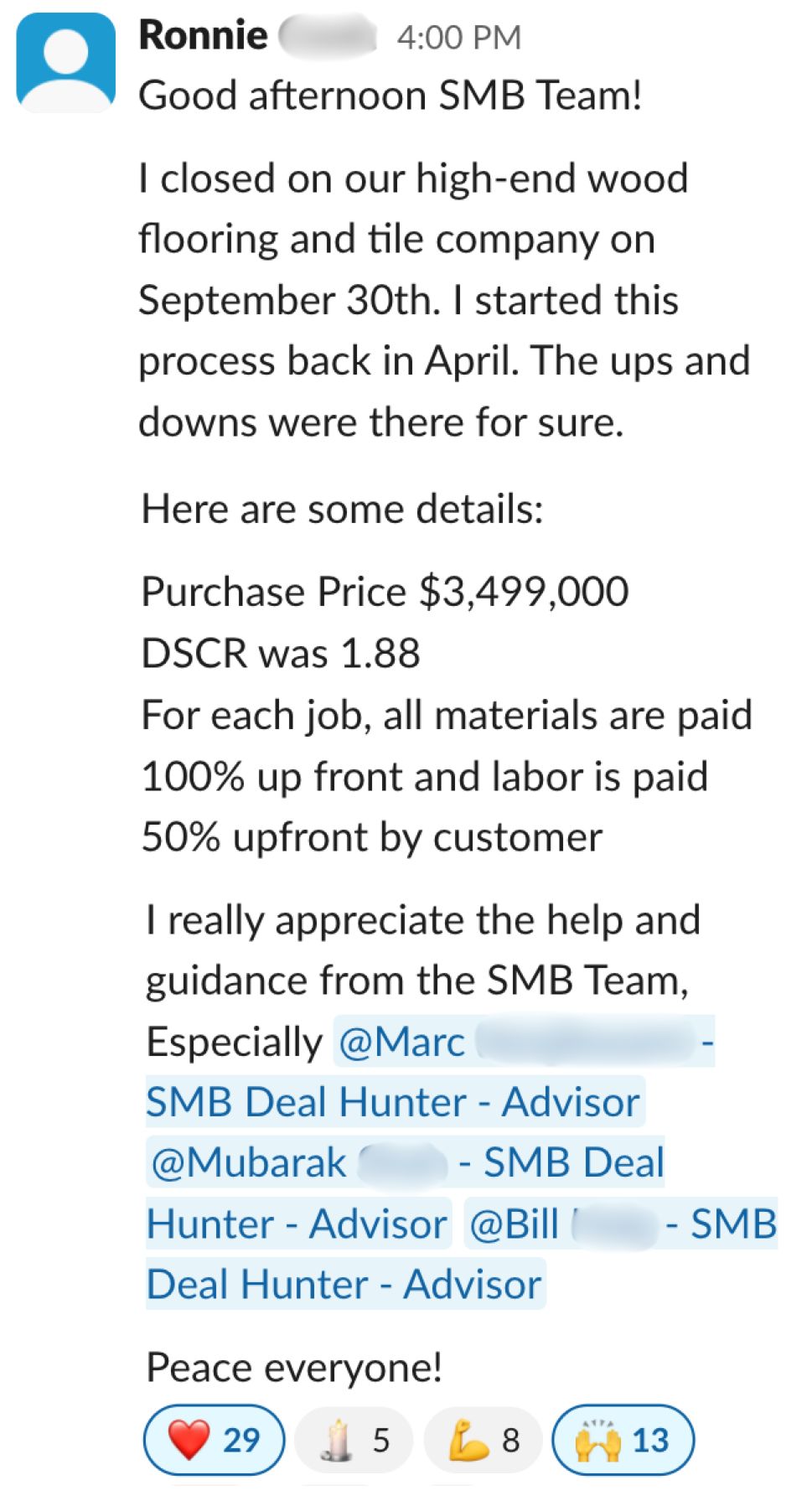

COMMUNITY WINS

Here’s what one SMB Deal Hunter Pro member shared this past week:

Want me and my team to work with you to find, finance, and acquire a million-dollar cash-flowing business in the next 6-12 months?

NEW DEALS

These deals span the country. For custom-sourced deals in your area, click here.

1/ Auto Transport Company

📍 Location: Nevada

💰 Asking Price: $4,750,000

💼 EBITDA: $1,000,000

📊 Revenue: $3,274,836

📅 Established: 2019

💭 My 2 Cents: This semi-absentee trucking company, headquartered in Las Vegas, specializes in automotive transport for dealerships, auctions, logistics firms, and private clients across the Western United States. What’s great about dealers and auctions as clients is the recurring demand as they can anchor volume with weekly runs, while private clients provide higher margins. Plus, even in slower retail markets, vehicles still trade between locations. I really like their strong margins for an asset-heavy business and the remote structure that offers flexibility for a new owner, whether they want to be hands-on and scale up or own it more passively as a cash-flowing asset. They operate with a lean team of seven (two full-time, five contract) and include $1M of trucks and trailers. Given its importance, I’d need detailed information on the fleet, including condition, projected lifespan, and annual maintenance costs. I’d also want to understand the revenue split between recurring contracts and one-time shipments, whether there are a few anchor customers driving the bulk of revenue, and the payment terms offered to large accounts (net-30/45/60) since that could impact cash flow and increase working-capital requirements. The good news is the business is already SBA pre-approved for up to 85% financing, and the owner is open to an extended transition.

2/ Commercial Excavation Company

📍 Location: Florida

💰 Asking Price: $1,999,999

💼 EBITDA: $816,574

📊 Revenue: $4,105,204

📅 Established: 2004

💭 My 2 Cents: What I like about excavation is that it’s essential at the very start of any construction project. You can’t install utilities or pour foundations until the dirt work is complete, so these companies get paid earlier in the project, which helps with cash flow and managing receivables compared to subcontractors who come in later. This 21-year-old excavation company provides comprehensive site services, including lot clearing, grading, fill dirt delivery, and material removal for both commercial and residential clients. They consistently rank in the top 5% of their field, generate approximately 80% of their revenue from repeat customers, and while this industry can slow during recessions, they’re located in a three-county region in Florida that has historically seen major development growth. Plus, their extremely strong asset base, consisting of heavy machinery, trucks, and related equipment, is valued at over $2.2M, which is more than the asking price of the entire business. I’d need to dig into the valuation calculation (book vs. market vs. resale), but if these assets are really worth that much, there’s a great downside backstop here. I’d also be curious about their split between residential and commercial work (residential slows faster in downturns), whether they’re reliant on a few GCs for most of their work, if projects are bid-based or negotiated, who handles estimating and bidding, and what their current backlog and pipeline look like.

3/ Marketing Agency for Law Firms

📍 Location: Florida

💰 Asking Price: $5,500,000

💼 EBITDA: $1,011,542

📊 Revenue: $2,718,224

📅 Established: 2008

💭 My 2 Cents: The legal vertical is notoriously difficult to penetrate for marketing agencies due to high customer acquisition costs and strict compliance nuances, so I was excited to come across this business for sale. This lead generation agency connects law firms to a national directory averaging 70,000 daily visitors. Their dual-revenue model involves charging attorneys for promoted placement within targeted search parameters, while also offering SEO, website development, and content marketing services. They have 300+ active clients, an 80% client retention rate, and an average client relationship of over five years — incredibly rare for marketing agencies. They also own 66 premium domains that strengthen SEO authority and lead generation performance. However, I’d need to analyze the revenue split between directory listings and agency services, evaluate their dependence on Google’s organic search traffic, and understand which types of law firms they serve (since consumer-facing practices like personal injury tend to pay the most for leads and visibility due to their high client lifetime value). I’d also want to learn more about their team structure and delivery systems, including whether core functions are handled in-house or outsourced and how client onboarding, reporting, and account management are managed operationally.

PRESENTED BY SMB DILIGENCE

Here’s Why You Shouldn’t Skip Due Diligence…

A friend of mine put a business under LOI and asked me for my advice.

I recommended he contract a 3rd party due diligence partner to rebuild the company's P&L from scratch.

Turns out their EBITDA was off by 2x 😳

Enter SMB Diligence.

SMB Diligence is the platform I helped start for matching business buyers with vetted diligence providers, from M&A lawyers to Quality of Earnings providers.

Their network of experts has worked on hundreds of small business transactions (including many from the SMB Deal Hunter community).

4/ Daycare Center

📍 Location: Maryland

💰 Asking Price: $2,900,000

💼 EBITDA: $844,000

📊 Revenue: $2,844,000

📅 Established: 2016

💭 My 2 Cents: Daycares benefit from strong tailwinds as dual-income households and demand for early education continue to grow. I also like that parents typically pay tuition in advance, creating recurring and predictable monthly revenue. This Maryland-based franchise daycare center caught my eye with its standout revenue and earnings for the industry. I really like their robust team of 32 full-time employees (staffing can be a challenge in childcare), newly redesigned facility with a lease secured through 2040, and the brand recognition and curriculum support provided by the franchisor. I’d want to look into their licensed capacity versus average daily enrollment, how their pricing and programs compare with nearby competitors, what percentage of families use subsidized childcare or state funding, teacher turnover, how long their waitlists are, and enrollment seasonality. It’s also important to understand whether the Maryland county or city they’re in is expanding public Pre-K access or lowering the start age, and what percentage of enrollment comes from 3–5-year-olds versus under-3s. What’s great is that SBA lenders are generally comfortable with franchise childcare models, which can make financing more accessible.

5/ Government IT Consulting Firm

📍 Location: Massachusetts

💰 Asking Price: $1,800,000

💼 EBITDA: $537,351

📊 Revenue: $1,150,557

📅 Established: 2001

💭 My 2 Cents: This Northeast-based IT company focuses on technology consulting and related services for government clients. They maintain long-term contracts with six state agencies, some extending over two decades, providing consistent recurring revenue and operational stability. Additionally, they’re a preferred vendor under a statewide technology services contract, placing them among an exclusive pool of roughly 50–70 qualified bidders, which offers limited competition for government engagements. They have a lean cost structure driving very strong margins, while their long-standing government relationships provide defensibility and insulation from market volatility. Plus, being a preferred vendor under a statewide IT contract is a major moat that can take years of compliance approvals, background checks, and performance history to qualify for. I’d want to dig into how often their long-term contracts renew, whether any single agency represents more than 25–30% of revenue, and who manages the government relationships. What’s great is that once you’re approved in one state, similar contracts in other states can often be added with reduced friction by leveraging your past performance record. While this deal is ideal for someone with an IT background, the seller is open to providing up to two years of transition support customized to the buyer’s needs.

THE BEST OF SMB TWITTER (X)

Explanation of new SBA rules on business expansion (link)

2 biggest cost levers for SMBs (link)

Dealing with the typical financial issues (link)

A common high-pressure broker tactic (link)

How to break out from $2-$3M revenue in the trades (link)

Why you shouldn’t get hung up on the purchase multiple (link)

What business you are actually in (link)

Non-recourse vs recourse debt (link)

COMMUNITY PERKS

• Ready to buy and operate a $1M+ business? Partner with my team and get expert support at every step.

• Want to invest passively in SMB acquisitions? Get access to investment opportunities.

• Get a personal introduction to my preferred SBA 7(a) lender, non-SBA lenders, Quality of Earnings providers, or legal counsel

• Raising capital for your deal? I’ll connect you with investors from the SMB Deal Hunter Community.

• Interested in selling your business? I’ll help you connect with buyers from the SMB Deal Hunter Community.

RECENT PODCAST EPISODES

• From Laid Off & Mid-Divorce -> $1.3M / Yr Business (link)

• This Software Engineer bought a $3.2M business with a baby on the way (link)

• He turned $100k -> $6M buying landscaping businesses (here's how) (link)

THAT’S A WRAP

See you next Tuesday!

-Helen Guo

Find Me On Twitter

Find Me On LinkedIn

P.S. I'd love your feedback. Tap the poll below or reply to this email.

How was today's newsletter? |

Disclaimer

This publication is a newsletter only and the information provided herein is the opinion of our editors and writers only. Any transaction or opportunity of any kind is provided for information only; SMB Deal Hunter does not verify nor confirm information. SMB Deal Hunter is not making any offer to readers to participate in any transaction or opportunity described herein.