- SMB Deal Hunter

- Posts

- New Deals: A tree care business, commercial painting business, and 3 other finds

New Deals: A tree care business, commercial painting business, and 3 other finds

Plus, how to build your network

Hello SMB Deal Hunters!

I’m excited to share 5 new businesses for sale worth checking out in this Market Watch issue. Each was handpicked from hundreds of fresh listings, with our quick take on why it stands out. First up…

🔥 Community Top Picks from the Last Market Watch Issue:

#1: Gas store and liquor store with real estate with $713K in EBITDA

#2: Security technology integration company with $643K in EBITDA

#3: Luxury flooring business with $1.26M in EBITDA

🔎 Looking for deals in your area? We can source them for you.

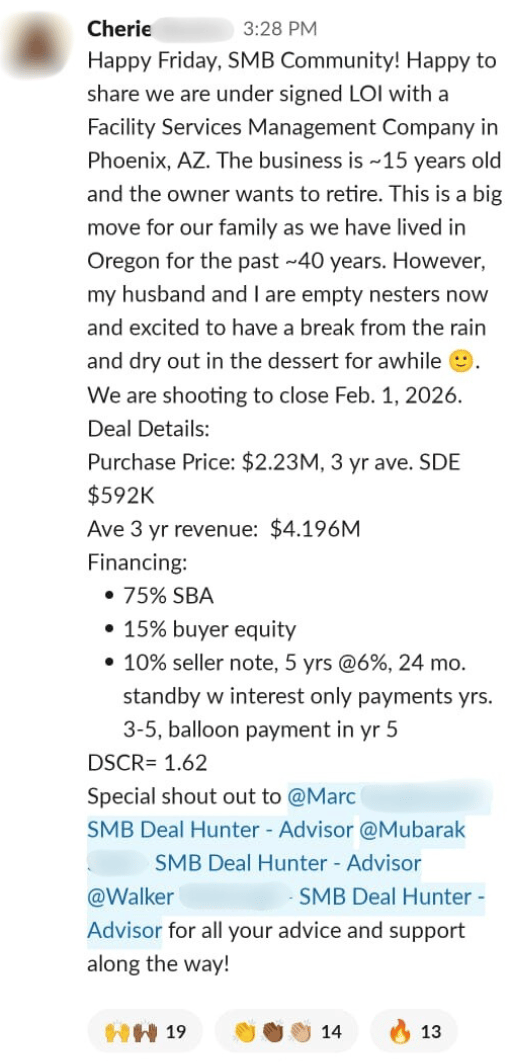

COMMUNITY WINS

Here’s what one SMB Deal Hunter Pro member shared this past week:

Want me and my team to work with you to find, finance, and acquire a million-dollar cash-flowing business in the next 6-12 months?

NEW DEALS

These deals span the country. For custom-sourced deals in your area, click here.

1/ Tree Care Business

📍 Location: North Carolina

💰 Asking Price: $1,735,000

💼 EBITDA: $650,844

📊 Revenue: $1,231,222

📅 Established: 2018

💭 My 2 Cents: Two things I really like about this full-service tree care provider are their unusually strong cash flow relative to revenue and their strong geographic footprint. The Asheville/Hendersonville corridor features dense tree canopy, aging forests, mountainous terrain, and frequent storm activity, all of which generate steady, recurring demand for pruning, emergency removals, and arborist services. With five full-time employees, one independent contractor, and $645,000 of FF&E included in the sale, this company is built around a lean operational structure, supported by the equipment and infrastructure needed to tackle a wide range of jobs. Add to this that their extremely low rent, locked in at $1,500 per month, and they should continue to have strong margins going forward. I’d want to know their revenue mix between their different services, how much of their client base is repeat residential versus recurring commercial/HOA contracts, how far out their current backlog and pipeline extend, the age and condition of their equipment, what job functions will need to be replaced as the seller departs, and if there are opportunities to add plant-health programs or land-clearing services to increase earnings. With their excellent reputation, stable staff, and large amount of equipment, a buyer can expect to be walking into a situation with a very solid foundation.

2/ Commercial Painting Business

📍 Location: Florida

💰 Asking Price: $1,000,000

💼 EBITDA: $340,000

📊 Revenue: $5,150,000

📅 Established: 1986

💭 My 2 Cents: This commercial painting contractor has nearly four decades of operating history in a consistently profitable Southwest Florida market characterized by sustained construction activity, extensive HOA and multifamily stock, and steady demand for repainting cycles due to climate wear. I like their team of experienced supervisors and painters, as well as their well-developed, proven operational systems and procedures, both of which should help ensure that the owner’s departure will not disrupt core service delivery. Companies that have delivered reliably for decades often become the default choice for property managers and general contractors, which appears to be the case here. Still, it’ll be very important to understand the exact nature of their client relationships to get comfortable with how this built-in sales engine is driving the business. I’d also need to look into any possible client concentration, if they carry a backlog of work or have a clear pipeline, what percentage of their work is repeat business versus competitively bid, and the nature and condition of the $225K of equipment included in the sale. Assuming their key employees are slated to stay post-transition, this looks like a very interesting turnkey available at a very manageable price.

3/ Industrial Staffing Company

📍 Location: Pennsylvania

💰 Asking Price: $4,700,000

💼 EBITDA: $982,999

📊 Revenue: $14,258,614

📅 Established: 20+ Years Ago

💭 My 2 Cents: Industrial staffing sits at the critical junction between manufacturers who need reliable labor and workers seeking consistent placement, and this firm has cracked the code on scaling that model profitably. While most staffing agencies in the space faced revenue declines over the past year, this business grew 30% by building a differentiated recruitment engine powered by proprietary systems: a custom CRM, advanced applicant tracking platforms, automated messaging tools, and an emerging AI layer that accelerates candidate sourcing and matching. I like their multi-location footprint (which gives them strategic coverage across key manufacturing regions) and that their service mix spans Direct Hire, Payrolling, Temp-to-Perm, and high-margin RPO (recruitment process outsourcing), which diversifies revenue streams and deepens client relationships. What stands out is the organizational maturity and the high-activity recruitment culture that drives volume, suggesting this isn't just technology but disciplined execution across the team. I'd want to understand the revenue breakdown by service line and geography, the specific KPIs that define their recruitment model and how performance is tracked, the scalability of their custom tech stack as they add locations, and their onboarding and training infrastructure for ramping new recruiters quickly. What's rare here is finding a staffing business that has moved beyond founder-driven hustle into repeatable systems and processes, positioning a buyer to step into momentum rather than rebuild it.

ALUMNI SPOTLIGHT

Irving had spent the last 20 years in corporate at a wealth management firm.

He realized there were only two paths in corporate: stagnant and passive (clocking in, clocking out, waiting for your two weeks of vacation), or hyper-competitive (constantly sharp, demanding your time, hoping for equity or a good bonus).

Within just over a year of joining SMB Deal Hunter Pro, our business buying accelerator, Irving and his wife closed on a ~$5.56M physical therapy practice in Texas cash-flowing $1.3M/year.

In this interview, he shares how we helped him:

✅ Save nearly $1M over the next 10 years (due to a little-known tax rule)

✅ Handle a tough negotiation all the way to the end of the deal (leading to Irving getting a $400k seller note and keeping the seller on for his PT license)

✅ Bring down the price of the deal by $135k during due diligence.

4/ Restaurant Equipment Repair Business

📍 Location: Florida

💰 Asking Price: $1,587,041

💼 EBITDA: $587,793

📊 Revenue: $1,169,373

📅 Established: 2005

💭 My 2 Cents: Commercial kitchen equipment repair is one of those sticky service businesses where downtime costs customers thousands per hour, creating urgent demand and pricing power that few repair categories enjoy. This company has positioned itself as the go-to specialist for restaurants and commercial kitchens, with deep expertise across all major brands including TurboChef, Baxter, Blodgett, and Bellshaw, which allows them to handle virtually any equipment issue without referring work elsewhere. What's most impressive is the blue-chip customer base that includes major franchise brands, combined with unusually strong margins that reflect both technical specialization and the premium customers pay for fast, reliable service. The business operates lean with low overhead, suggesting the current footprint is highly efficient and that expansion into adjacent markets wouldn't require heavy infrastructure investment. I'd want to understand the split between recurring maintenance contracts and emergency repair calls, the technician headcount and certification requirements, how factory authorizations transfer to a new owner, and whether after-hours service is handled in-house or outsourced. The real question is owner dependence: how much technical work, customer relationships, or dispatch coordination sits with the seller versus the existing team. Assuming there's a capable lead technician or manager who can step up, this business benefits from the fact that commercial kitchens will always break down and operators will always pay top dollar to get back online fast.

5/ Truck Equipment Sales and Service Business

📍 Location: Massachusetts

💰 Asking Price: $2,900,000

💼 EBITDA: $576,741

📊 Revenue: $3,848,566

📅 Established: 1977

💭 My 2 Cents: Welding and fabrication shops that survive five decades don't just fix things, they become the infrastructure that entire commercial fleets and municipalities depend on. This Massachusetts operation has done exactly that, building a loyal base of over 3,000 active clients by combining precision custom metalwork with authorized dealerships for premium trailer and snow equipment brands. Their revenue diversification is smart: custom welding and fabrication drives 35%, trailer sales and parts another 25%, and snow plows and sanders 18%, which smooths out the seasonal volatility that plagues single-service competitors. What stands out is the asset base, with $1.2M in fixtures, furniture, and equipment plus $500K in inventory included in the sale, giving the business the production capacity and parts depth to serve demanding commercial and municipal accounts that require fast turnaround and technical reliability. I'd want to understand whether the two facilities are owned or leased, review the skill level and tenure of welders and fabricators, confirm any exclusivity or preferred pricing with manufacturers, and assess upcoming capital requirements for aging equipment or facility expansion. The beauty here is that nearly half a century of technical reputation and installed equipment creates natural switching costs that insulate this business from low-cost entrants who lack the expertise, certifications, or manufacturer relationships to compete for the highest-value contracts.

THE BEST OF SMB TWITTER (X)

The nature of the relationship between buyer and seller is critical (link)

Business is a brutal game (link)

2026 AI predictions (link)

The difficult but rewarding challenges in pivoting from W-2 to SMB ownership (link)

How to build your network (link)

The shadow IT problem (link)

Running an SMB has to be about more than money (link)

Top takeaways on building a business (link)

COMMUNITY PERKS

• Ready to buy and operate a $1M+ business? Partner with my team and get expert support at every step.

• Want to invest passively in SMB acquisitions? Get access to investment opportunities.

• Get a personal introduction to my preferred SBA 7(a) lender, non-SBA lenders, Quality of Earnings providers, or legal counsel

• Raising capital for your deal? I’ll connect you with investors from the SMB Deal Hunter Community.

• Interested in selling your business? I’ll help you connect with buyers from the SMB Deal Hunter Community.

RECENT PODCAST EPISODE

Bill was an Army officer who bought his first gym with zero experience right after his MBA.

And after spending the first few years in the business, he was able to work himself completely out of the day-to-day.

And now, he’s opening his 4th location.

And for our audio-only listeners, jump in and listen on Spotify or Apple Podcasts!

THAT’S A WRAP

See you tomorrow!

-Helen Guo

Find Me On Twitter

Find Me On LinkedIn

P.S. I'd love your feedback. Tap the poll below or reply to this email.

How was today's newsletter? |

Disclaimer

This publication is a newsletter only and the information provided herein is the opinion of our editors and writers only. Any transaction or opportunity of any kind is provided for information only; SMB Deal Hunter does not verify nor confirm information. SMB Deal Hunter is not making any offer to readers to participate in any transaction or opportunity described herein.