- SMB Deal Hunter

- Posts

- New Deals: A managed IT service provider, tree service business, and 3 other finds

New Deals: A managed IT service provider, tree service business, and 3 other finds

Plus, why buying a business with its real estate can be a cheat code

Hello SMB Deal Hunters!

I’m excited to share 5 new businesses for sale worth checking out. First up…

🔥 Community Top Picks from the Last Issue:

#1: Hydraulic hose supply and service provider with $504K in EBITDA

#2: Assisted living facility with $2.9M in EBITDA

#3: Granite fabrication business with $1M in EBITDA

Today's issue is sponsored by SMB Diligence, the platform I helped start for matching business buyers with vetted legal counsel and Quality of Earnings providers.

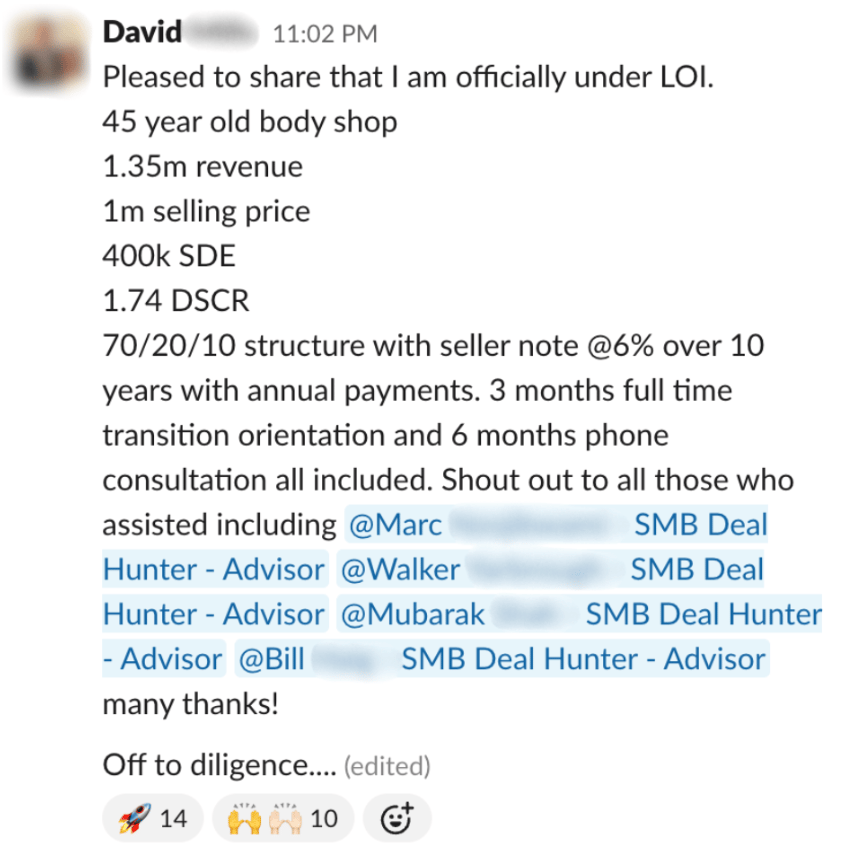

COMMUNITY WINS

Here’s what one SMB Deal Hunter Pro member shared this past week:

Want me and my team to work with you to find, finance, and acquire a million-dollar cash-flowing business in the next 6-12 months?

NEW DEALS

These deals span the country. For custom-sourced deals in your area, click here.

1/ Managed IT Service Provider (MSP)

📍 Location: Pennsylvania

💰 Asking Price: $3,800,000

💼 EBITDA: $825,000

📊 Revenue: $2,600,000

📅 Established: 2003

💭 My 2 Cents: Managed IT services are subscription-like, and once a provider is embedded, switching is painful and disruptive, which leads to very high retention. This 20+ year-old MSP offers 24/7 monitoring, cybersecurity services, and technology consulting to SMBs across Pennsylvania, Southern NY, and New Jersey. What I like about the SMB niche is that most can’t justify full-time internal IT teams but still require reliable IT support, so they outsource. The cybersecurity focus is particularly compelling as cyber threats are exploding, and SMBs are often the easiest targets since they have weaker defenses. I also like that they generate predictable, recurring revenue through ongoing contracts, with a near-100% client retention rate, backed by partner certifications (Cisco, Sophos) and vendor relationships with major distributors (D&H, TD Synnex, Ingram Micro). I’d want more detail on their average client tenure and lifetime value, revenue mix (recurring vs. one-time projects), client concentration, and industry exposure (especially to cyclical sectors). They don’t currently invest in external marketing, so I see significant growth potential through adding a dedicated sales team.

2/ Tree Service Business

📍 Location: Florida

💰 Asking Price: $3,250,000

💼 EBITDA: $993,087

📊 Revenue: $3,000,000

📅 Established: 2017

💭 My 2 Cents: As a rule, I like Florida-based tree service companies because the stormy weather creates urgent demand for their services, while the temperate climate supports year-round work. This franchise location offers a full suite of arboriculture services from removals (including crane-assisted) and land clearing to pruning and pest/disease management—services that require specialized equipment, training, and insurance, which provides a strong moat against small “pickup truck + chainsaw” operators. They include a fully built team and heavy equipment valued at approximately $1M, while the real estate, valued at around $280K, is available for separate purchase. As with any franchise, it’s critical to understand the full scope of benefits, fees, and operational restrictions that come with the relationship. I’d also want to assess the percentage of revenue from storm-driven jobs versus recurring maintenance, average ticket size, client acquisition channels, how their capabilities stack up against local competitors, the condition and remaining useful life of their equipment, and the difficulty of finding and retaining skilled staff. With expected support from the national franchisor, this high-margin company looks like an excellent turnkey opportunity.

3/ Modular Commercial Buildings Manufacturer

📍 Location: Midwest

💰 Asking Price: $6,600,000

💼 EBITDA: $1,436,099

📊 Revenue: $9,481,379

📅 Established: 1976

💭 My 2 Cents: Prefabricated and modular structures are gaining adoption because they reduce build times, cut costs, and improve quality compared to traditional construction. This Midwest-based company designs and manufactures them for sectors including energy, agriculture, mining, healthcare, and education, with applications such as workforce housing, medical clinics, classrooms, storage, labs, and utility enclosures. I like their 50-year operating history, diversified end-market exposure, meaningful scale with revenues approaching $10M, and strong cash flow. I also like the $700K of inventory and FF&E included in the asking price and that they operate from a 46,000 sq. ft. production and warehouse facility, providing efficient operations and room for future growth. I’d want to understand whether they offer standardized base designs (to drive efficiency and mitigate costs) or if every project is custom, the status of their work-in-progress, contracted backlog, and pipeline, their bid-to-win ratio, sensitivity to raw material costs and ability to pass on price increases, whether they own proprietary designs, and their current plant capacity utilization. Overall, this looks like a proven cash producer in a sector with strong tailwinds, driven by steady demand for flexible and efficient building solutions.

PRESENTED BY SMB DILIGENCE

Here’s Why You Shouldn’t Skip Due Diligence…

A friend of mine put a business under LOI and asked me for my advice.

I recommended he contract a 3rd party due diligence partner to rebuild the company's P&L from scratch.

Turns out their EBITDA was off by 2x 😳

Enter SMB Diligence.

SMB Diligence is the platform I helped start for matching business buyers with vetted diligence providers, from M&A lawyers to Quality of Earnings providers.

Their network of experts has worked on hundreds of small business transactions (including many from the SMB Deal Hunter community).

4/ Freight Company

📍 Location: Pennsylvania

💰 Asking Price: $8,500,000

💼 EBITDA: $2,000,000

📊 Revenue: $4,500,000

📅 Established: 1995

💭 My 2 Cents: Freight is the backbone of the economy, and this carrier provides local, regional, and long-haul service for long-tenured manufacturing customers across the Pennsylvania, New York, and New Jersey tri-state region. Their overall service area extends down to Florida and as far west as Texas, and they also offer on-site warehousing and limited seasonal refrigerated delivery. The sale includes 12 trucks and 23 trailers, with the option to purchase $2.5M of real estate. Freight demand can be tied to economic cycles, and a downturn could lead to lower volumes and pricing pressure. That’s why it’s important to understand the industries their customers represent, how much revenue comes from durable goods vs. consumables (durables are more cyclical, consumables more stable), and whether they serve counter-cyclical segments such as food, healthcare supplies, or maintenance parts. I’d also want to know how revenues, volumes, and margins performed during past downturns (COVID, the 2008 financial crisis), and if customer relationships are contract-based with minimum volume commitments. Assuming a resilient customer base and the fleet check out, this business could be a compelling opportunity.

5/ Playground & Park Equipment Business

📍 Location: Arizona

💰 Asking Price: $6,200,000

💼 EBITDA: $1,744,184

📊 Revenue: $17,872,689

📅 Established: 2012

💭 My 2 Cents: This company operates in a quiet corner of construction that’s surprisingly recession-resistant. They specialize in playground and park equipment design, installation, sales, and service for schools, municipalities, HOAs, developers, and community organizations across the Southwest. What’s compelling about this niche is that these customers have ongoing, mandated needs for safe, compliant playgrounds and community spaces and prefer to work with trusted vendors who meet strict safety standards. The equipment has a finite replacement cycle (10–15 years), and public budgets often earmark funds for these projects. Their partnerships with multiple top-tier manufacturers let them offer clients a true one-stop solution, while their combination of in-house staff and outsourced contractors enables them to take on the largest, most complex projects. I’d want to dig into what % of revenue is repeat vs. new projects, how much of their business comes from inspections and repairs, and how far out their current backlog and pipeline extend. One key area often overlooked in this industry is working capital—many companies need to front expenses long before reimbursement, especially with municipalities, so studying AR aging and project cash cycles will be critical.

THE BEST OF SMB TWITTER (X)

Why buying a business with its real estate can be a cheat code (link)

37 deal commandments (link)

Top ways to mitigate business buying risks (link)

Why you should hire a skilled QoE professional (link)

Why 90% of transactions never close (link)

3 signs your cash flow is giving you a false sense of security (link)

How to pick the right industry (link)

COMMUNITY PERKS

• Ready to buy and operate a $1M+ business? Partner with my team and get expert support at every step.

• Want to invest passively in SMB acquisitions? Get access to investment opportunities.

• Get a personal introduction to my preferred SBA 7(a) lender, non-SBA lenders, Quality of Earnings providers, or legal counsel

• Raising capital for your deal? I’ll connect you with investors from the SMB Deal Hunter Community.

• Interested in selling your business? I’ll help you connect with buyers from the SMB Deal Hunter Community.

RECENT PODCAST EPISODES

• This Software Engineer bought a $3.2M business with a baby on the way (link)

• He turned $100k -> $6M buying landscaping businesses (here's how) (link)

• He bought a $1.3M business with just $15k (here's how) (link)

THAT’S A WRAP

See you tomorrow with a new podcast episode!

-Helen Guo

Find Me On Twitter

Find Me On LinkedIn

P.S. I'd love your feedback. Tap the poll below or reply to this email.

How was today's newsletter? |

Disclaimer

This publication is a newsletter only and the information provided herein is the opinion of our editors and writers only. Any transaction or opportunity of any kind is provided for information only; SMB Deal Hunter does not verify nor confirm information. SMB Deal Hunter is not making any offer to readers to participate in any transaction or opportunity described herein.