- SMB Deal Hunter

- Posts

- New Deals: A plumbing company, safety and janitorial supplies distributor, and 3 other finds

New Deals: A plumbing company, safety and janitorial supplies distributor, and 3 other finds

Plus, metros with $1-1.5M EBITDA businesses with less buyer competition

Hello SMB Deal Hunters!

📣 Reminder: I’m pooling capital to invest in the acquisition of an 80+ year old manufacturer that builds mission-critical parts for everything from Boeing rockets to AI data center turbines. We’ve already passed 83% of the $4.45M target raise with over $3.7M in soft commitments. Learn more about this fully passive opportunity.

Now onto regular business: I’m excited to share 5 new businesses for sale worth checking out in this Market Watch issue. Each was handpicked from hundreds of fresh listings, with our quick take on why it stands out. First up…

🔥 Community Top Picks from the Last Market Watch Issue:

#1: Demolition company with $1.1M in EBITDA

#2: Commercial glass company with $1.7M in EBITDA

#3: Dump truck business with $650K in EBITDA

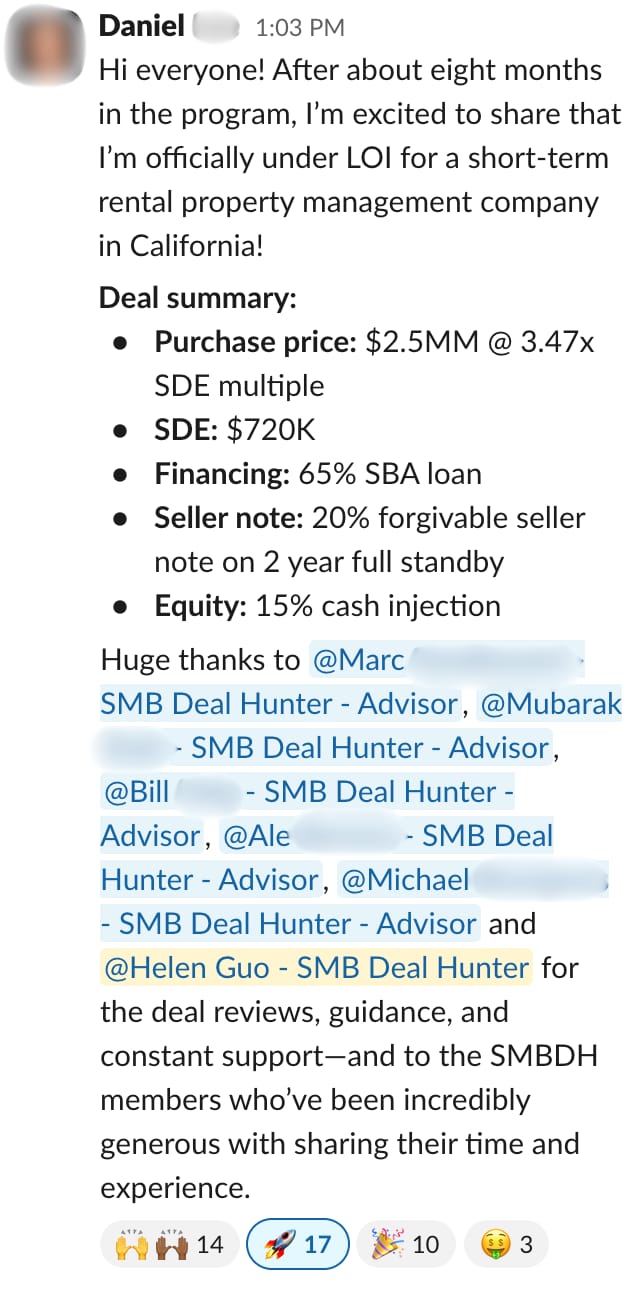

COMMUNITY WINS

Here’s what one SMB Deal Hunter Pro member shared this past week:

Want me and my team to work with you to find, finance, and acquire a million-dollar cash-flowing business in the next 6-12 months?

P.S. Prices are going up on Jan. 1st. We’ve spent the last year…

Helping our members close over $115M in deals

Doubling the amount of M&A advisors that every Pro member has 1:1 access to

Building an off-market marketplace that has hundreds of listings no one else has access to (with more added every single week)

So, if you have been dragging your feet on making a call and buying a business…

👉️ Book a call and lock in your rate (even if you don’t plan on starting till next year. We can hold your spot!)

NEW DEALS

These deals span the country. For custom-sourced deals in your area, click here.

1/ Plumbing Company

📍 Location: California

💰 Asking Price: $3,500,000

💼 EBITDA: $1,136,261

📊 Revenue: $2,368,733

📅 Established: 1994

💭 My 2 Cents: Plumbing companies that layer specialized mechanical and regulatory services on top of standard repair work tend to command better pricing and face less competition, and this San Bernardino County operation is a textbook example. Beyond typical plumbing calls, they handle backflow certification, air piping systems, and municipal contracts, which creates multiple revenue streams and insulates them from the pricing pressure and commoditization that hammers residential-only shops. Their 64% EBITDA margin is striking for a trade business and tells me they've either built exceptional operational efficiency or secured premium contracts that most competitors can't access, though I'd want to review 5-10 years of financials to confirm these margins hold steady rather than reflecting one anomalous year. The business comes with $600K in equipment and vehicles, which means a buyer walks into day-one capacity without immediate capital needs, and the 24-hour emergency service line suggests an established customer base that relies on them for urgent work. I'd focus diligence on the split between recurring contracts like backflow testing versus one-time service calls, client concentration given the municipal work, and if there’s a Responsible Managing Employee who's staying post-salehold who holds the C-36 plumbing license. The SBA pre-approval is a real advantage here, since lenders rarely greenlight deals with owner-dependent technical credentials unless the transition risk is manageable.

2/ Landscaping and Snow Plowing Company

📍 Location: New Jersey

💰 Asking Price: $2,999,999

💼 EBITDA: $600,000

📊 Revenue: $5,000,000

📅 Established: 25+ Years Ago

💭 My 2 Cents: Most northern landscaping companies get crushed by seasonality, labor turnover, and equipment constraints, but this New Jersey operation has built the kind of scale and infrastructure that solves all three problems at once. Snow removal alone generates roughly $900K annually under three-year contracts that lock in winter revenue, which takes the guesswork out of the slow season and creates predictable cash flow when most competitors are scrambling for work. The business runs with over 40 employees and a management team that handles day-to-day operations, freeing the owner from the field, and the sale includes $1.8M in equipment and vehicles that would cost a fortune to replicate from scratch. What's particularly smart is the 3+ acre industrial site with subleases throwing off $7K monthly, which materially offsets the lease cost and adds another income stream that has nothing to do with weather or seasonality. I'd focus diligence on the revenue split between residential, commercial, and municipal clients, what portion is recurring contracts versus one-time projects and how margins differ across those categories, and how sensitive profitability is to fuel and material cost swings given the equipment-intensive nature of the work. The real edge here is that three-year snow contracts eliminate the single biggest risk in this business, turning winter from a liability into a guaranteed revenue pillar.

3/ Behavioral Health Practice

📍 Location: N/A

💰 Asking Price: $6,000,000

💼 EBITDA: $2,065,027

📊 Revenue: $4,646,851

📅 Established: 2011

💭 My 2 Cents: Behavioral health practices that combine strong clinical infrastructure with enhanced reimbursement credentials tend to outperform their peers financially, and this operation checks both boxes with 30% annual growth and margins that are exceptional for outpatient mental health. The practice qualifies as a Culturally Linguistic Specific program, which unlocks higher reimbursement rates across multiple insurance panels and creates a meaningful competitive advantage in a market where most practices accept standard rates. With 21 staff members including a Clinical Director who's staying post-sale, a buyer doesn't need their own clinical license to step in, which opens the deal to operators and investors who can focus on growth rather than providing direct care. The recent addition of a prescriber is a smart move that increases revenue per patient by keeping psychiatric medication management in-house rather than referring it out, and their State Certificate of Approval to host master's-level interns gives them a built-in pipeline for recruiting and training future clinicians. I'd need to understand the payer mix between Medicaid, commercial insurance, and self-pay to understand reimbursement stability, clinician utilization rates and compensation structures to spot capacity for additional patients without new hires, and what compliance or reporting requirements come with their state certifications. The bigger opportunity might be in adding intensive outpatient programs, group therapy, or telehealth capabilities, all of which could leverage the existing staff and referral network without requiring major capital investment or additional licensing hurdles.

ALUMNI SPOTLIGHT

Josh was an experienced business owner looking to diversify his income away from one sector.

But despite his strong operating background, this was his first acquisition, and he quickly realized he needed support: more (and better) deal flow, clarity on the jargon, and guidance on how to evaluate businesses without constantly wondering, “What am I missing?”

7 months after joining SMB Deal Hunter Pro, our business buying accelerator, Josh closed on a $4M window-treatment company in South Florida generating over $1.2M in annual cash flow.

In this interview, Josh breaks down his journey, including how a financing delay almost cost him the deal and what it’s like running a business from another state.

4/ Safety and Janitorial Supplies Distributor

📍 Location: Southern California

💰 Asking Price: $1,600,000

💼 EBITDA: $508,720

📊 Revenue: $3,311,983

📅 Established: 1997

💭 My 2 Cents: B2B consumables distributors built around safety supplies, janitorial goods, and packaging materials benefit from predictable repeat purchasing and low customer churn, since manufacturers and industrial clients reorder these products like clockwork regardless of economic conditions. This Southern California operation serves a diverse base spanning food manufacturing to industrial services, which spreads risk across multiple end markets and creates resilience even during downturns in any single sector. What's particularly interesting is their current 10,000 sq. ft. warehouse, where they're actively using only about 3,000 sq. ft. for inventory, which tells me they've got tight inventory discipline and a real opportunity to slash occupancy costs at lease renewal in 2027 by downsizing to a smaller footprint. The owner is willing to stay on full-time as a salesperson post-sale, which would preserve existing client relationships and give a new buyer time to build their own rapport with key accounts without risking revenue drop-off during transition. I'd focus diligence on customer concentration among the top 10 clients, how they compete against larger national distributors like Grainger or Uline and whether they win on price or service differentiation, and the composition of their $300K inventory to understand working capital needs and exposure to slow-moving stock or tariff-sensitive imports. The 30-year track record is the best proof of concept here, showing this business has survived multiple recessions by selling products companies simply can't operate without.

5/ Preschool

📍 Location: Northern California

💰 Asking Price: $2,000,000

💼 EBITDA: $562,000

📊 Revenue: $1,800,000

📅 Established: 1981

💭 My 2 Cents: Childcare can be operationally tricky, but established providers with strong reputations benefit from sticky clients and inelastic demand since working parents need reliable care regardless of economic conditions. This San Francisco Bay Area preschool has been operating for over 40 years in one of the country's strongest childcare markets, where dual-income households and high costs of living create consistent waitlists for quality programs. The business occupies a purpose-built facility licensed for 80 to 120 children, which is a major advantage since large-capacity preschools are rare due to strict zoning requirements and high land costs, and purpose-built layouts maximize space efficiency to hit the highest possible enrollment limits. With an experienced director already running day-to-day operations, this could be a semi-absentee opportunity for a buyer who wants cash flow without being onsite full-time. I'd focus diligence on the lease terms and facility condition since location and real estate are make-or-break in this industry, current enrollment versus capacity and the waitlist depth to gauge demand, and staff size, turnover, and wage structures given how labor-intensive childcare operations are. The 40-year track record tells me this isn't just another daycare scrambling to fill slots, but rather an institution that parents trust enough to keep coming back, which is the kind of reputation that takes decades to build and can't be replicated overnight.

THE BEST OF SMB TWITTER (X)

Characteristics of a perfect business (link)

Building your 2026 cashflow forecast in 8 steps (link)

To be successful in business, copy what works (link)

Deals should be built around alignment, not leverage (link)

Marketing channels ranked by purchasing power (link)

Emotional consistency is critical for a founder/owner (link)

10 step process that gets deals closed (link)

Metros with $1-1.5M EBITDA businesses with less buyer competition (link)

COMMUNITY PERKS

• Ready to buy and operate a $1M+ business? Partner with my team and get expert support at every step.

• Want to invest passively in SMB acquisitions? Get access to investment opportunities.

• Get a personal introduction to my preferred SBA 7(a) lender, non-SBA lenders, Quality of Earnings providers, or legal counsel

• Raising capital for your deal? I’ll connect you with investors from the SMB Deal Hunter Community.

• Interested in selling your business? I’ll help you connect with buyers from the SMB Deal Hunter Community.

RECENT PODCAST EPISODE

Brian was a partner at a Big Law firm, the pinnacle of the corporate ladder.

But he was still unfulfilled. Watching his PE clients made him realize he was on the sidelines. So, he jumped in and, within 20 months, rolled up 3 MarTech SaaS companies and exited to private equity.

This episode is a masterclass on how to go 0 → 100 at breakneck speed.

And for our audio-only listeners, jump in and listen on Spotify or Apple Podcasts!

THAT’S A WRAP

See you tomorrow!

-Helen Guo

Find Me On Twitter

Find Me On LinkedIn

P.S. I'd love your feedback. Tap the poll below or reply to this email.

How was today's newsletter? |

Disclaimer

This publication is a newsletter only and the information provided herein is the opinion of our editors and writers only. Any transaction or opportunity of any kind is provided for information only; SMB Deal Hunter does not verify nor confirm information. SMB Deal Hunter is not making any offer to readers to participate in any transaction or opportunity described herein.