- SMB Deal Hunter

- Posts

- New Deals: A car wash, agricultural equipment business, and 3 other finds

New Deals: A car wash, agricultural equipment business, and 3 other finds

Plus, 10 business red flags

Hello SMB Deal Hunters!

I’m excited to share 5 new businesses for sale worth checking out. First up…

🔥 Community Top Picks from the Last Issue:

#1: Commercial electrical contractor with $1.6M in EBITDA

#2: Tile and flooring retailer with $2.2M in EBITDA

#3: Property maintenance business with $508K in EBITDA

Today's issue is sponsored by SMB Diligence, the platform I helped start for matching business buyers with vetted legal counsel and Quality of Earnings providers.

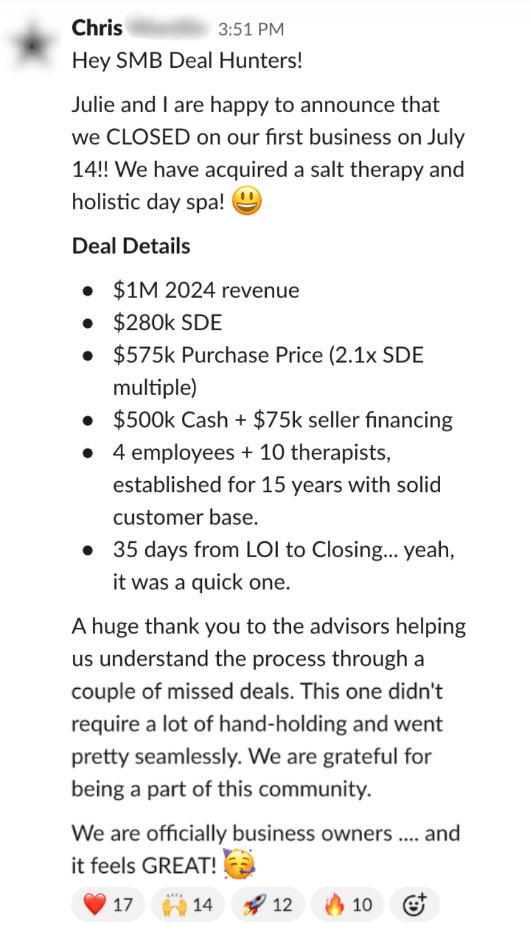

COMMUNITY WINS

Here’s what one SMB Deal Hunter Pro member shared this past week:

Want me and my team to work with you to find, finance, and acquire a million-dollar cash-flowing business in the next 6-12 months?

NEW DEALS

These deals span the country. For custom-sourced deals in your area, click here.

1/ Agricultural Equipment Business

📍 Location: Nebraska

💰 Asking Price: $6,500,000

💼 EBITDA: $2,440,270

📊 Revenue: $8,976,982

📅 Established: 1990

💭 My 2 Cents: This Nebraska business specializes in the sale and servicing of large-scale agricultural equipment. Given the strong margins, a meaningful portion of earnings likely comes from the high-margin service and parts side of the business, which often provides stable, recurring revenue. I like that they sell niche, capital-intensive products and then continue monetizing those same customers through long-term maintenance and support. Other clear positives are their exclusive product lines and longstanding B2B relationships in the Midwest region. I’d want to dig into how secure and defensible those exclusive OEM relationships are, whether there are performance requirements or quotas, how much recurring revenue they bring in from service contracts, whether seasonality significantly impacts cash flow, the terms and triggers of any floorplan financing (which is essentially a short-term loan secured by inventory that allows dealers to stock equipment before it's sold), and the turnover and condition of the $700K in inventory and $400K in FF&E included in the sale. With SBA pre-approval for up to $5 million and an additional $1 to $1.5 million in conventional funding available, this looks like a highly financeable deal, though it's important to closely evaluate the working capital requirements and any exposure tied to inventory financing.

2/ Car Wash

📍 Location: Montana

💰 Asking Price: $3,600,000

💼 EBITDA: $742,497

📊 Revenue: $2,844,043

📅 Established: 2003

💭 My 2 Cents: Car washes are a private equity favorite for their recession resilience, potential recurring revenue from memberships, and tax advantages from bonus depreciation on high-value equipment like wash tunnels and vacuums. This business combines a full-service car wash (I'd want to confirm whether it’s express, in-bay automatic, or another model) with light automotive repairs and tire services in a 6,000 sq ft multipurpose facility. I like the combination of interrelated revenue streams, the mix of retail and fleet clients, and the heated apron that allows for year-round operation in Montana’s winter. The sale includes real estate valued at $1.2M and roughly $1.4M in FF&E and inventory, putting the asking price on the lower end of what I typically see for similar deals and offering meaningful downside protection. I’d want to understand the revenue breakdown across car wash, repairs, and tire services, the split between fleet and retail customers, and whether traffic remains steady year-round or is subject to seasonal swings. I’d also dig into the age and condition of the key equipment. There appear to be some clear growth levers: with operations currently limited to Monday–Thursday, a new owner could expand by extending hours and adding staff. If the business doesn’t already offer unlimited wash memberships, or if there’s room to scale them, that could unlock a high-margin recurring revenue stream.

3/ Composting Yard

📍 Location: Massachusetts

💰 Asking Price: $1,900,000

💼 EBITDA: $550,000

📊 Revenue: $1,000,000

📅 Established: 1985

💭 My 2 Cents: This composting yard sits at the intersection of sustainability, infrastructure, and recurring B2B demand, a rare combination that offers both purpose and profit. It provides a strategic mix of organic recycling, soil production, and mulch and aggregate sales to a steady base of landscapers, contractors, and municipalities. Composting facilities are notoriously hard to permit and replicate, especially in Massachusetts, so if this site has the right approvals and zoning, it represents a defensible, high-barrier asset in a tightly regulated market. There's a strong management team in place, ensuring operational continuity through and beyond the transition. The facility also includes significant real estate (valued at $600K) and $900K in FF&E and inventory, offering downside protection and room for future expansion. I’d want to understand where their waste inputs come from (contracted or drop-off), whether they have off-take agreements or repeat buyers for finished products, how reliant they are on a small number of clients (particularly municipalities), and how revenue fluctuates seasonally, especially in winter. Ultimately, growing pressure on municipalities to meet zero-waste goals, combined with rising demand from landscapers for organic, locally sourced materials, is driving long-term tailwinds on both the intake and sales sides of the business.

PRESENTED BY SMB DILIGENCE

Here’s Why You Shouldn’t Skip Due Diligence…

A friend of mine put a business under LOI and asked me for my advice.

I recommended he contract a 3rd party due diligence partner to rebuild the company's P&L from scratch.

Turns out their EBITDA was off by 2x 😳

Enter SMB Diligence.

SMB Diligence is the platform I helped start for matching business buyers with vetted diligence providers, from M&A lawyers to Quality of Earnings providers.

Their network of experts has worked on hundreds of small business transactions (including many from the SMB Deal Hunter community).

4/ Organic Dry Cleaner

📍 Location: Delaware

💰 Asking Price: $950,000

💼 EBITDA: $585,516

📊 Revenue: $786,612

📅 Established: 1975

💭 My 2 Cents: Located on a high-traffic street in an affluent, upscale neighborhood, this organic dry cleaning business has served a loyal clientele for over 50 years. You’re acquiring decades of trust in a market that values quality, health, and convenience. The operation runs lean with a team of just three, and with $300K in recently upgraded equipment and the capacity to handle nearly double its current volume, there’s clear growth potential. If not already in place, expanding into pickup and delivery, corporate partnerships, or wedding and formalwear concierge services could open up new high-margin revenue streams. I’d want to review five years of financials to evaluate revenue trends, earnings, capital expenditures, and maintenance costs (particularly how the business has performed post-COVID). Has volume recovered, and are revenues stable or growing? I’d also dig into the revenue mix across dry cleaning, laundry, tailoring, and specialty garments, examine lease terms, and evaluate the competitive landscape within a five-mile radius. While this may not be a flashy acquisition, its strong fundamentals, excess capacity, and multiple paths to growth make it a quietly compelling cash-flow asset for the right buyer.

5/ Commercial Landscaper

📍 Location: New Jersey

💰 Asking Price: $1,600,000

💼 EBITDA: $536,059

📊 Revenue: $1,539,654

📅 Established: 1997

💭 My 2 Cents: This decades-old company provides commercial landscaping and related services for clients ranging from hotels and restaurants to commercial businesses and property managers. I love their business model, with its emphasis on recurring revenue, as they earn over $1M annually from clients on long-term contracts. They currently have 160 full-service clients who are also contracted for snow removal, with this winter work mitigating seasonality issues and ensuring year-round revenue continuity. They come with nearly $1M in FF&E and a team of 20 that includes several employees able to function as management, which could readily help post-sale in executing various duties now handled by the current owner. I’d need to understand what percent of their revenue comes from their top five clients and if there’s any concentration risk, the standard duration and renewal rate for their recurring service contracts, how they differentiate themselves from competitors in what can be a crowded space, how secure their current lease is and what would be involved in relocating their office and parking site, and the condition of their fleet and other key equipment. With a stable client base, essential services, and infrastructure already in place, this looks like a solid platform for steady cash flow and potential regional expansion.

THE BEST OF SMB TWITTER (X)

A quicker primer on seller’s notes (link)

How to spot red flags in a balance sheet (link)

EBITDA explained (link)

10 business red flags (link)

ROIC > WACC (link)

Financial statement green flags (link)

Best subreddits for founders (link)

COMMUNITY PERKS

• Ready to buy and operate a $1M+ business? Partner with my team and get expert support at every step.

• Want to invest passively in SMB acquisitions? Get access to investment opportunities.

• Get a personal introduction to my preferred SBA 7(a) lender, non-SBA lenders, Quality of Earnings providers, or legal counsel

• Raising capital for your deal? I’ll connect you with investors from the SMB Deal Hunter Community.

• Interested in selling your business? I’ll help you connect with buyers from the SMB Deal Hunter Community.

RECENT PODCAST EPISODES

• Former Talent Agent Buys 40-Year-Old Trade Publication And Modernizes It for the Digital Age (link)

• Why This Startup Founder Bought an Electrical Contracting Business (link)

• From Wall Street to Main Street—Why He Left Private Equity to Roll Up Tree Care Companies (link)

THAT’S A WRAP

See you tomorrow with a new podcast episode!

-Helen Guo

Find Me On Twitter

Find Me On LinkedIn

P.S. I'd love your feedback. Tap the poll below or reply to this email.

How was today's newsletter? |

Disclaimer

This publication is a newsletter only and the information provided herein is the opinion of our editors and writers only. Any transaction or opportunity of any kind is provided for information only; SMB Deal Hunter does not verify nor confirm information. SMB Deal Hunter is not making any offer to readers to participate in any transaction or opportunity described herein.