- SMB Deal Hunter

- Posts

- New Deals: A power equipment parts seller, precision grinding company, and 3 other finds

New Deals: A power equipment parts seller, precision grinding company, and 3 other finds

Plus, the main reasons businesses don’t sell

Hello SMB Deal Hunters!

I’m excited to share 5 new businesses for sale worth checking out. First up…

🔥 Community Top Picks from the Last Issue:

#1: Agricultural equipment business with $2.4M in EBITDA

#2: Car wash with $742K in EBITDA

#3: Composting yard with $550K in EBITDA

Today's issue is sponsored by SMB Diligence, the platform I helped start for matching business buyers with vetted legal counsel and Quality of Earnings providers.

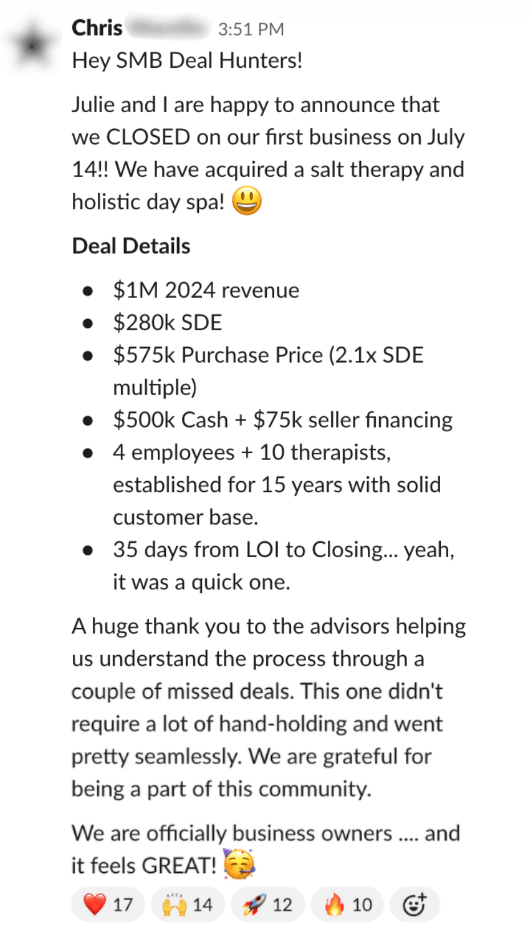

COMMUNITY WINS

Here’s what one SMB Deal Hunter Pro member shared this past week:

Want me and my team to work with you to find, finance, and acquire a million-dollar cash-flowing business in the next 6-12 months?

NEW DEALS

These deals span the country. For custom-sourced deals in your area, click here.

1/ Commercial Flooring Contractor

📍 Location: Florida

💰 Asking Price: $3,200,000

💼 EBITDA: $1,050,000

📊 Revenue: $7,000,000

📅 Established: 2011

💭 My 2 Cents: This commercial flooring contractor has generated consistent revenue by focusing on a loyal client base of top-tier general contractors involved in projects for various industries across the booming South Florida. I really like their streamlined business model, as they utilize subcontracted labor for installations, allowing for scalability while minimizing fixed labor costs. A core staff of 12 oversees estimating, operations, and project management, so a new owner should be able to count on a high degree of continuity during and after a transition. They currently turn down 30–40% of inbound project requests due to selective capacity, underscoring how a new owner should also be able to quickly expand the business with targeted investment. I’d need more details on why they are turning away work requests, including what resources you would need to be able to meet them. I’d also need to look into any possible client concentration on the GC side, their current backlog and pipeline, if they are part of a bidding rotation or the “go-to” vendor for these GCs, which types of jobs (new builds vs reno vs retail refresh) are most profitable, and if they rely heavily on one or two crews. While this seems like a great opportunity for someone looking to enter the industry, it should especially appeal to a contractor seeking to extend their capabilities and offerings.

2/ Precision Grinding Company

📍 Location: Illinois

💰 Asking Price: $9,000,000

💼 EBITDA: $1,600,000

📊 Revenue: $8,200,000

📅 Established: 1978

💭 My 2 Cents: This precision grinding company stood out to me as one well-positioned to benefit from U.S. reshoring trends and defense-industrial policy driving increased demand to domestic suppliers. Precision manufacturing involves producing highly accurate, tight-tolerance components for demanding industries like aerospace, automotive, medical, and defense. This one-stop-shop is a family-owned operation housed in a high-quality 55,000 sq ft facility, supported by $1.6M in specialty equipment and other FF&E. I really like their base of over 2,000 clients, with no concentration issues (top customer only 7.7%), a robust staff, and hard-to-replicate industry expertise that provides both pricing power and strong customer retention. I’d want to understand their revenue breakdown between recurring contracts and spot project-based work, the blend of prototype versus production grinding, the age and condition of their grinding machines, and their current utilization rate and capacity to take on more work. With a defensible niche, sticky customer base, and favorable industry tailwinds, this looks like a compelling opportunity for a motivated buyer.

3/ Commercial Cleanup and Environmental Services Company

📍 Location: Arizona

💰 Asking Price: $4,900,000

💼 EBITDA: $1,221,117

📊 Revenue: $8,424,881

📅 Established: 1986

💭 My 2 Cents: I like commercial cleanup companies on their own, so this business with its additional capabilities immediately caught my eye. They have carved out a distinctive niche offering four large-scale trucking and environmental services: construction site cleanup, farm and dairy waste removal, organic fertilizer distribution, and rodeo arena preparation. Each of these has different demand cycles, creating insulation from downturns in any one segment. Plus, farm and dairy waste removal is often recurring and compliance-driven, making it a non-discretionary service. I love their proven 40-year track record, large stock of trucks and specialized equipment, experienced crew of 35, facilities located on an ample 25-acre lot, and real estate (which must be purchased separately) that, depending on its quality and possible use, could represent valuable upside potential for a buyer. I’d want to dig into the revenue split across their four core service lines, if they face any seasonality from their farm and rodeo services, whether they have any long-term contracts in place, the value and condition of their fleet and related equipment, and how many CDL drivers, laborers, and operators they have. Assuming the key personnel stay in place, this could be either a solid turnkey opportunity or an appealing bolt-on.

PRESENTED BY SMB DILIGENCE

Here’s Why You Shouldn’t Skip Due Diligence…

A friend of mine put a business under LOI and asked me for my advice.

I recommended he contract a 3rd party due diligence partner to rebuild the company's P&L from scratch.

Turns out their EBITDA was off by 2x 😳

Enter SMB Diligence.

SMB Diligence is the platform I helped start for matching business buyers with vetted diligence providers, from M&A lawyers to Quality of Earnings providers.

Their network of experts has worked on hundreds of small business transactions (including many from the SMB Deal Hunter community).

4/ Power Equipment Parts Seller

📍 Location: Florida

💰 Asking Price: $9,900,000

💼 EBITDA: $2,134,367

📊 Revenue: $11,558,967

📅 Established: 2011

💭 My 2 Cents: This outdoor power equipment parts e-Commerce business is known for the quality of its U.S.-designed and assembled products. They currently sell through Amazon and eBay, but what jumped out at me is that they have started to attract OEM buyers thanks to their strong online reviews and excellent performance, pointing to their ability to function as both a B2C and B2B business. The company is supported by a solid team of 23 employees, and the asking price includes $3 million in inventory and $1.1 million in FF&E. I’d want to better understand their product line, supply chain, and how their products are designed and assembled. There’s always platform risk with Amazon and eBay, so I’d also want to check their seller account health and ratings. I’d also want to know what percentage of their earnings is DTC versus B2B, what seasonality in revenue looks like (parts demand can be seasonal), if they are dependent on any single SKU or product category, how fast inventory moves and how much working capital is tied up in inventory, and how scalable their operations are with their existing personnel and equipment. Given the strong foundation and asset base already in place, it's rare to find an e-Commerce business with this kind of longevity and a clear path to B2B expansion.

5/ Food Equipment Sales and Service Business

📍 Location: Iowa

💰 Asking Price: $2,900,000

💼 EBITDA: $750,026

📊 Revenue: $2,900,000

📅 Established: 1977

💭 My 2 Cents: This decades-old, family-owned, Des Moines-based company sells and services commercial kitchen equipment and food processing tools. They offer a full-service model with expert repair technicians and loaner equipment, which has helped them build long-standing customer relationships. I really like how they capture all sides of the customer relationship, from the initial sale to ongoing service, maximizing customer value and deepening retention. I also like that $821K in inventory and $325K in FF&E are included in the sale, though I’d check whether the inventory is all moving or if there are slow-moving or dead SKUs. I’d want to explore whether they have longer-term contracts and a meaningful level of recurring revenue, if they hold any exclusive distribution agreements, how they source new business (referrals, sales reps, SEO, or vendor relationships), whether their customer base is restaurant-heavy or more recession-resistant segments like healthcare and institutional foodservice, the condition of their real estate (available for separate purchase), and whether they’re experiencing any challenges hiring or retaining skilled technicians. The seller is open to a long transition of up to one year, providing the time needed to fully transfer key customer and staff relationships to the new owner.

THE BEST OF SMB TWITTER (X)

Some top KPIs (link)

A huge update to Yelp ads for home service businesses (link)

5 reasons to say no to purchase agreements (link)

The 3 main debt metrics in real estate (link)

Making an expansion acquisition with an SBA loan (link)

The main reasons businesses don’t sell (link)

12 cash flow insights (link)

COMMUNITY PERKS

• Ready to buy and operate a $1M+ business? Partner with my team and get expert support at every step.

• Want to invest passively in SMB acquisitions? Get access to investment opportunities.

• Get a personal introduction to my preferred SBA 7(a) lender, non-SBA lenders, Quality of Earnings providers, or legal counsel

• Raising capital for your deal? I’ll connect you with investors from the SMB Deal Hunter Community.

• Interested in selling your business? I’ll help you connect with buyers from the SMB Deal Hunter Community.

RECENT PODCAST EPISODES

• He Left Corporate to Buy a Pallet Company. Then He Doubled It. (link)

• Former Talent Agent Buys 40-Year-Old Trade Publication And Modernizes It for the Digital Age (link)

• Why This Startup Founder Bought an Electrical Contracting Business (link)

THAT’S A WRAP

See you next Tuesday!

-Helen Guo

Find Me On Twitter

Find Me On LinkedIn

P.S. I'd love your feedback. Tap the poll below or reply to this email.

How was today's newsletter? |

Disclaimer

This publication is a newsletter only and the information provided herein is the opinion of our editors and writers only. Any transaction or opportunity of any kind is provided for information only; SMB Deal Hunter does not verify nor confirm information. SMB Deal Hunter is not making any offer to readers to participate in any transaction or opportunity described herein.