- SMB Deal Hunter

- Posts

- New Deals: An auto event services business, artificial turf installation business, and 3 other finds

New Deals: An auto event services business, artificial turf installation business, and 3 other finds

Plus, the next big boring business (and how to get in before PE does)

Hello SMB Deal Hunters!

I’m excited to share 5 new businesses for sale worth checking out. First up…

🔥 Community Top Picks from the Last Issue:

#1: Landscaping company with $1.2M in EBITDA

#2: Residential and commercial plumbing company with $727K in EBITDA

#3: Short term rental property manager with $570K in EBITDA

Today's issue is sponsored by SMB Diligence, the platform I helped start for matching business buyers with vetted legal counsel and Quality of Earnings providers.

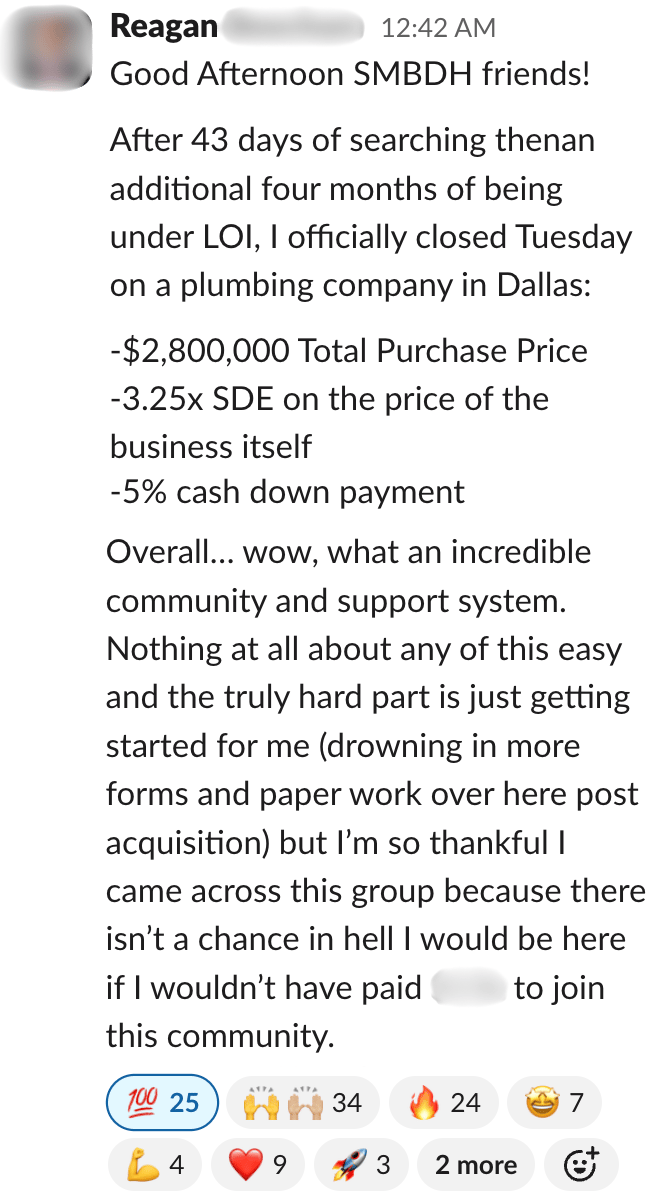

COMMUNITY WINS

Here’s what one SMB Deal Hunter Pro member shared this past week:

Want me and my team to work with you to find, finance, and acquire a million-dollar cash-flowing business in the next 6-12 months?

NEW DEALS

These deals span the country. For custom-sourced deals in your area, click here.

1/ Niche Auto Event Services Business

📍 Location: California

💰 Asking Price: $3,850,000

💼 EBITDA: $1,117,234

📊 Revenue: $4,886,269

📅 Established: 1990

💭 My 2 Cents: The riches are in the niches, and this specialized company proves it. In operation for over 30 years, they provide auto-related event services and support to Fortune 500 clients nationwide. They likely produce test drive experiences, manage auto shows and exhibits, oversee brand activations, and coordinate consumer engagement programs (capabilities that OEMs, auto suppliers, and agencies don’t want to build in-house). This niche creates sticky client relationships and recurring revenue, especially given how difficult it is to get on vendor lists of F500s, who typically stick with the same partners year after year. I like that the business is led by an experienced management team that handles all day-to-day operations and intends to stay post-transaction (they are fully capable of running the business without owner involvement). I’d dig into client concentration risk from the top F500s, strength of the pipeline, percentage of events that recur annually, and event-level P&Ls to understand margin by event type. Overall, this looks like an excellent hands-off, turnkey opportunity.

2/ Auto Body Shop

📍 Location: Minnesota

💰 Asking Price: $3,000,000

💼 EBITDA: $1,116,440

📊 Revenue: $3,590,308

📅 Established: 2003

💭 My 2 Cents: People get into car accidents in any economic cycle, and with most repairs covered by insurance, demand translates into steady, reliable cash flow. This high-volume business comes fully staffed with 12 experienced employees and operates out of a 27,000 sq ft facility valued at $2.7M (available separately for purchase). I like their 20+ year track record, modern equipment and technology, and the limited local competition (especially since auto body shops are costly and difficult for new entrants to establish). I also like how their cash flow appears sufficient to support the debt required to buy the business and real estate with an SBA loan. That said, I’d want to understand the percentage of work from retail walk-ins vs. insurance referrals, if there are any DRP (Direct Repair Program) agreements in place with major insurers (which would provide reliable recurring referrals), how strong their online presence is (check reviews and SEO), the current throughput vs. max facility capacity, and whether the technicians intend to stay (given the shortage of skilled auto body workers). The seller is offering financing, and if they’re not already, there could be growth opportunities in securing fleet contracts, marketing direct-to-consumer, and expanding into mechanical or glass services.

3/ Artificial Turf Installation Business

📍 Location: New Mexico

💰 Asking Price: $2,490,000

💼 EBITDA: $907,044

📊 Revenue: $5,819,761

📅 Established: 2002

💭 My 2 Cents: I like the macro tailwinds supporting this artificial turf business, as increasing demand for water conservation in the Southwest makes synthetic turf an appealing alternative to natural grass. The 15-person company installs turf for residential lawns, commercial properties, and sports fields across New Mexico and Southwest Texas. They have a diversified customer base, with 72% of revenue from commercial work, 25% from residential, and 3% from putting greens. Though it's a project-based business, I like that they are heavily skewed towards commercial work, which drives a growing base of repeat clients (20% of revenue). They currently have more than $6.4M in open bids that could carry them well into next year, with 2025 projections expected to exceed their strong 2024 performance. They also recently purchased a specialized SMG turf maintenance machine, making them the only provider in the region with this capability and positioning them to capture recurring revenue through annual service contracts with schools, municipalities, and sports complexes. I’d want to understand their historical bid win rate, the makeup of their backlog, and how they generate leads on the residential side (SEO, digital ads, referrals, word of mouth). The asking price looks reasonable relative to performance, and with continued growth in youth and recreational sports, there appears to be meaningful upside.

PRESENTED BY SMB DILIGENCE

Here’s Why You Shouldn’t Skip Due Diligence…

A friend of mine put a business under LOI and asked me for my advice.

I recommended he contract a 3rd party due diligence partner to rebuild the company's P&L from scratch.

Turns out their EBITDA was off by 2x 😳

Enter SMB Diligence.

SMB Diligence is the platform I helped start for matching business buyers with vetted diligence providers, from M&A lawyers to Quality of Earnings providers.

Their network of experts has worked on hundreds of small business transactions (including many from the SMB Deal Hunter community).

4/ Demolition Company

📍 Location: Colorado

💰 Asking Price: $4,900,000

💼 EBITDA: $1,256,000

📊 Revenue: $5,386,000

📅 Established: 1997

💭 My 2 Cents: This 28-year-old Colorado demolition contractor should benefit from the ongoing construction, redevelopment, and urban renewal along the Front Range that is home to nearly 85% of Colorado's population. They have a strong presence in both the commercial (80%) and residential (20%) markets and operate as a regional leader with a 50-person team. That’s not an easy scale to reach, as demolition requires specialized equipment, permits, disposal access, and strict compliance with environmental regulations. Though revenue is project-based, contractors like this often work with the same GCs, municipalities, and developers, creating repeat revenue opportunities. That said, I’d want to dig into any client concentration, their current contracted backlog and historical bid win rates, the age and condition of their $500K equipment fleet and upcoming capex needs, and any environmental liabilities. This is an impressive cash producer, with clear upside in expanding into complementary services such as recycling, materials recovery, or hazardous material abatement.

5/ Drain & Plumbing Service

📍 Location: Massachusetts

💰 Asking Price: $2,600,000

💼 EBITDA: $600,000

📊 Revenue: $1,700,000

📅 Established: 2001

💭 My 2 Cents: This drain and plumbing service company serves a balanced mix of residential (60%) and commercial (40%) clients, but what stands out is that half of their commercial revenue comes from recurring contracts with institutional clients such as hospitals, schools, and utilities, which is rare in the plumbing industry. The business runs 24/7, provides lifetime service guarantees, and benefits from steady referrals due to its strong reputation and reliability. I like their specialized offerings (trenchless repairs, hydro-jetting, camera inspections, and grease trap compliance) that set them apart from competitors, along with the $600K in assets included in the sale. I’d want to understand their contract terms and renewal rates, whether there is any customer concentration on the commercial side, how residential leads are generated (SEO, referrals, Angi/HomeAdvisor, etc.), the mix of emergency service calls vs. scheduled maintenance, whether anyone besides the owner holds a licensed master plumber designation, and what technician turnover looks like. The company also benefits from regulatory tailwinds, as aging infrastructure in the Northeast is driving municipalities and utilities to upgrade, replace, or line pipes to meet EPA and MassDEP standards.

THE BEST OF SMB TWITTER (X)

Pick investors with these 4 realistic expectations (link)

8 business models you should think twice about before buying (link)

Thoughts on boomer-owned businesses (link)

The next big boring business, and how to get in before PE does (link)

An example of when to run from a deal (link)

Payroll is an investment, not a cost (link)

Focus on Return on Hassle (link)

COMMUNITY PERKS

• Ready to buy and operate a $1M+ business? Partner with my team and get expert support at every step.

• Want to invest passively in SMB acquisitions? Get access to investment opportunities.

• Get a personal introduction to my preferred SBA 7(a) lender, non-SBA lenders, Quality of Earnings providers, or legal counsel

• Raising capital for your deal? I’ll connect you with investors from the SMB Deal Hunter Community.

• Interested in selling your business? I’ll help you connect with buyers from the SMB Deal Hunter Community.

RECENT PODCAST EPISODES

• He bought a $1.3M business with just $15k (here's how) (link)

• What to do when almost everything goes wrong (and still build a $4.6M business) (link)

• He Left Corporate to Buy a Pallet Company. Then He Doubled It. (link)

THAT’S A WRAP

See you tomorrow with a new podcast episode!

-Helen Guo

Find Me On Twitter

Find Me On LinkedIn

P.S. I'd love your feedback. Tap the poll below or reply to this email.

How was today's newsletter? |

Disclaimer

This publication is a newsletter only and the information provided herein is the opinion of our editors and writers only. Any transaction or opportunity of any kind is provided for information only; SMB Deal Hunter does not verify nor confirm information. SMB Deal Hunter is not making any offer to readers to participate in any transaction or opportunity described herein.