- SMB Deal Hunter

- Posts

- New Deals: A septic waste management business, electronics recycling business, and 3 other finds

New Deals: A septic waste management business, electronics recycling business, and 3 other finds

Plus, 13 ways that sellers can trick you

Hello SMB Deal Hunters!

I’m excited to share 5 new businesses for sale worth checking out in this Market Watch issue. Each was handpicked from hundreds of fresh listings, with our quick take on why it stands out. First up…

🔥 Community Top Picks from the Last Market Watch Issue:

#1: Merchandise distribution business with $920K in EBITDA

#2: Tree removal, lawn care, and pest control business with $487K in EBITDA

#3: Digital marketing agency with $554K in EBITDA

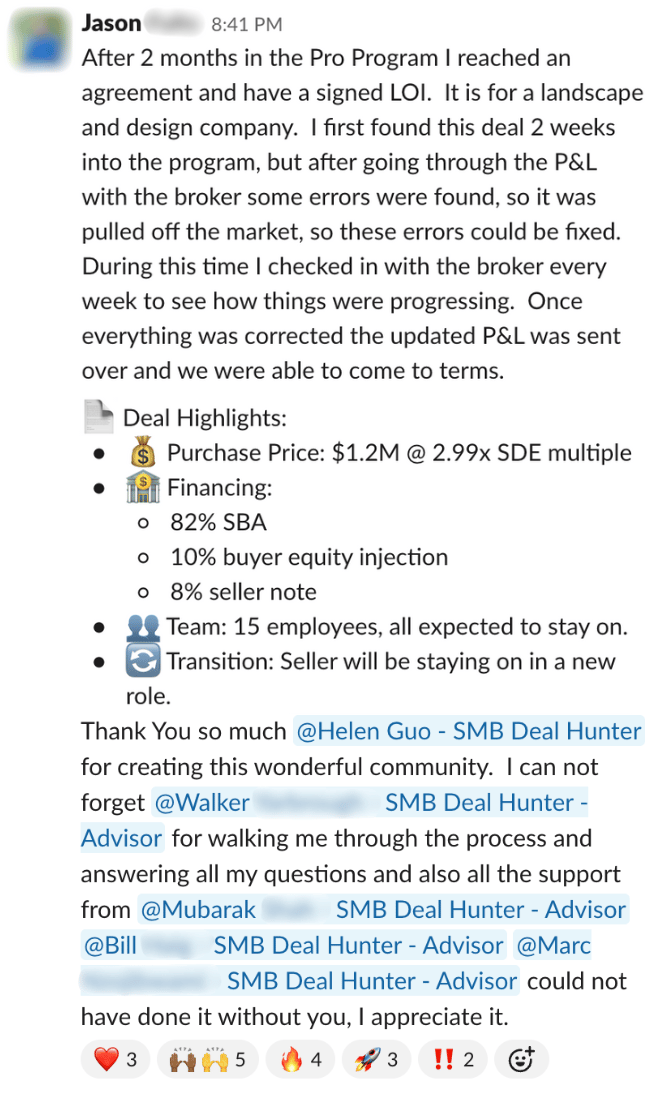

COMMUNITY WINS

Here’s what one SMB Deal Hunter Pro member shared this past week:

Want me and my team to work with you to find, finance, and acquire a million-dollar cash-flowing business in the next 6-12 months?

NEW DEALS

These deals span the country. For custom-sourced deals in your area, click here.

1/ Septic Waste Management Business

📍 Location: New York

💰 Asking Price: $12,950,000

💼 EBITDA: $1,890,944

📊 Revenue: $5,854,097

📅 Established: 2009

💭 My 2 Cents: I love an industry with steady, legally required demand like septic and wastewater management, where upgrades and inspections are mandated. This regional leader serving the Hudson Valley, a market with aging infrastructure driving consistent replacement work, offers a well-diversified mix of routine pumping, emergency sewage and hydro jetting, and high-ticket system installations and repairs. The big draw here is the combination of recurring cash flow from mandatory maintenance and high-margin project work that lifts the revenue ceiling. I also like their strong digital advertising strategy and the inclusion of over $2M in specialized vehicles and high-tech equipment in the sale. I’d dig into the breakdown between recurring maintenance vs. installation revenue, contract renewal terms and service frequency, the current backlog, the condition and replacement schedule for the fleet and equipment, and opportunities to expand their geographic footprint or add new services. The multiple, while on the higher side even with the asset base, is defensible if a large portion of revenue is recurring and customer relationships are sticky. Plus, regional roll-ups by private equity and large environmental service firms (e.g., Wind River Environmental, EnviroVac) may create an opportunity for a strategic exit down the line.

2/ Awning and Patio Business

📍 Location: Florida

💰 Asking Price: $2,499,999

💼 EBITDA: $533,337

📊 Revenue: $1,863,632

📅 Established: 2016

💭 My 2 Cents: This company specializes in premium outdoor living solutions, including retractable awnings, solar and insect screens, and insulated or louvered roof structures, serving both residential and commercial clients throughout South Florida. While competing in a market with other well-established firms, they differentiate themselves through exclusive dealer relationships with top manufacturers. I really like their streamlined operations and low overhead, with sales handled by independent contractors and all installations performed by trusted subcontractors. I’d need more detail on their exclusive dealer agreements, specifically which products they cover, how much revenue they represent, and how long those agreements are secured for. I’d also want clarity on lead generation channels (Google Ads, SEO, referrals, builders/GCs, designers, showroom walk-ins), any sales rep concentration, how scalable the subcontractor network is for increased project volume, and the working capital dynamics, particularly the balance between customer deposits and vendor prepayments, and inventory turns for long-lead items like motors, fabrics, and extrusions. Even though this is a discretionary purchase category, the migration tailwinds into South Florida provide a strong demand backdrop.

3/ Residential HVAC & Plumbing Business

📍 Location: New Jersey

💰 Asking Price: $1,600,000

💼 EBITDA: $659,916

📊 Revenue: $1,723,546

📅 Established: 2017

💭 My 2 Cents: This residential HVAC and plumbing company caught my eye immediately with its strong cash flow on sub-$2M revenue and exceptional margins. They offer a balanced 50-50 mix of HVAC and plumbing services, which helps smooth out seasonality (cooling demand peaks in summer, heating in winter, and plumbing work remains steady year-round), creating consistent cash flow and better technician utilization. The company maintains over 1,000 active customers and 74 maintenance agreements, and is supported by a CRM system that streamlines scheduling, billing, and client communications. I like their limited exposure to new construction, which makes their revenue more predictable and recession-resistant. I’d want to understand how they define an “active account,” what marketing channels drive new customer acquisition, turnover and retention among lead technicians, how deposits and vendor prepayments are managed, and the timeline from job completion to payment collection. The valuation multiple appears reasonable, and for a new buyer, there’s clear room to grow recurring revenue through expanded maintenance agreements.

ALUMNI SPOTLIGHT

Reagan went from a career in corporate tech sales to owning a 36-year-old commercial plumbing company in Dallas cash flowing $860K/year. He shares how he:

Got under LOI 41 days after his onboarding call and closed in 5 months

Only put 5% down and extended his loan from 10 to 13 years

Structured a 4-year operating agreement with the seller to solve the licensing issue people run into with plumbing businesses

4/ Demolition Company

📍 Location: Colorado

💰 Asking Price: $3,700,000

💼 EBITDA: $849,088

📊 Revenue: $3,257,158

📅 Established: 2009

💭 My 2 Cents: Redevelopment and infrastructure spending are driving steady demand for experienced demolition contractors like this one. This Colorado-based demolition company has served commercial, industrial, and municipal clients for over 15 years in a fast-growing region. Their main focus is demolition, disposal, and site preparation, while also offering a profitable dumpster rental division, adding a recurring revenue stream and cross-selling opportunities. What I like about demolition is that it sits at the front end of every construction or redevelopment project, meaning cash flow comes early. I also like their solid contracts, strong operational team (9 full-time employees and 20 contractors), scalable structure, and about $510K in equipment included in the sale. Given the importance of a current airport contract, I’d want to confirm they have enough project diversification to avoid a future earnings cliff once that work wraps up. I’d also want to review their current backlog and pipeline, how they source and bid for new projects, payment terms on contracts, and the remaining lifespan of key equipment to identify any pending capex. Ultimately, this is an intriguing deal, made even more appealing by the seller offering financing and being open to remaining involved for up to a year.

5/ Electronics Recycling Business

📍 Location: New York

💰 Asking Price: $3,500,000

💼 EBITDA: $700,000

📊 Revenue: $2,400,000

📅 Established: 2003

💭 My 2 Cents: This electronics recycling company handles everything from computers and servers to batteries and monitors, serving businesses, schools, healthcare facilities, and government agencies. They’re government-certified for compliant recycling and disposal, giving them a clear advantage and keeping them eligible for public sector contracts and large-scale collection programs. What’s great is electronics recycling is now legally required in many cases, and companies face growing pressure to manage e-waste responsibly, creating consistent demand. I also like that their mix of institutional and government clients brings stability, while the commercial side adds upside through pickup fees, resale of refurbished equipment, and recovered materials. I’d want to review the margin mix between collection, processing, and resale, the balance between contract and one-off work, and how commodity prices affect earnings. I’d also look at revenue dependence on top customers, facility capacity, and growth opportunities through new municipal or enterprise partnerships. Looking ahead, this company is perfectly positioned to ride the surge in demand as the US e-waste industry grows from $27.7 billion in 2025 to an estimated $84.3 billion by 2032.

THE BEST OF SMB TWITTER (X)

The world is screaming at you to start a business (link)

Surprises for first-time founders and CEOs (link)

Most small businesses are a job, but also so much more (link)

13 ways that sellers can trick you (link)

A business goal without a personal goal is half a plan (link)

A hidden deal risk you need to consider when buying a business that takes 100% payment up front (link)

Pros and cons of sub $500K SDE businesses (link)

COMMUNITY PERKS

• Ready to buy and operate a $1M+ business? Partner with my team and get expert support at every step.

• Want to invest passively in SMB acquisitions? Get access to investment opportunities.

• Get a personal introduction to my preferred SBA 7(a) lender, non-SBA lenders, Quality of Earnings providers, or legal counsel

• Raising capital for your deal? I’ll connect you with investors from the SMB Deal Hunter Community.

• Interested in selling your business? I’ll help you connect with buyers from the SMB Deal Hunter Community.

RECENT PODCAST EPISODE

Marc bought his first business at 27 and pulled off 30% growth in year 1.

In this episode, he breaks down the one unexpected change that made it happen:

THAT’S A WRAP

See you tomorrow!

-Helen Guo

Find Me On Twitter

Find Me On LinkedIn

P.S. I'd love your feedback. Tap the poll below or reply to this email.

How was today's newsletter? |

Disclaimer

This publication is a newsletter only and the information provided herein is the opinion of our editors and writers only. Any transaction or opportunity of any kind is provided for information only; SMB Deal Hunter does not verify nor confirm information. SMB Deal Hunter is not making any offer to readers to participate in any transaction or opportunity described herein.