- SMB Deal Hunter

- Posts

- New Deals: A sliding glass door repair business, shipment monitoring device manufacturer, and 3 other finds

New Deals: A sliding glass door repair business, shipment monitoring device manufacturer, and 3 other finds

Plus, how to think about SDE as a buyer

Hello SMB Deal Hunters!

I’m excited to share 5 new businesses for sale worth checking out. First up…

🔥 Community Top Picks from the Last Issue:

#1: IT managed service provider with $559K in EBITDA

#2: Plumbing business with $505K in EBITDA

#3: Facility maintenance company with $1M in EBITDA

Today's issue is sponsored by SMB Diligence, the platform I helped start for matching business buyers with vetted legal counsel and Quality of Earnings providers.

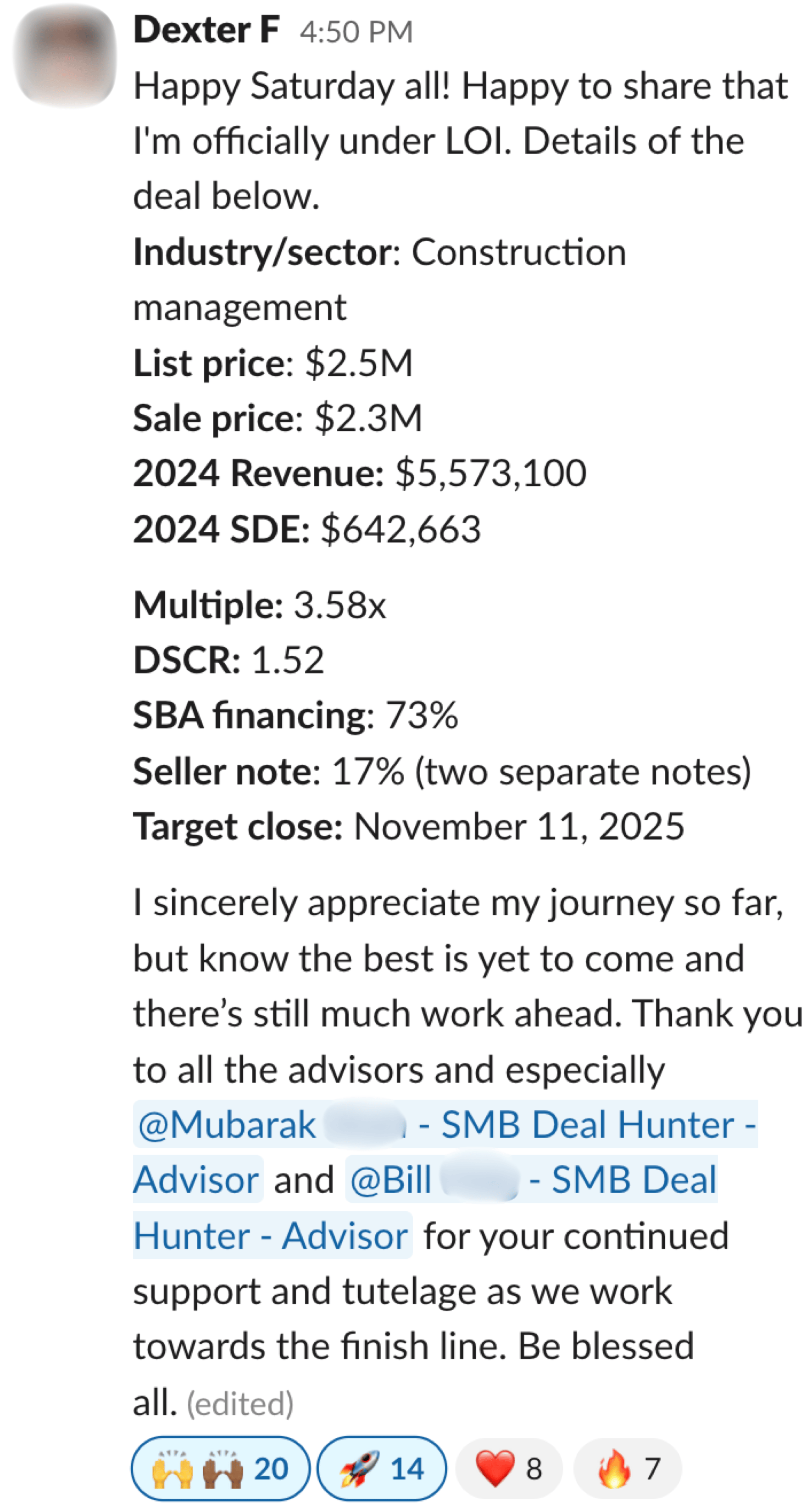

COMMUNITY WINS

Here’s what one SMB Deal Hunter Pro member shared this past week:

Want me and my team to work with you to find, finance, and acquire a million-dollar cash-flowing business in the next 6-12 months?

NEW DEALS

These deals span the country. For custom-sourced deals in your area, click here.

1/ Sliding Glass Door Repair Business

📍 Location: Florida

💰 Asking Price: $2,100,000

💼 EBITDA: $562,776

📊 Revenue: $2,428,314

📅 Established: 2003

💭 My 2 Cents: Cape Coral has one of the highest concentrations of homes with patios, lanais, and waterfront views, meaning sliding doors are everywhere. And with hurricanes, salt air, and humidity, ongoing maintenance of doors, rollers, and tracks is a constant need. This 20+ year-old business has carved out a strong niche (established operators like this typically have deep relationships with local GCs, HOAs, and property managers) and their sale includes a facility valued at $600K, $334K in inventory, and $273K in FF&E. The real value is in skilled labor (parts are inexpensive compared to labor margins). Good techs can generate $100–150/hour billable work with low COGS, so I’d want to dig into how many techs there are, their pay, and their tenure. I’d also want to understand how the business is structured to scale up during storm surges that drive spikes in demand (and how they manage off-season slowdowns), as well as how leads are currently generated (Google reviews, SEO, Angi, property managers, storm events). For a growth-minded buyer, there is a clear opportunity to grow through upselling hurricane-rated glass, impact windows, and energy-efficient upgrades.

2/ Shipment Monitoring Device Manufacturer

📍 Location: California

💰 Asking Price: N/A

💼 EBITDA: $1,363,205

📊 Revenue: $4,109,700

📅 Established: 1971

💭 My 2 Cents: This California-based supplier has a 50+ year track record designing and manufacturing shipment monitoring devices for a diversified global client base of large companies across the logistics, aerospace, energy, and electronics sectors. While they already produce items that are mission-critical to the global supply chain, what stands out is how they’ve stayed current with the latest developments, having recently launched an IoT-enabled product line that supports smart packaging, cold chain, and e-commerce monitoring. Because these devices protect high-value cargo and compliance, customers pay for reliability rather than the cheapest tag (which is reflected in their strong margins). Legacy firms in this space generally generate ~70–80% of revenue from hardware sales with some calibration/service revenue, whereas modernized firms are shifting toward ~40–50% hardware + 20–30% calibration/recertification + 20–40% software/SaaS, so I’d want to know if there’s an opportunity here to expand into subscription revenue. I’d also want to understand their inventory levels and lead times and how much cash is tied up in receivables and inventory. With tailwinds from global trade, defense reshoring, stricter pharma regulations, and rising demand for electronics and semiconductors, this company appears well-positioned for durable growth.

3/ Electrical Contractor

📍 Location: Florida

💰 Asking Price: $3,000,000

💼 EBITDA: $1,020,637

📊 Revenue: $3,702,629

📅 Established: 2001

💭 My 2 Cents: Electrical work is essential in residential, commercial, and industrial settings, with consistent demand driven by new construction, renovation, and service/maintenance (especially in a growing market like Central Florida). Notably, electrical contractors generally carry a backlog of signed projects, providing near-term revenue certainty for a buyer. This 25-year-old electrical contractor operates from a facility available on a long-term lease at a favorable rate and comes with approximately $600K in vehicles and equipment. I’d want to know their revenue and margin breakdown across residential vs. commercial vs. service, the mix of recurring service contracts vs. one-off project work, the size and visibility of their current backlog and pipeline, and who holds the qualifying master electrician license in the business (and whether they will stay). I’d also want to understand if a handful of general contractors provide most of the work (such that losing one relationship could materially impact revenue) and what working capital requirements look like, since subcontractor work often requires floating payroll before GC/client payments are received. It’s hard to recruit qualified electricians today, so acquiring an existing crew can be a huge entry barrier for competitors.

PRESENTED BY SMB DILIGENCE

Here’s Why You Shouldn’t Skip Due Diligence…

A friend of mine put a business under LOI and asked me for my advice.

I recommended he contract a 3rd party due diligence partner to rebuild the company's P&L from scratch.

Turns out their EBITDA was off by 2x 😳

Enter SMB Diligence.

SMB Diligence is the platform I helped start for matching business buyers with vetted diligence providers, from M&A lawyers to Quality of Earnings providers.

Their network of experts has worked on hundreds of small business transactions (including many from the SMB Deal Hunter community).

4/ Landscaping Company

📍 Location: New Hampshire

💰 Asking Price: $2,050,000

💼 EBITDA: $625,000

📊 Revenue: $1,103,000

📅 Established: 2005

💭 My 2 Cents: I’m a big fan of residential landscaping companies as they provide a recurring revenue base while capturing higher margins through one-off projects such as hardscaping, tree care, irrigation, and property enhancements. At the same time, it can be a crowded space, so businesses need to clearly differentiate themselves. This company has done so with a 20-year history built around sustainability and environmentally conscious practices. They address the seasonality of their New Hampshire market by offering snowplowing services to their customer base. Notably, their revenue has remained consistent over the past 4+ years with strong 50%+ net margins, and the sale includes $1.2M in vehicles and equipment. I’d want to evaluate the share of recurring revenue, whether they have an established lead generation engine for new customer acquisition, the age, mileage, and maintenance logs for their trucks, plows, and equipment (and any upcoming capex needs), and how they manage seasonal staffing. Two experienced foremen oversee day-to-day operations, and the owner is open to staying involved for up to a year, making this a potentially compelling turnkey opportunity.

5/ CRM Consulting Firm

📍 Location: Florida

💰 Asking Price: $6,000,000

💼 EBITDA: $1,532,808

📊 Revenue: $2,985,980

📅 Established: 2013

💭 My 2 Cents: I was excited to come across this consulting business because it mixes predictable subscription-style revenue with exposure to a fast-growing market projected to expand at double-digit rates through 2030. Mid-sized companies are investing heavily in CRM and workflow automation to stay competitive, and this company already serves clients in the US, Canada, and Europe. A key strength at this size is their established marketing strategy that consistently generates new leads, coupled with an experienced management team committed to staying on. I especially like how their streamlined operation translates into strong cash flow and margins, and how their proprietary AI tools show they’re keeping pace with new technology. I’d need to better understand their average contract length and renewal rates, the industries their clients represent and how recession-resilient they are, their average sales cycle and customer acquisition cost, and which CRMs/automation platforms they are proficient with (Hubspot, Salesforce, Make, Zapier, etc.). Ultimately, switching costs are high because their services become deeply embedded in client workflows.

THE BEST OF SMB TWITTER (X)

How SMBs can outperform PE portfolio companies (link)

Guarding against accounting fraud (link)

6-step plan to extend your runway (link)

3 biggest marketing mistakes in home service businesses (link)

How to think about SDE as a buyer (link)

10 businesses that always make money (link)

HVAC sales are declining (link)

COMMUNITY PERKS

• Ready to buy and operate a $1M+ business? Partner with my team and get expert support at every step.

• Want to invest passively in SMB acquisitions? Get access to investment opportunities.

• Get a personal introduction to my preferred SBA 7(a) lender, non-SBA lenders, Quality of Earnings providers, or legal counsel

• Raising capital for your deal? I’ll connect you with investors from the SMB Deal Hunter Community.

• Interested in selling your business? I’ll help you connect with buyers from the SMB Deal Hunter Community.

RECENT PODCAST EPISODES

• This Software Engineer bought a $3.2M business with a baby on the way (link)

• He turned $100k -> $6M buying landscaping businesses (here's how) (link)

• He bought a $1.3M business with just $15k (here's how) (link)

THAT’S A WRAP

See you next Tuesday!

-Helen Guo

Find Me On Twitter

Find Me On LinkedIn

P.S. I'd love your feedback. Tap the poll below or reply to this email.

How was today's newsletter? |

Disclaimer

This publication is a newsletter only and the information provided herein is the opinion of our editors and writers only. Any transaction or opportunity of any kind is provided for information only; SMB Deal Hunter does not verify nor confirm information. SMB Deal Hunter is not making any offer to readers to participate in any transaction or opportunity described herein.