- SMB Deal Hunter

- Posts

- New Deals: An online tutoring business, home care company, and 3 other finds

New Deals: An online tutoring business, home care company, and 3 other finds

Plus, when a stock purchase structure is necessary

Hello SMB Deal Hunters!

I’m excited to share 5 new businesses for sale worth checking out in this Market Watch issue. Each was handpicked from hundreds of fresh listings, with our quick take on why it stands out. First up…

🔥 Community Top Picks from the Last Market Watch Issue:

#1: Commercial facility services business with $604K in EBITDA

#2: Digital marketing agency with $1.65M in EBITDA

#3: Crane servicing and repair company with $1.46M in EBITDA

🔎 Looking for deals in your area? We can source them for you.

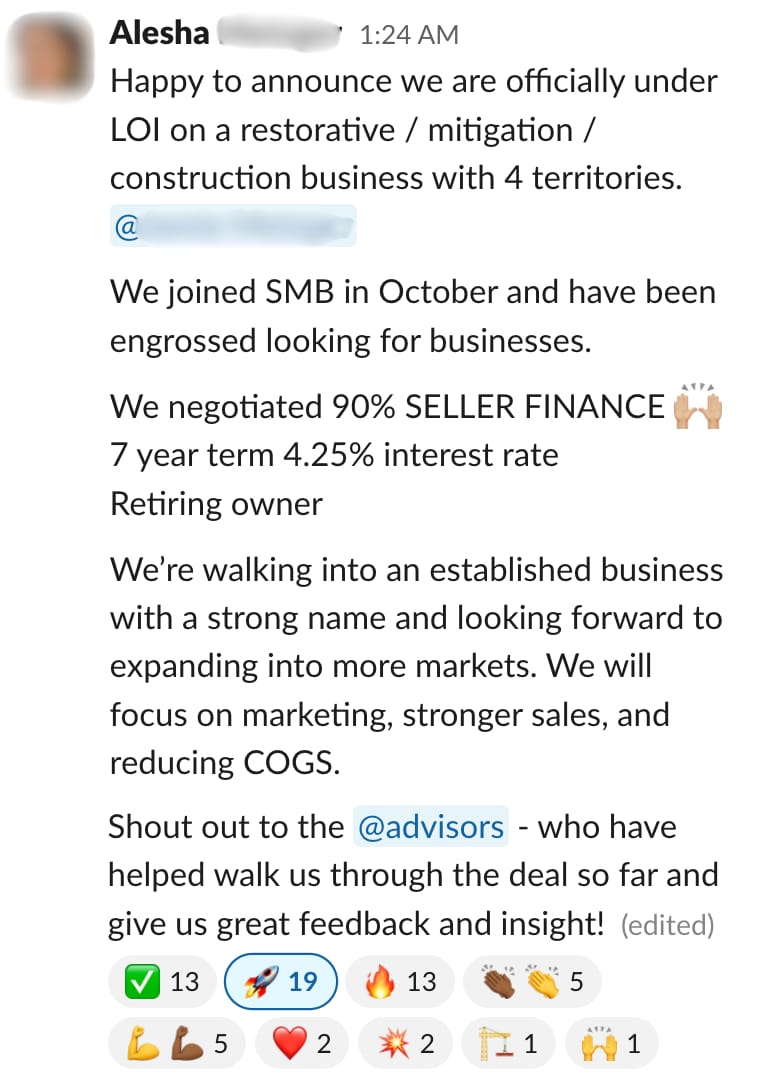

COMMUNITY WINS

Here’s what one SMB Deal Hunter Pro member shared this past week:

Want me and my team to work with you to find, finance, and acquire a million-dollar cash-flowing business in the next 6-12 months?

NEW DEALS

These deals span the country. For custom-sourced deals in your area, click here.

1/ Online Tutoring Business

📍 Location: Florida

💰 Asking Price: $6,000,000

💼 EBITDA: $1,092,338

📊 Revenue: $4,929,302

📅 Established: 2014

💭 My 2 Cents: Online language tutoring combines the sticky economics of subscriptions with the high-margin structure of marketplace platforms, and this Spanish instruction business has reached a scale where unit economics truly work. With over 4,600 active subscribers connected to 260+ tutors across Latin America through a proprietary platform, the company has solved the core challenges that sink most edtech startups: customer acquisition, engagement, and long-term retention. The 70% trial-to-paid conversion rate and strong LTV-to-CAC ratio reflect product-market fit, while a managing director running daily operations alongside fully staffed functional teams suggests the business operates without heavy founder dependency. What's notable is the organic growth trajectory and the recurring revenue base, though there's clear upside through corporate B2B partnerships with companies expanding into Latin American markets, upselling group classes or specialized business Spanish tracks, and potentially leveraging their recorded lesson library for supplemental self-paced content. I'd want to understand tutor churn and compensation structures given how critical talent retention is in marketplace models, platform scalability if subscriber count doubled, and customer concentration across age segments or geographies. As remote learning continues normalizing post-pandemic and Spanish remains the second most studied language globally, this business sits at the intersection of durable demand and a business model that improves with scale.

2/ Home Care Company

📍 Location: Indiana

💰 Asking Price: $11,900,000

💼 EBITDA: $2,380,000

📊 Revenue: $9,800,000

📅 Established: 2008

💭 My 2 Cents: Home care is one of those industries where the hardest problems are operational rather than strategic, and franchise systems exist precisely to solve caregiver recruitment, retention, and scheduling at scale. Operating in protected territories covering Bloomington and Columbus, this business serves a market of over 76,000 seniors with above-average household incomes and strong healthcare infrastructure, providing both senior care and services for disabled adults through integrated scheduling and billing systems. I like that a seasoned administrative team already handles day-to-day execution with minimal owner involvement, while strong caregiver retention addresses the sector's biggest operational challenge. I'd want to understand the revenue split between private pay, Medicaid, and VA contracts given the margin and collection implications, caregiver supply constraints in the local labor market, and whether current office infrastructure and management capacity could support a 50-100% increase in client volume. While growth upside depends heavily on the franchise agreement's economics, this is one of the few industries where demographic trends guarantee demand growth for decades.

3/ Office Printer Supplies E-Commerce Retailer

📍 Location: Florida

💰 Asking Price: $5,500,000

💼 EBITDA: $1,174,321

📊 Revenue: $16,205,738

📅 Established: 2007

💭 My 2 Cents: Printer supplies deliver the kind of predictable, recurring revenue that flashier e-commerce categories struggle to match, and this operation has built a scalable logistics machine around that reliability. They stock over 7,700 SKUs from a 20,000 sq. ft. warehouse processing 2,400 orders weekly, with an experienced operations team running the fulfillment engine while the owner dedicates fewer than five hours per week to the business. What's most impressive is the 67% repeat order rate and 650K+ customer database, metrics that reflect genuine customer loyalty in a category where buying behavior is habitual rather than emotional. Growth has come primarily through PPC and email campaigns without tapping into subscription replenishment models and B2B corporate accounts that could unlock significant upside given the natural reorder cadence of consumables. I'd want to understand exposure to tariffs and overseas sourcing risk given current trade policy uncertainty, competitive pressure from Amazon Business in the office supplies segment, and whether the warehouse has capacity to expand SKU count or handle higher order volumes without major capital investment. While traditional office printing has declined, the broader supplies market continues growing through e-commerce packaging and specialty applications, and this business sits in the sweet spot where customers need to reorder regardless of broader market shifts.

ALUMNI SPOTLIGHT

Debbie was a high-powered tech executive who left her job in 2024 after 25 years and wanted to take control of her financial future.

And within 6 months of joining SMB Deal Hunter Pro, our business buying accelerator, she bought a $1.7M kitchen and bath remodeling business on Cape Cod cash-flowing over $500K/year. In this interview, we discuss how she:

✅ Negotiated a 25 year loan (instead of the usual 10 years) with one specific SBA rule

✅ Pivoted from looking at only online businesses to a very strong local business (and why the former can sometimes be worse)

✅ Prepped for taking over a business that is much more seasonal than many others

4/ Tire Sales & Service Business

📍 Location: Colorado

💰 Asking Price: $2,950,000

💼 EBITDA: $841,865

📊 Revenue: $6,877,593

📅 Established: 2004

💭 My 2 Cents: Tire shops that serve commercial fleets and agricultural operations enjoy fundamentally better economics than consumer-focused competitors, with higher tickets, recurring maintenance schedules, and customers who prioritize uptime over price. This business has built around that reality, serving individual, commercial, and agricultural customers with $500K in equipment and a $1.5M inventory that handles everything from passenger vehicles to heavy farm equipment without delays that cost fleet operators real money. What's particularly attractive is the mix away from price-sensitive retail consumers toward commercial and ag segments, where relationships matter more than Costco's tire prices and seasonal swings are smoothed by year-round equipment needs. An experienced team staying through transition reduces execution risk, while the path to higher valuation lies in expanding adjacent services like alignments, fleet maintenance contracts, or mechanical repairs that leverage existing customer relationships and bay capacity. I'd want to understand why the $1.5M inventory isn't included in the purchase price and the age of that stock, the revenue and margin split between retail, commercial, and ag segments, and whether current bay capacity could support 30-50% more volume. In a fragmented market where most tire shops remain small owner-operator businesses competing on price, this operation's commercial and ag focus creates a defensible position that budget chains struggle to replicate.

5/ Commercial Roof Maintenance Business

📍 Location: Connecticut

💰 Asking Price: $5,800,000

💼 EBITDA: $1,389,162

📊 Revenue: $14,718,399

📅 Established: 2014

💭 My 2 Cents: Commercial roofing contractors that specialize in institutional work operate in a different world than residential roofers, with longer project cycles, higher barriers to entry, and customers who prioritize reliability over low bids. This business has carved out that position exclusively, serving hospitals, schools, and government agencies on large-scale maintenance, reroof, and new construction projects while avoiding the smaller repair work that drags down margins and creates scheduling chaos. With over 50 employees, $2.2M in equipment and assets, and more than $1M in working capital, the company has the operational scale and balance sheet strength to handle multi-month projects that smaller contractors can't bond or staff properly. What's compelling is the insulation from residential construction volatility, as institutional clients plan capital projects years in advance with budgets tied to bond issues and facility master plans rather than home equity and consumer sentiment. I'd want to understand the sales process and whether they rely on a few key relationships or have a repeatable system for winning bids, client concentration across their top five accounts, and whether bonding capacity and facility infrastructure could support 50% more revenue without major capital investment. In a market where most roofing companies stay small because they lack the balance sheet, workforce, and expertise to pursue institutional work, this business has built the exact capabilities that create pricing power and limit competition.

THE BEST OF SMB TWITTER (X)

“Passive income” is probably not going to happen (link)

Non-compete agreements remain fully enforceable (link)

When a stock purchase structure is necessary (link)

Where to use LLM workflows (link)

You need tangible skills to build a business (link)

Doing the things that don’t scale (link)

The highest leverage thing in a business is to change the culture (link)

COMMUNITY PERKS

• Ready to buy and operate a $1M+ business? Partner with my team and get expert support at every step.

• Want to invest passively in SMB acquisitions? Get access to investment opportunities.

• Get a personal introduction to my preferred SBA 7(a) lender, non-SBA lenders, Quality of Earnings providers, or legal counsel

• Raising capital for your deal? I’ll connect you with investors from the SMB Deal Hunter Community.

• Interested in selling your business? I’ll help you connect with buyers from the SMB Deal Hunter Community.

RECENT PODCAST EPISODE

Nathan lost everything on his first deal. Four deals later, and he now makes over $13M/year.

In this episode, he breaks down how he went from broke to a massively successful HVAC rollup:

Prefer audio-only? Listen on Spotify or Apple Podcasts.

THAT’S A WRAP

See you tomorrow!

-Helen Guo

Find Me On Twitter

Find Me On LinkedIn

P.S. I'd love your feedback. Tap the poll below or reply to this email.

How was today's newsletter? |

Disclaimer

This publication is a newsletter only and the information provided herein is the opinion of our editors and writers only. Any transaction or opportunity of any kind is provided for information only; SMB Deal Hunter does not verify nor confirm information. SMB Deal Hunter is not making any offer to readers to participate in any transaction or opportunity described herein.