- SMB Deal Hunter

- Posts

- New Deals: A porta potty business, moving and junk removal business, and 3 other finds

New Deals: A porta potty business, moving and junk removal business, and 3 other finds

Also, I'm hiring again. Details inside.

Hello SMB Deal Hunters!

📣 Before we jump into today's deals:

I'm hiring a Business Development and Go-To-Market Lead to help us launch the next evolution of our off-market deal engine that gives vetted buyers access to proprietary deals that never hit the public market.

If you're that rare breed who's just as comfortable picking up the phone to push a deal forward as you are building the tools and workflows to scale the process, and you want to join our rocketship that’s powered $70M+ in closed deals this past year alone, apply here.

Now onto regular business! I’m excited to share 5 new businesses for sale worth checking out. First up…

🔥 Community Top Picks from the Last Issue:

#1: Commercial flooring contractor with $1M in EBITDA

#2: Precision grinding company with $1.6M in EBITDA

#3: Commercial cleanup and environmental services company with $1.2M in EBITDA

Today's issue is sponsored by SMB Diligence, the platform I helped start for matching business buyers with vetted legal counsel and Quality of Earnings providers.

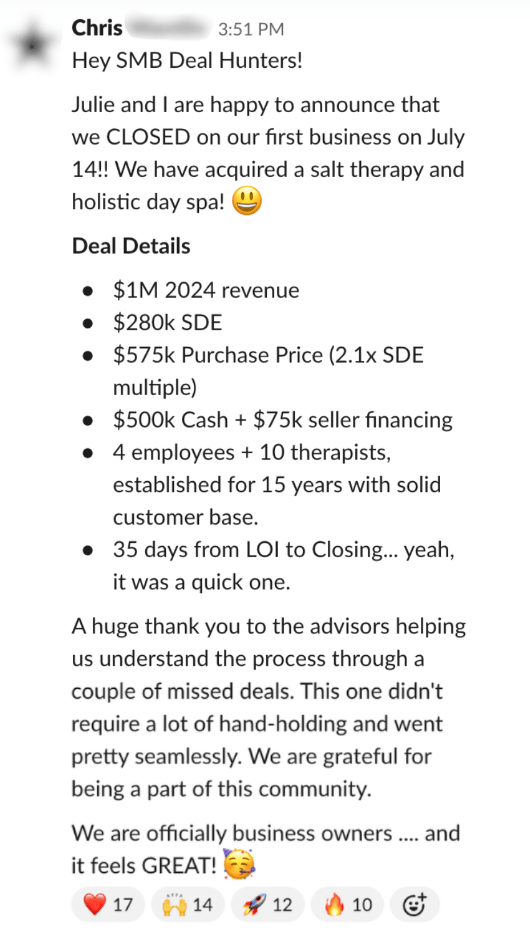

COMMUNITY WINS

Here’s what one SMB Deal Hunter Pro member shared this past week:

Want me and my team to work with you to find, finance, and acquire a million-dollar cash-flowing business in the next 6-12 months?

NEW DEALS

These deals span the country. For custom-sourced deals in your area, click here.

1/ Porta Potty and Septic Pumping Business

📍 Location: Maine

💰 Asking Price: $4,500,000

💼 EBITDA: $985,000

📊 Revenue: $1,690,000

📅 Established: 2002

💭 My 2 Cents: This business offers portable toilet rentals and septic tank pumping for residential, commercial, special event, and construction clients across Northern New England. It may not be glamorous work, but septic pumping is mandatory and recurring for many properties (especially rural homes), and construction and long-term porta potty rentals generate monthly or weekly income with little customer churn. Their multiple revenue streams also include some $40K from 50 self-storage units on their real estate, where there is also an in-use gravel pit that could be used to supply customers. I like how this real estate is included in the purchase price, as well as $750K worth of FF&E and $100K of inventory. Other real positives are their 20+ year history, loyal client base, and strong 58% EBITDA margin. I’d want to get a breakdown of revenue that’s contracted vs. one-off and by service line, the condition of their rental toilets and fleet and expected replacement timelines, and what seasonality looks like (event-driven or construction-heavy businesses can experience lulls in winter). This may not be the sexiest industry, but it’s essential, defensible, and highly profitable—a combination that’s hard to beat.

2/ Home Inspection Company

📍 Location: Georgia

💰 Asking Price: $2,500,000

💼 EBITDA: $709,356

📊 Revenue: $2,051,453

📅 Established: 2002

💭 My 2 Cents: While cyclical with the housing market, inspections are required for nearly every financed home and many cash sales. Georgia has also experienced strong population and housing growth in its key metro areas thanks to its affordable cost of living, fueling consistent inspection volume. I like how this home inspection company has built a reputation for high-quality work, leading to longstanding relationships with top real estate agents in the area. They boast a lean cost structure with home-based operations, a small leased facility, and a team of 13 experienced employees, including skilled inspectors. Importantly, the bulk of this business’s expenses are variable, so you can flex up and down depending on demand and won’t be on the hook for a lot of fixed overhead if there’s a slower period or year (this can make a real difference for a buyer utilizing a large amount of debt). I’d need to look into what percentage of their inspections are for buyers/sellers versus other purposes (e.g., mold, radon), client concentration among agents and brokerages, how inspectors are hired and compensated (salary, contract, commission), how much additional work the current team could absorb, and how volume has tracked against interest rate cycles in recent years. The owner is committed to staying for up to a year to make sure all key relationships transfer and employees are fully integrated with the new operation, so a buyer wouldn’t need direct experience to take the reins of this solid cash producer.

3/ Abatement and Demolition Company

📍 Location: California

💰 Asking Price: $4,490,000

💼 EBITDA: $1,000,000

📊 Revenue: $10,000,000

📅 Established: 1980

💭 My 2 Cents: What first caught my eye about this business is their five different primary revenue streams: Environmental Remediation, Demolition, Coatings/Painting, HazMat Hauling, and Training & Consulting. Reflecting their diverse offerings, they serve an unusually wide range of clients, including government agencies, military installations, bridges, schools, and commercial and residential buildings. I love their recurring revenue, with long-term contracts (60% repeat customers), a significant asset base entailing $2M in FF&E and $318K in inventory, and multiple licenses and regulatory approvals, including those for asbestos and hazardous waste removal (which can take significant time and cost to earn and serve as a meaningful moat). I’d need to dig into the revenue breakdown across their five divisions, recurring vs. project-based work, their backlog and pipeline health, contract terms, if any obligations with the unionized staff would affect a buyer’s flexibility or cost structure, and which licenses are entity-held vs. individual-held. The demand for their services isn’t going away (and if anything, will only increase). Regulations around environmental hazards are only getting stricter, aging infrastructure will continue to require remediation, and compliance with hazardous material laws isn’t optional.

PRESENTED BY SMB DILIGENCE

Here’s Why You Shouldn’t Skip Due Diligence…

A friend of mine put a business under LOI and asked me for my advice.

I recommended he contract a 3rd party due diligence partner to rebuild the company's P&L from scratch.

Turns out their EBITDA was off by 2x 😳

Enter SMB Diligence.

SMB Diligence is the platform I helped start for matching business buyers with vetted diligence providers, from M&A lawyers to Quality of Earnings providers.

Their network of experts has worked on hundreds of small business transactions (including many from the SMB Deal Hunter community).

4/ Water Well Drilling Business

📍 Location: Florida

💰 Asking Price: $5,200,000

💼 EBITDA: $1,114,354

📊 Revenue: $4,678,841

📅 Established: 1984

💭 My 2 Cents: Water is a non-discretionary utility. Whether it’s for households, farms, or commercial properties, clean, reliable water is critical. This Southwest Florida company provides well drilling, pump installation, and complete water system setups for a region undergoing ongoing construction and population growth and often relies on private wells and pump systems. I like their 45-year history, solid client list that includes homeowners, builders, and municipal agencies, significant cash flow, and $1.6M in specialized vehicles and equipment included in the sale. However, I’d need to get a handle on their revenue mix, how much of it is recurring service revenue, what their current backlog and pipeline look like, and any seasonal swings (especially around hurricane season). I’d also want to understand what systems are in place for upselling filtration or locking in service contracts. All that considered, there may be meaningful opportunities to expand into surrounding counties or deepen recurring revenue through maintenance and water treatment.

5/ Moving and Junk Removal Business

📍 Location: Florida

💰 Asking Price: $1,800,000

💼 EBITDA: $604,799

📊 Revenue: $3,369,053

📅 Established: 2006

💭 My 2 Cents: This business offers moving/storage and hauling/junk removal, services with constant demand driven by life events. What jumped out to me is that each service is run by an experienced operations manager, providing day-to-day stability. I also really like the complementary nature of the two services (many customers who use the company for moving also end up needing junk removal) and the even revenue and earnings split between the two divisions. There is a robust team of 30 employees in place, and they come with nearly $500K of trucks, containers/dumpsters, storage pods, and other gear included in the sale. I’d need to find out why the reported value of the FF&E feels low relative to the amount of assets, though this may just reflect accumulated depreciation on the books rather than actual market value. I’d also want to check if their client base is residential, commercial, or both, if they have any recurring clients, average job size and gross margin by job type, where leads come from (Google Ads, SEO, referrals, repeat?), the cost per lead and conversion rate, and if they have any relationships with realtors, property managers, or contractors. Most small operators in this industry are weak on SEO, Google Ads, CRM follow-up, and lead conversion tracking, so there could be an interesting opportunity for a strong operator to build a dominant local brand or roll up other mom-and-pop players.

THE BEST OF SMB TWITTER (X)

Amortization vs depreciation (link)

Harsh truth of scaling a business (link)

Understanding financial metrics (link)

Always take the line of credit (link)

How to avoid buying a job (link)

8 very profitable boring service businesses (link)

How to avoid cash flow problems (link)

COMMUNITY PERKS

• Ready to buy and operate a $1M+ business? Partner with my team and get expert support at every step.

• Want to invest passively in SMB acquisitions? Get access to investment opportunities.

• Get a personal introduction to my preferred SBA 7(a) lender, non-SBA lenders, Quality of Earnings providers, or legal counsel

• Raising capital for your deal? I’ll connect you with investors from the SMB Deal Hunter Community.

• Interested in selling your business? I’ll help you connect with buyers from the SMB Deal Hunter Community.

RECENT PODCAST EPISODES

• He Left Corporate to Buy a Pallet Company. Then He Doubled It. (link)

• Former Talent Agent Buys 40-Year-Old Trade Publication And Modernizes It for the Digital Age (link)

• Why This Startup Founder Bought an Electrical Contracting Business (link)

THAT’S A WRAP

See you Thursday!

-Helen Guo

Find Me On Twitter

Find Me On LinkedIn

P.S. I'd love your feedback. Tap the poll below or reply to this email.

How was today's newsletter? |

Disclaimer

This publication is a newsletter only and the information provided herein is the opinion of our editors and writers only. Any transaction or opportunity of any kind is provided for information only; SMB Deal Hunter does not verify nor confirm information. SMB Deal Hunter is not making any offer to readers to participate in any transaction or opportunity described herein.