- SMB Deal Hunter

- Posts

- New Deals: A supplement co-manufacturer, property management company, and 3 other finds

New Deals: A supplement co-manufacturer, property management company, and 3 other finds

Plus, the deadline to close an SBA-financed acquisition before year-end

Hello SMB Deal Hunters!

I’m excited to share 5 new businesses for sale worth checking out. First up…

🔥 Community Top Picks from the Last Issue:

#1: Landscaping company with $1.96M in EBITDA

#2: HVAC contractor with $768K in EBITDA

#3: Electrical contractor with $2.19M in EBITDA

Today's issue is sponsored by SMB Diligence, the platform I helped start for matching business buyers with vetted legal counsel and Quality of Earnings providers.

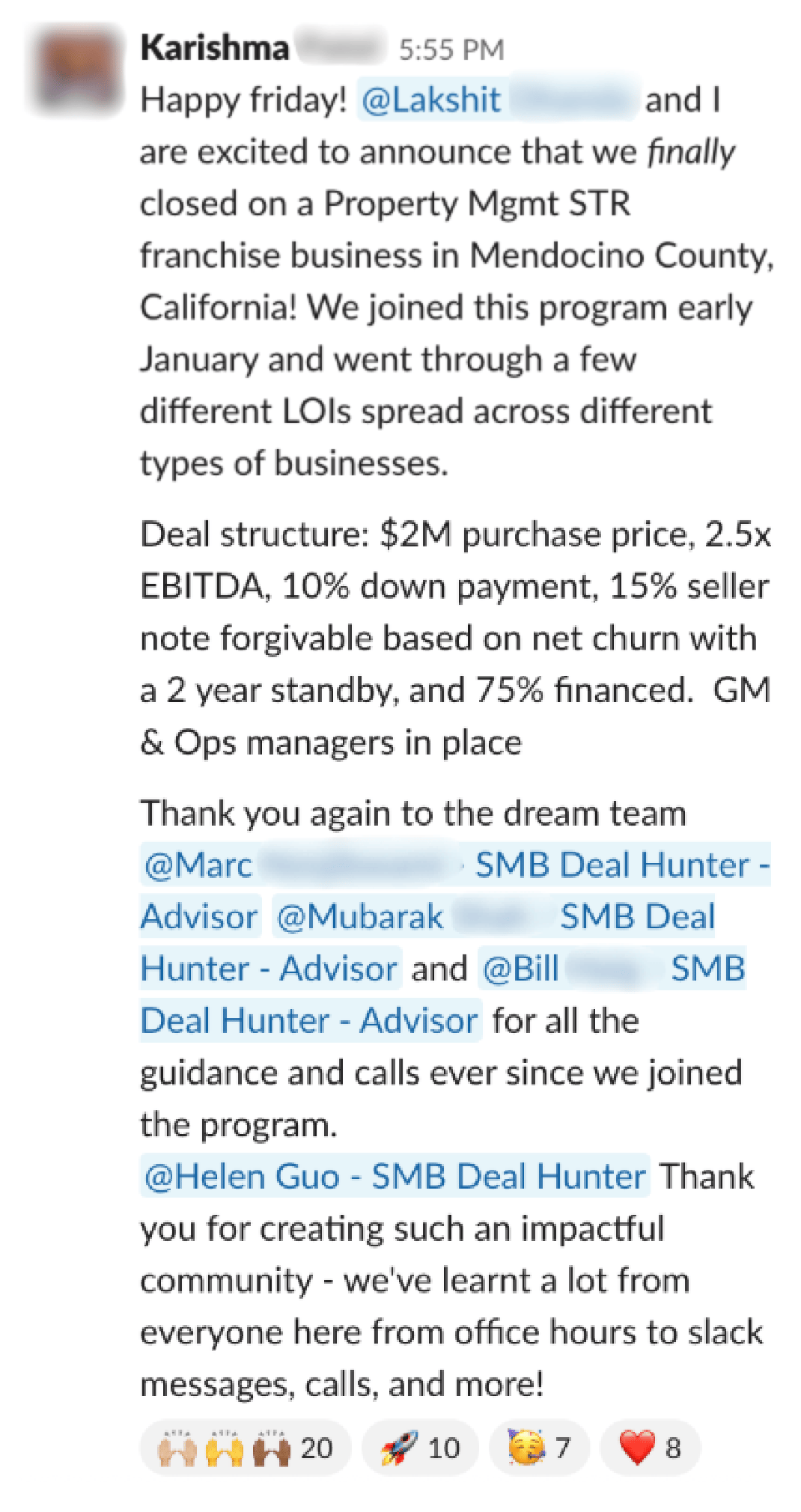

COMMUNITY WINS

Here’s what one SMB Deal Hunter Pro member shared this past week:

Want me and my team to work with you to find, finance, and acquire a million-dollar cash-flowing business in the next 6-12 months?

NEW DEALS

These deals span the country. For custom-sourced deals in your area, click here.

1/ Supplement Co-Manufacturer

📍 Location: Florida

💰 Asking Price: $4,900,000

💼 EBITDA: $1,300,000

📊 Revenue: $4,000,000

📅 Established: 1997

💭 My 2 Cents: I really like contract manufacturers (companies that make products on behalf of other brands) because they can serve a diverse client base without being tied to a single end market or brand. That diversification adds stability compared to owning one product line. Plus, their customers tend to be sticky due to high switching costs (long formulation cycles, validation runs, stability testing, and packaging requirements). This supplement co-manufacturer produces custom vitamins, dietary supplements, keto products, and nutritional blends for clients ranging from health food stores to major drug chains. They operate out of a modern 25,000 sq. ft. facility, hold full certifications (FDA, GMP/NSF) with an A+ rating from the Natural Products Association, employ 38 people under a seasoned leadership team with 75+ years of combined experience, and come with $1.2M in FF&E and $250K in inventory. I’d want to dig into revenue by customer (and any concentration risk) as well as contract terms, including whether raw material cost increases can be passed on to customers, MOQs/lead times, termination clauses, and formulation IP ownership. With excess production capacity and steady growth in health and wellness driven by an aging population and rising focus on preventative health, this looks like a profitable turnkey platform with significant upside potential.

2/ Property Management Company

📍 Location: Georgia

💰 Asking Price: $3,140,000

💼 EBITDA: $722,748

📊 Revenue: $1,237,006

📅 Established: 2019

💭 My 2 Cents: Short-term rental management is one of the most compelling models in real estate today, with asset-light operations, recurring revenue, and built-in scalability. This Atlanta-based operator manages 150+ units across multiple metropolitan areas, reducing reliance on any single market’s regulations or seasonality. They've garnered strong ratings on multiple platforms and maintain a 78% occupancy rate (vs. the industry average of 65–70%), while still achieving solid margins despite a 30-person team. I like their focus on premium services, balanced mix of leisure and corporate clients, and proprietary tech stack that enables dynamic pricing and fully integrated, end-to-end management. I’d want to understand their fee model (fixed %, hybrid, or performance-based), the strength of their management agreements (are they binding for 12+ months?), customer concentration (top 5 owners as % of revenue), units gained vs. lost per year, how new units are sourced, and a breakdown of units by jurisdiction and an assessment of any pending legislation. What’s most exciting is the clear scalability: this platform could grow to 300–500 units without doubling overhead.

3/ Plumbing Business

📍 Location: Minnesota

💰 Asking Price: $3,500,000

💼 EBITDA: $855,437

📊 Revenue: $8,876,078

📅 Established: 2018

💭 My 2 Cents: Many buyers are interested in plumbing companies, but they can’t acquire them because the business relies on the owner as the only licensed master plumber. That’s why this company stands out—it has multiple licensed master plumbers and a dedicated management team already in place. This plumbing business has quickly scaled since its founding in 2018, growing to nearly $9M in annual sales. I like that they focus on residential maintenance work, where urgent needs like leaks, clogs, and water heater failures ensure steady demand, and that the sale includes $1.5M in equipment. I also like their internal training platform, which helps them recruit and retain talent in a highly competitive labor market. Because this company operates as a franchise, you’d want to fully understand the franchise agreement, including all requirements, fees, and restrictions. I’d also want to know what proportion of revenue comes from repeat vs. one-time jobs, whether service contracts or memberships are in place, and how they source new work (including whether the franchise assists with customer acquisition). The combination of a strong licensed team, steady demand for services, and franchisor support makes this an attractive option for a buyer without direct plumbing experience.

PRESENTED BY SMB DILIGENCE

Here’s Why You Shouldn’t Skip Due Diligence…

A friend of mine put a business under LOI and asked me for my advice.

I recommended he contract a 3rd party due diligence partner to rebuild the company's P&L from scratch.

Turns out their EBITDA was off by 2x 😳

Enter SMB Diligence.

SMB Diligence is the platform I helped start for matching business buyers with vetted diligence providers, from M&A lawyers to Quality of Earnings providers.

Their network of experts has worked on hundreds of small business transactions (including many from the SMB Deal Hunter community).

4/ Asphalt Contractor

📍 Location: Colorado

💰 Asking Price: $8,950,000

💼 EBITDA: $2,383,769

📊 Revenue: $8,954,110

📅 Established: 1995

💭 My 2 Cents: Asphalt surfaces deteriorate every year due to weather, salt, and traffic, creating consistent demand for asphalt contractors. This Colorado-based contractor has been serving a diversified mix of residential, commercial, and municipal clients for more than 30 years. I like that they are large enough to tackle sizable projects yet still lean and agile enough to capture smaller, often overlooked jobs. The region’s severe climate drives consistent demand for maintenance and repair, while the $1.9M of FF&E included in the sale not only supports ongoing operations but also creates a meaningful barrier to entry for competitors. I’d want to review the revenue mix across client types, the contract backlog and awarded municipal bids, pricing structure (fixed bid vs. time & materials) and whether pass-through clauses exist for material and fuel costs, annual spend on maintaining and replacing core equipment (pavers, rollers, trucks), and how winter downtime is managed. A buyer will also benefit from infrastructure tailwinds, with public funding increasing for roads and highways, and from the growing shift toward preventative maintenance among municipalities and property managers.

5/ Pool Maintenance Business

📍 Location: Tennessee

💰 Asking Price: $2,000,000

💼 EBITDA: $500,000

📊 Revenue: $4,000,000

📅 Established: 2013

💭 My 2 Cents: This Nashville-based company offers a full suite of swimming pool construction, renovation, and maintenance services. What's exciting is the bulk of their business comes from year-round maintenance, with 300–350 weekly residential accounts providing a steady base of recurring revenue. I like their strong online reputation, with a high number of Google reviews and a 4.8-star rating, their experienced staff that supports current remote ownership, and the significant equipment package included in the sale, including 13 fully outfitted trucks. There also appears to be untapped growth potential, as a new owner could take advantage of Nashville’s rapid residential population and wealth expansion, which translates into more homes with pools, while also expanding into commercial accounts such as apartments, HOAs, and hotels. I’d want more detail on the lifetime value and churn rate of maintenance clients, technician headcount and turnover (since recruiting and retaining pool techs is challenging), and the geographic and operational restrictions imposed by the franchise that could limit expansion. The seller is offering 13 months of support, and combined with standard franchisor assistance, this makes for an appealing turnkey opportunity that can even be operated remotely if desired.

THE BEST OF SMB TWITTER (X)

The #1 rule for getting into business with a family member (link)

Top tips for a successful search (link)

The deadline to close an SBA-financed acquisition before year-end (link)

Running an HVAC business (link)

Entrepreneurship versus escapism (link)

10 investment commandments (link)

New SBA program for manufacturers (link)

COMMUNITY PERKS

• Ready to buy and operate a $1M+ business? Partner with my team and get expert support at every step.

• Want to invest passively in SMB acquisitions? Get access to investment opportunities.

• Get a personal introduction to my preferred SBA 7(a) lender, non-SBA lenders, Quality of Earnings providers, or legal counsel

• Raising capital for your deal? I’ll connect you with investors from the SMB Deal Hunter Community.

• Interested in selling your business? I’ll help you connect with buyers from the SMB Deal Hunter Community.

RECENT PODCAST EPISODES

• He turned $100k -> $6M buying landscaping businesses (here's how) (link)

• He bought a $1.3M business with just $15k (here's how) (link)

• What to do when almost everything goes wrong (and still build a $4.6M business) (link)

THAT’S A WRAP

See you next Tuesday!

-Helen Guo

Find Me On Twitter

Find Me On LinkedIn

P.S. I'd love your feedback. Tap the poll below or reply to this email.

How was today's newsletter? |

Disclaimer

This publication is a newsletter only and the information provided herein is the opinion of our editors and writers only. Any transaction or opportunity of any kind is provided for information only; SMB Deal Hunter does not verify nor confirm information. SMB Deal Hunter is not making any offer to readers to participate in any transaction or opportunity described herein.