- SMB Deal Hunter

- Posts

- New Deals: A web design and digital marketing agency, liquor store, and 3 other finds

New Deals: A web design and digital marketing agency, liquor store, and 3 other finds

Plus, something new we're trying out that I'd love your feedback on!

Hello SMB Deal Hunters!

👀 Quick heads up before we dive in: I’m testing a new section today called Pro Tip of the Week (scroll down). It breaks down a real challenge a first-time buyer ran into this week, and exactly how we helped them solve it. Give it a read and tell me if this is worth keeping!

Now onto regular business…I’m excited to share 5 new businesses for sale worth checking out in this Market Watch issue. Each was handpicked from hundreds of fresh listings, with our quick take on why it stands out. First up…

🔥 Community Top Picks from the Last Market Watch Issue:

#1: Commercial Signage Agency in South Florida with $474K in EBITDA

#2: Roofing Company in Montana with $1M in EBITDA

#3: Hardwood Flooring Distributor in SoCal with $444K in EBITDA

Today’s issue is sponsored by SMB Deal Hunter Pro, our accelerator that helps business buyers find, finance, and acquire a million-dollar cash-flowing business in 6–12 months.

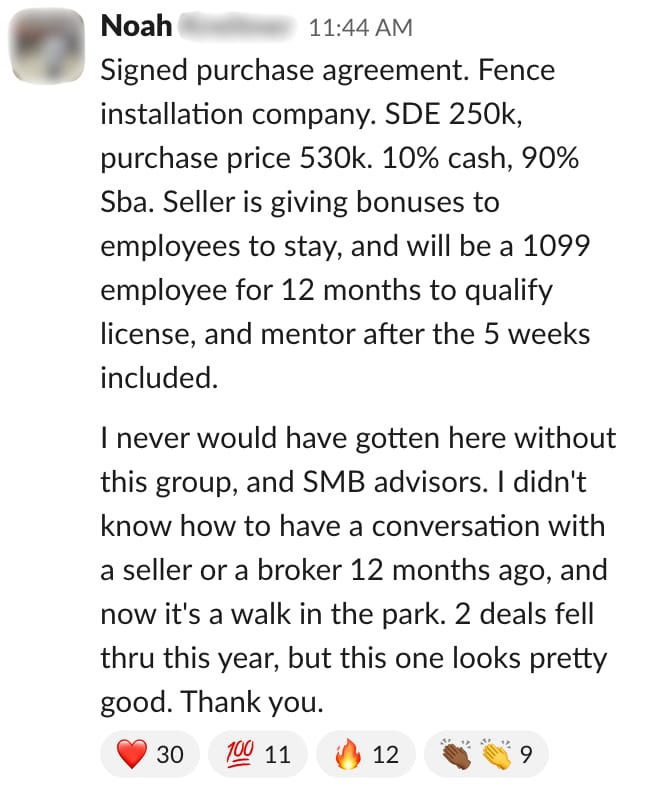

COMMUNITY WINS

Here’s what one SMB Deal Hunter Pro member shared this past week:

👀 Heads up: In just the last 60 days, we’ve helped 11 Pro members acquire $30.75M in businesses. We help serious buyers:

Source on- and off-market opportunities

Get 1:1 support from first outreach to close

Avoid the mistakes that kill most acquisitions

NEW DEALS

These deals span the country. For custom-sourced deals in your area, click here.

1/ Web Design & Digital Marketing Agency

📍 Location: Florida

💰 Asking Price: $3,000,000

💼 EBITDA: $1,081,920

📊 Revenue: $1,178,579

📅 Established: 2004

💭 My 2 Cents: A 92% net margin tells you everything you need to know about this business model. This digital agency has spent 18 years building a book of 656 recurring clients who pay monthly retainers for web hosting, maintenance, and support, with most clients paying under $100/month and sticking around for years. The brilliance here is that after the initial website build (which requires significant effort but should get faster and cheaper with AI tools), clients settle into low-touch relationships where payments continue reliably while support needs drop to near zero. The client base spans HVAC contractors, law firms, medical practices, and engineering firms, many of whom have stayed for over a decade. What makes this particularly interesting is the embedded upsell opportunity: many long-tenured clients are on legacy pricing and only use basic hosting, leaving room for a new owner to layer in SEO, content services, or AI-driven blogging without chasing new customers. I'd want to understand the churn rate by client cohort, whether the 24-month service agreements actually retain customers or just delay cancellations, and how dependent revenue is on the founding team's technical capabilities versus documented processes. For a digital agency operator looking to acquire immediate recurring revenue without the typical customer acquisition grind, this is the kind of bolt-on that pencils out fast.

2/ Specialty Contractor with Government & Healthcare Clients

📍 Location: South Florida

💰 Asking Price: $23,000,000

💼 EBITDA: $4,779,584

📊 Revenue: $41,243,982

📅 Established: 2007

💭 My 2 Cents: Government contracts get a bad rap for bureaucracy, but they also mean predictable cash flow and multi-year visibility. This South Florida specialty contractor has built its business around exactly that, with 80-85% of revenue coming from renewable 3-5 year contracts with healthcare facilities and airports. The $52 million contracted backlog provides serious downside protection and tells me this isn't a company scrambling for the next job. Customer relationships average 8+ years, which in the contracting world signals that they've figured out how to navigate the compliance requirements and deliver consistently. The leadership team averages over a decade of tenure, and the Managing Director is positioned to step into a GM role post-acquisition, which should ease transition concerns for buyers unfamiliar with institutional construction. At 4.81x EBITDA, the multiple reflects the premium that comes with contracted revenue, though I'd want to dig into contract renewal mechanics, whether there's competitive bidding at renewal or preferential treatment for incumbents, and how much of the backlog converts to revenue in the next 12 months versus being spread over years. For a strategic buyer or PE platform looking to enter the infrastructure services space with immediate scale, this checks a lot of boxes.

3/ Multi-Unit Food Franchise

📍 Location: North Florida

💰 Asking Price: $1,594,000

💼 EBITDA: $481,733

📊 Revenue: $2,303,489

📅 Established: 2022

💭 My 2 Cents: Two franchise locations operating with no rent is an unusual cost structure that immediately improves the margin profile. These units sit in grocery-anchored retail environments, which provides built-in foot traffic without the traditional lease expense (and the 21% net margin reflects that advantage). The business is set up for absentee ownership with 25 trained employees across both locations. Plus, the 6.5% royalty rate is on the lower end for franchises, which helps protect margins. The catch is that these locations are only 3-4 years old, so you're buying a shorter track record than many other businesses for sale. Obviously you'll need to know what the actual concept is before going further, but I'd also want to understand why there's "no rent" (is it a percentage rent deal, a related-party arrangement, or something else?), dig into the franchisor's unit economics and support infrastructure, and review the FDD carefully. The $15,000 transfer fee per location includes franchisor training, which helps with transition. For a buyer who wants franchise support and North Florida market exposure without the typical occupancy costs, this is worth investigating.

ALUMNI SPOTLIGHT

Arman was looking for a way out before the wave of tech layoffs came for him.

12 months after joining SMB Deal Hunter Pro, Arman closed on a $5.2M HVAC and weatherization company in the DC area. He only put 6% down, and EBITDA grew from $1.1M at LOI to $1.6-$1.7M by close (bringing his multiple down from 5x to ~3x).

The wild part is the timing. He was laid off from his tech role the day after the deal closed.

But the path to close wasn't smooth. In the interview, Arman breaks down:

→ How a “done-for-you” acquisition program led him down the wrong path (and nearly cost him $150,000) before he turned to SMB Deal Hunter Pro

→ How he handled SBA rule changes mid-deal that required him to ask sellers to change from 2-year standby to 10-year standby on $400K of seller financing (and the exact approach he used so they didn't walk)

→ Why the bank delayed closing from July to October and how the advisors kept him sane

→ The "oh sh*t" moment when he took over and realized the previous owner had left zero deals in the pipeline for the business for the rest of the year.

4/ Liquor Store

📍 Location: South Florida

💰 Asking Price: $1,900,000

💼 EBITDA: $420,000

📊 Revenue: $3,100,000

📅 Established: 2008

💭 My 2 Cents: Being the only liquor store serving a large residential neighborhood is exactly the kind of local monopoly that makes retail work. This 18-year-old store does $280,000 in average monthly sales with the customer base coming primarily from the high-density neighborhood at its entrance. Liquor retail has historically performed well across economic cycles, with sales often ticking up during downturns as consumers shift spending from bars and restaurants to at-home consumption. The multiple is on the higher end for retail, but liquor stores with this kind of geographic positioning tend to hold value. The lease runs through January 2028 with five-year renewal options, and monthly rent of $5,543 is reasonable for South Florida. One detail worth noting: liquor inventory is not included and will be valued separately at closing, so budget accordingly. There's also potential upside through delivery apps like Drizly or Instacart, which have become meaningful revenue channels for liquor retailers and don't appear to be a current focus. I'd want to understand the lease renewal terms in detail (landlords in good locations can get aggressive), the customer demographic and whether it's shifting, and how much of the current revenue is cash versus card transactions. The liquor license transfers with the sale, which is the key asset here. For a buyer looking for steady, defensible retail income in a growing Florida market, this fits the profile.

5/ Custom Art & Framing Business

📍 Location: Minnesota

💰 Asking Price: $1,199,000

💼 EBITDA: $443,261

📊 Revenue: $2,475,384

📅 Established: 1993

💭 My 2 Cents: Custom framing for multi-family construction, hospitality, and hotels is a niche I wouldn't have expected to generate $2.5M in revenue, but here we are. This 33-year-old operation has carved out a B2B position supplying artwork and framing to commercial clients who need consistent quality at scale. The 18% margin is solid for a service business with physical inventory, and what’s great is they have the capacity to take on more volume without significant infrastructure investment. What makes this interesting is the client base: multi-family developers and hotel groups need framed artwork for every unit and room, and once you're an approved vendor, the orders keep coming. I'd want to understand the customer concentration across the top accounts, the competitive landscape for commercial framing in the Midwest, and how dependent the business is on new construction versus replacement and renovation work. For a buyer looking for a niche B2B service business with established relationships in a fragmented market, this is an unusual find.

PRO TIP OF THE WEEK

A real challenge we helped a first-time buyer solve in SMB Deal Hunter Pro this week.

❓️ The Problem

“E” found a general contracting business in southern California that checked a lot of boxes. Solid operations, strong strategic fit (his wife has GC experience), and a seller who had a strong reason for sale.

But there was a catch: one customer made up a huge chunk of revenue. And that customer's numbers were trending down.

“E” wanted to move forward, but he didn't want to overpay if that customer’s revenue kept declining. At the same time, he didn't want to lowball and kill the deal before it started.

💡 How We Tackled It

Instead of negotiating harder on price, “E” structured a forgivable seller note on a sliding scale pegged to the company’s revenue staying at the same pace it was at in the last year.

Here’s what a forgivable note is in simple terms: part of the purchase price gets paid to the seller over time. But unlike a normal seller note, you can peg the payment of the note to an element of the business.

In this case, “E” pegged it to revenue because he was afraid the declining customer would cause the business to stagnate.

If revenue stayed healthy, the seller got the full amount. If revenue dropped, “E” paid less.

✅ The Takeaway

When you spot a risk in a deal, your first instinct might be to cut the price. But that can blow up the relationship before you even get to the finish line.

Instead, ask: can I structure around this risk in a way where we both win?

This can do a lot to reframe the negotiation from “me vs you” to “win win”. The seller still got a shot at their full price. “E” got protection if things went south.

Note: These are real stories, but we anonymize them for privacy.

COMMUNITY PERKS

• Ready to buy and operate a $1M+ business? Partner with my team and get expert support at every step.

• Want to invest passively in SMB acquisitions? Get access to investment opportunities.

• Get a personal introduction to my preferred SBA 7(a) lender, non-SBA lenders, Quality of Earnings providers, or legal counsel

• Raising capital for your deal? I’ll connect you with investors from the SMB Deal Hunter Community.

• Interested in selling your business? I’ll help you connect with buyers from the SMB Deal Hunter Community.

RECENT PODCAST EPISODE

Michael is an Air Force veteran and former private equity analyst.

He and his partner run Skyline Partnership, a holding company focused on $5M+ EBITDA businesses with two acquisitions to-date: a cybersecurity software developer and an HVAC company.

In this episode, we discuss:

🔥 The off-market sourcing playbook that's landed both of their deals (no brokers involved)

🔥 How many companies you actually have to reach to close one deal a year at their scale (the number might surprise you)

🔥 Why they send direct mail to business owners in target geographies (and what actually gets through)

🔥 The CRM habit that keeps cold leads alive until they're ready

And for our audio-only listeners, jump in and listen on Spotify or Apple Podcasts!

THAT’S A WRAP

See you tomorrow!

-Helen Guo

Find Me On Twitter

Find Me On LinkedIn

P.S. I'd love your feedback. Tap the poll below or reply to this email.

How was today's newsletter? |

Disclaimer

This publication is a newsletter only and the information provided herein is the opinion of our editors and writers only. Any transaction or opportunity of any kind is provided for information only; SMB Deal Hunter does not verify nor confirm information. SMB Deal Hunter is not making any offer to readers to participate in any transaction or opportunity described herein.