- SMB Deal Hunter

- Posts

- New Deals: A commercial security & IT installation company, dump truck business, and 3 other finds

New Deals: A commercial security & IT installation company, dump truck business, and 3 other finds

Plus, the hardest industries to buy into with no previous experience

Hello SMB Deal Hunters!

📣 Quick reminder: I’m investing in the acquisition of an 80+ year old manufacturer that builds mission-critical parts for everything from Boeing rockets to AI data center turbines and opening it to a few SMB Deal Hunter members. Learn more about this fully passive opportunity.

Now onto regular business! I’m excited to share 5 new businesses for sale worth checking out in this Market Watch issue. Each was handpicked from hundreds of fresh listings, with our quick take on why it stands out. First up…

🔥 Community Top Picks from the Last Market Watch Issue:

#1: Asphalt and paving business with $877K in EBITDA

#2: Auto glass repair business with $1.67M in EBITDA

#3: Wildlife removal and home renovation company with $1.34M in EBITDA

🔎 Looking for deals in your area? We can source them for you.

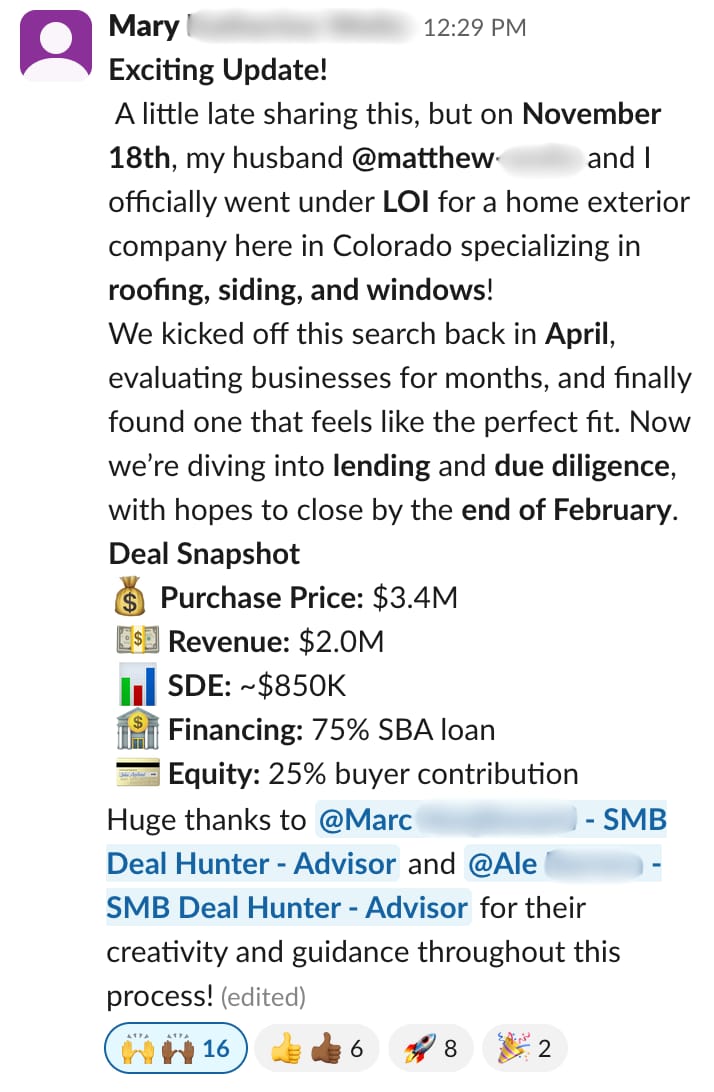

COMMUNITY WINS

Here’s what one SMB Deal Hunter Pro member shared this past week:

P.S. This year, we helped our Pro members close over $115MM in deals. We've added 3 new M&A advisors, launched an off-market deal exchange, and set up a program to pay members back 66% of the Pro price when they close.

But on Jan 1st, prices are going up. So, if you've been on the fence about starting your business buying journey, now's a good time to seriously explore it.

NEW DEALS

These deals span the country. For custom-sourced deals in your area, click here.

1/ Commercial Security & IT Installation Company

📍 Location: Southern California

💰 Asking Price: $6,500,000

💼 EBITDA: $1,575,280

📊 Revenue: $3,011,860

📅 Established: 2014

💭 My 2 Cents: This SoCal-based technology integrator delivers a highly specialized blend of video surveillance, access control, Wi-Fi, network cabling, audio, and data solutions to thousands of active commercial clients. They have experienced consistent 30% year-over-year growth, a lean operation that helps achieve very strong margins, and a management structure that handles nearly all day-to-day operations, while the seller works part-time and mostly remotely. I like how much of their work is and will be insulated from economic swings and AI encroachment, as the physical aspects of their services will always be necessary, with security and networking integrations forming a “must-have” category for commercial buildings. I also like their location in a Southern California market that is dense, compliance-driven, and tech-forward, representing a strong pipeline for future projects. I'd want to understand revenue concentration among top clients, the sales process and lead generation channels, whether they've built any managed services or recurring monitoring contracts (and if not, what it would take to layer those in), and the status of vendor certifications and technical staff retention given how critical those relationships and skills are to project execution. The seller’s minimal involvement suggests this could be an appealing remote opportunity, but I’d want to be sure their key personnel are planning to stick around post-transition.

2/ Demolition Company

📍 Location: Colorado

💰 Asking Price: $3,900,000

💼 EBITDA: $1,121,000

📊 Revenue: $5,300,000

📅 Established: 1997

💭 My 2 Cents: Demolition contractors sit at the front end of every development cycle, which means they get paid before anyone else touches a project. This Front Range operator has built steady relationships across Colorado's booming construction corridor over the past decade, with 80% commercial work and 20% residential providing a balanced revenue mix that insulates them from housing market swings. Their 50-person W-2 workforce and $500K equipment base suggest they've scaled beyond owner-operator size while maintaining the infrastructure to handle meaningful project volume without major capital outlays. Operating in the Denver market also gives them access to constant bid flow from repeat general contractors who value reliability and safety track records over pure price competition. I'd want to understand their contracted backlog and pipeline visibility, whether they hold specialized certifications for asbestos or hazardous materials that command premium pricing, and how much incremental capacity exists with current equipment before needing significant capital investment. Demolition businesses thrive on relationships more than marketing, and nearly three decades of repeat clients in a market this active tells me they've cracked the code on execution consistency that's difficult for new entrants to replicate.

3/ Commercial Glass Company

📍 Location: Utah

💰 Asking Price: $6,950,000

💼 EBITDA: $1,698,413

📊 Revenue: $6,142,589

📅 Established: 2007

💭 My 2 Cents: Commercial glazing is typically a low-margin, price-driven business where contractors scramble for work and underbid each other, which makes this Utah operation's pricing power and steady backlog stand out. They focus exclusively on 1-3 story buildings across industrial, retail, government, school, and warehouse projects, with a multi-million-dollar backlog and a client base that includes repeat accounts like Hill Air Force Base. What separates them from typical installation shops is their in-house fabrication capability, which lets them control lead times, capture margin that would otherwise go to suppliers, and respond faster to project changes or custom specifications. The owner claims the main constraint is capacity, not demand, and believes adding staff would immediately translate to revenue growth without sacrificing profitability. I'd want to dig into what actually drives their pricing power, whether it's reputation built over 25 years, technical expertise that commands premium rates, or sticky relationships with general contractors and developers who value reliability over low bids. I'd also need to understand typical project duration and ticket size, the condition and replacement schedule for the $310K in equipment, and how dependent estimating and client relationships are on the current owner. The real upside here isn't just hiring more installers but potentially expanding into 4+ story projects or adding complementary services like storefront maintenance contracts that turn one-time installations into recurring revenue streams.

ALUMNI SPOTLIGHT

Ben was a real estate developer, leading the renovation of over $100 million in historic buildings and condo conversions.

However, after experiencing the challenges of real estate development in today’s high-interest rate environment, Ben set his sights on a different path: acquiring established, cash-flowing businesses.

Within 7 months of joining SMB Deal Hunter Pro, our business buying accelerator, we helped Ben buy a $3.2M cabinet manufacturing business in NY cash-flowing over $1M/year.

In this interview, Ben breaks down how we helped him source and diligence the deal, manage tough broker and seller dynamics when things went sideways, secure financing with just 10% down, and build a clear post-acquisition plan.

4/ Dump Truck Business

📍 Location: Arizona

💰 Asking Price: $2,500,000

💼 EBITDA: $650,000

📊 Revenue: $2,095,000

📅 Established: 2000

💭 My 2 Cents: Dump truck businesses live or die on fleet utilization, and this 25-year-old operation has clearly figured out how to keep eight trucks working consistently. The company runs an eight-unit fleet serving a consistent roster of commercial clients, parked on a rented lot with minimal facility overhead. In an asset-dominated transaction like this, the key question is what the fleet is actually worth. Is the $1.5M listed value book value, fair market value, or replacement cost? That determines whether a buyer is paying $1M ($2.5M ask less $1.5M truck value) for goodwill and customer relationships or significantly more if the trucks are depreciated below market. The beauty of dump truck operations is predictable utilization when you've locked in commercial accounts, but I'd want to understand the average age and condition of the fleet, annual maintenance and fuel costs as a percentage of revenue, and whether there's any deferred capex lurking that could hit immediately post-close. I'd also dig into dispatch systems, driver retention and wages, and the terms of existing customer contracts to assess how sticky the relationships really are. The big opportunity here is that the Phoenix metro area continues to see strong construction and infrastructure activity driven by data center expansion and industrial development, and if this operator has proven they can keep trucks running profitably, adding 2-4 units with the right financing could meaningfully increase cash flow without proportionally increasing overhead.

5/ Tire Shop

📍 Location: Connecticut

💰 Asking Price: $1,495,000

💼 EBITDA: $610,459

📊 Revenue: $2,271,361

📅 Established: 35+ Years Ago

💭 My 2 Cents: This tire shop has built a solid foundation with premium tire sales, auto accessories, and U-Haul rentals, but the real story here is what they're not doing yet. They're licensed to offer auto repair services but haven't added them, which is unusual since most successful tire shops generate meaningful margin from alignments, brakes, suspension work, and general maintenance. Similarly, they're licensed to rent vehicles but keep only one rental car available, leaving rental income largely untapped. For a buyer with automotive service experience, these are ready-made expansion opportunities that could lift profitability without requiring new customer acquisition. I'd want to understand why repair services haven't been launched and what equipment is already in place versus what would need to be added, dig into their current tire inventory value and whether it's included in the sale, and assess the facility lease terms and local competition from chains like Discount Tire or independent shops. The advantage here is that tire shops benefit from non-discretionary demand and recurring customer needs, so a buyer who can execute on the existing licenses could see returns quickly without fighting for market share.

THE BEST OF SMB TWITTER (X)

The importance of rhythm for a company (link)

Possible issues with a PE-backed business (link)

How business brokers narrow down LOIs (link)

Why client concentration is such a big deal (link)

The hardest industries to buy into with no previous experience (link)

A cautionary analysis of proprietary/off-market deals (link)

A deep dive on deal structure (link)

Your job as a business leader is to concentrate only on the big stuff (link)

COMMUNITY PERKS

• Ready to buy and operate a $1M+ business? Partner with my team and get expert support at every step.

• Want to invest passively in SMB acquisitions? Get access to investment opportunities.

• Get a personal introduction to my preferred SBA 7(a) lender, non-SBA lenders, Quality of Earnings providers, or legal counsel

• Raising capital for your deal? I’ll connect you with investors from the SMB Deal Hunter Community.

• Interested in selling your business? I’ll help you connect with buyers from the SMB Deal Hunter Community.

RECENT PODCAST EPISODE

Jacky has built a portfolio of 50 online businesses over 10 years that now make a whopping $200K/month.

But here's what makes this episode even more fascinating: Only 20 of Jackie’s 50+ acquisitions make up that $200K/month. The rest have ‘died.’

This is a must-watch episode for anyone curious about online assets or just wants to understand platform risk before it bites you:

And for our audio-only listeners, jump in and listen on Spotify or Apple Podcasts!

THAT’S A WRAP

See you tomorrow!

-Helen Guo

Find Me On Twitter

Find Me On LinkedIn

P.S. I'd love your feedback. Tap the poll below or reply to this email.

How was today's newsletter? |

Disclaimer

This publication is a newsletter only and the information provided herein is the opinion of our editors and writers only. Any transaction or opportunity of any kind is provided for information only; SMB Deal Hunter does not verify nor confirm information. SMB Deal Hunter is not making any offer to readers to participate in any transaction or opportunity described herein.