- SMB Deal Hunter

- Posts

- New Deals: An urgent care veterinary clinic, security guard and services company, and 3 other finds

New Deals: An urgent care veterinary clinic, security guard and services company, and 3 other finds

Plus, ways to overcome the fear of buying a business

Hello SMB Deal Hunters!

I’m excited to share 5 new businesses for sale worth checking out in this Market Watch issue. Each was handpicked from hundreds of fresh listings, with our quick take on why it stands out. First up…

🔥 Community Top Picks from the Last Market Watch Issue:

#1: Car Wash & Detailing Center with $535K in EBITDA

#2: Montessori School with $1.8M in EBITDA

#3: Commercial Roofing Company with $813K in EBITDA

Today’s issue is sponsored by SMB Deal Hunter Pro, our accelerator that helps business buyers find, finance, and acquire a million-dollar cash-flowing business in 6–12 months.

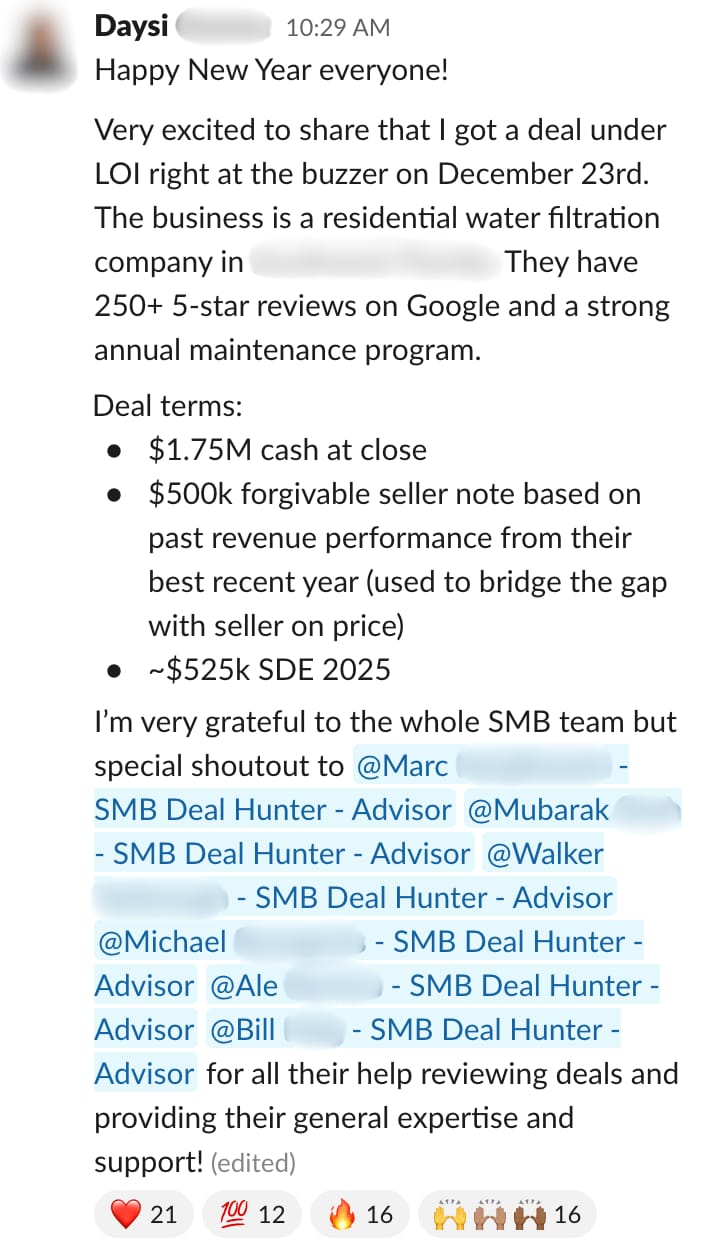

COMMUNITY WINS

Here’s what one SMB Deal Hunter Pro member shared this past week:

Want me and my team to work with you to find, finance, and acquire a million-dollar cash-flowing business in the next 6-12 months?

NEW DEALS

These deals span the country. For custom-sourced deals in your area, click here.

1/ Urgent Care Veterinary Clinic

📍 Location: Wisconsin

💰 Asking Price: $5,100,000

💼 EBITDA: $1,450,000

📊 Revenue: $2,500,000

📅 Established: 2018

💭 My 2 Cents: Urgent care veterinary clinics occupy a sweet spot between routine appointments and full emergency hospitals, capturing same-day cases that general vets can't fit in while charging 30-40% less than emergency rooms. This Wisconsin clinic has built a profitable niche since 2018, operating out of a modern 4,800 sq ft purpose-built facility with a full team of veterinary technicians, assistants, and front-office staff handling walk-ins during extended evening and weekend hours. The fact that customers are largely referred from general vets or overloaded emergency hospitals means the business benefits from established referral networks rather than needing to spend heavily on patient acquisition. What's also appealing is that the business has room to grow within its existing footprint by adding staff shifts or expanding operating hours without major capital expenditure. I'd want to understand whether those referral relationships are formalized through written agreements or just based on goodwill, how concentrated the referral sources are among a handful of key practices, if the founding veterinarian is critical to maintaining those relationships or if the business operates independently of any single personality, and if margins are artificially high due to owner compensation structure. Unlike traditional emergency hospitals that require massive facilities and 24/7 staffing, this model delivers urgent care economics with a fraction of the overhead, making it one of the more capital-efficient plays in veterinary services.

2/ Security Guard and Services Company

📍 Location: Pennsylvania

💰 Asking Price: $3,600,000

💼 EBITDA: $720,000

📊 Revenue: $3,600,000

📅 Established: 2015

💭 My 2 Cents: Security services is a people-heavy business that typically struggles with thin margins and high turnover, but this company has differentiated itself by moving beyond basic guard services into higher-value offerings like executive protection, corporate investigations, and cell phone data recovery. Operating across Pennsylvania's tri-state area with 50 employees, they've built a diversified revenue base that includes both government contracts and private sector clients, which provides stability and reduces reliance on any single customer segment. The fact that contracts are ongoing and transferable is crucial in this industry, where long-term agreements with municipalities or corporate campuses can create predictable cash flow and make it harder for competitors to displace you. What I like about this business is the mix of armed and unarmed services, which allows them to serve different risk profiles and price points, from retail locations needing overnight presence to executives requiring close protection. I'd want to understand the wage structure and retention rates for security personnel, licensing requirements for specialized services like investigations and data recovery, and whether growth has come from contract expansions with existing clients or new customer acquisition. While plenty of security firms are still stuck providing warm bodies for overnight shifts, the investigative and technical expertise here opens doors to clients who need sophisticated solutions and are willing to pay for them.

3/ Dumpster Rental Business

📍 Location: North Carolina

💰 Asking Price: $3,480,000

💼 EBITDA: $741,918

📊 Revenue: $2,952,795

📅 Established: 1991

💭 My 2 Cents: Few businesses benefit more from population growth and construction booms than dumpster rental, and this Charlotte operation sits right in the middle of both. This company has been around since 1991, serving a mix of residential cleanouts, home renovations, and contractor jobs with a reputation for reliable service. The 25% EBITDA margin and strong revenue relative to assets tell me they've nailed route density and equipment utilization, and the inclusion of over $900K in dumpsters and trucks adds real tangible value to the purchase price. What stands out is how conservative the operation has been: nine full-time employees handle everything without any dedicated sales function or push into recurring commercial routes, which means the business has grown entirely on inbound demand in one of America's fastest-growing metros. Their two facilities also extend their geographic reach and give them staging flexibility that smaller single-location competitors can't replicate. I'd want to understand peak period utilization rates to see if there's room for more capacity, pricing power against national players like Waste Management, and what the economics look like for layering in consistent commercial accounts that could smooth out seasonal residential swings. The asking price of 4.7x EBITDA is steep for the industry, but with the owner willing to stick around as long as needed, and with a clear runway for both sales-driven and commercial route expansion, I think this deal is worth a conversation.

ALUMNI SPOTLIGHT

Ben was a real estate developer, leading the renovation of over $100 million in historic buildings and condo conversions.

However, after experiencing the challenges of real estate development in today’s high-interest rate environment, Ben set his sights on a different path: acquiring established, cash-flowing businesses.

Within 7 months of joining SMB Deal Hunter Pro, our business buying accelerator, we helped Ben buy a $3.2M cabinet manufacturing business in NY cash-flowing over $1M/year.

In this interview, Ben breaks down how we helped him source and diligence the deal, manage tough broker and seller dynamics when things went sideways, secure financing with just 10% down, and build a clear post-acquisition plan.

4/ Facilities Management Business

📍 Location: Texas

💰 Asking Price: $2,950,000

💼 EBITDA: $663,632

📊 Revenue: $1,905,738

📅 Established: 2017

💭 My 2 Cents: Landing Fortune 500 clients and national storage operators as a seven-year-old facilities business tells me this company has figured out something most local janitorial outfits never crack: how to win and service multi-site commercial contracts at scale. This Houston-based operation bundles janitorial and light maintenance work across auto dealerships, storage facilities, and enterprise clients, creating predictable recurring revenue from customers who need consistent service across dozens of locations. With just four full-time employees handling nearly $2M in revenue, the business operates as more of a contract management play than a labor-intensive operation, likely subcontracting most fieldwork while maintaining client relationships and quality control. The 35% EBITDA margin is strong for the industry and reflects the capital-light nature of the model, with minimal inventory needs and low overhead. I'd want to understand contract length and renewal rates with major clients, the gross margin after subcontractor costs, and how much institutional knowledge sits with the owner versus the small team. The challenge with facilities services isn't winning the work, it's keeping quality consistent across dozens of locations while managing a network of subcontractors who can make or break your reputation.

5/ Packaging Machine Manufacturer

📍 Location: N/A

💰 Asking Price: $7,500,000

💼 EBITDA: $1,090,000

📊 Revenue: $3,321,000

📅 Established: 1963

💭 My 2 Cents: This company has been building custom filling and bagging systems for over 60 years, serving food processors, pharmaceutical companies, and industrial manufacturers who need reliable equipment to automate their packaging lines. The product architecture is smart: 12 core models with 75+ configurable variations means they can standardize engineering and manufacturing while still offering customization that keeps customers from commoditizing the purchase or switching to cheaper alternatives. What's interesting is the installed equipment base can apparently support an additional $2.5M in revenue without major capital investment, which tells me the current bottleneck is sales execution rather than production capacity. The lack of a developed sales function is both the risk and the opportunity here. That’s why I'd want to understand the sales cycle length, whether revenue comes from new machine sales versus parts and service, and how much technical expertise is required to spec and sell these systems. The 7x EBITDA asking price is high for a business doing $3.3M in revenue, which makes me think either there's meaningful backlog or intellectual property not reflected in the financials, or the seller is banking on a buyer who sees the growth potential from professionalizing the sales operation and capturing that unused manufacturing capacity.

THE BEST OF SMB TWITTER (X)

Contracts matter, but they’re not a safety net for bad diligence (link)

5 questions that tell if you’re ready to scale (link)

Why WIP blows up so many deals (link)

Ways to overcome the fear of buying a business (link)

Don’t let ego get in the way of good decisions (link)

What’s involved in scaling from $5M to $50M (link)

The Onion Theory of Risk (link)

COMMUNITY PERKS

• Ready to buy and operate a $1M+ business? Partner with my team and get expert support at every step.

• Want to invest passively in SMB acquisitions? Get access to investment opportunities.

• Get a personal introduction to my preferred SBA 7(a) lender, non-SBA lenders, Quality of Earnings providers, or legal counsel

• Raising capital for your deal? I’ll connect you with investors from the SMB Deal Hunter Community.

• Interested in selling your business? I’ll help you connect with buyers from the SMB Deal Hunter Community.

RECENT PODCAST EPISODE

Most buyers never see what actually happens behind the scenes of a business acquisition.

I sat down with Alejandra, a business broker who’s facilitated over $100M in transactions, to walk through exactly what happens on the other side of the table.

Here are some of the highlights from the deep dive:

🔥 What the first 48 hours look like from the broker’s perspective when a hot listing goes up

🔥 The three documents Alejandra needs before she'll present you to a seller. (Most buyers only send one)

🔥 War stories on deals that fell apart (and what you can learn from them)

And she pulls back the curtain on why brokers often don’t return calls, why ‘cash buyers only’ listings are usually not serious, and how you can stand out from the crowd when competing for a popular business.

And for our audio-only listeners, jump in and listen on Spotify or Apple Podcasts!

THAT’S A WRAP

See you tomorrow!

-Helen Guo

Find Me On Twitter

Find Me On LinkedIn

P.S. I'd love your feedback. Tap the poll below or reply to this email.

How was today's newsletter? |

Disclaimer

This publication is a newsletter only and the information provided herein is the opinion of our editors and writers only. Any transaction or opportunity of any kind is provided for information only; SMB Deal Hunter does not verify nor confirm information. SMB Deal Hunter is not making any offer to readers to participate in any transaction or opportunity described herein.