- SMB Deal Hunter

- Posts

- New Deals: A commercial facility services business, crane servicing and repair company, and 3 other finds

New Deals: A commercial facility services business, crane servicing and repair company, and 3 other finds

Plus, why working capital is so important

Hello SMB Deal Hunters!

I’m excited to share 5 new businesses for sale worth checking out in this Market Watch issue. Each was handpicked from hundreds of fresh listings, with our quick take on why it stands out. First up…

🔥 Community top picks from the last Market Watch issue:

#1: Jukebox route business with $1.1M in EBITDA

#2: Specialty foods manufacturer with $1M in EBITDA

#3: Residential and commercial plumbing company with $561K in EBITDA

🔎 Looking for deals in your area? We can source them for you.

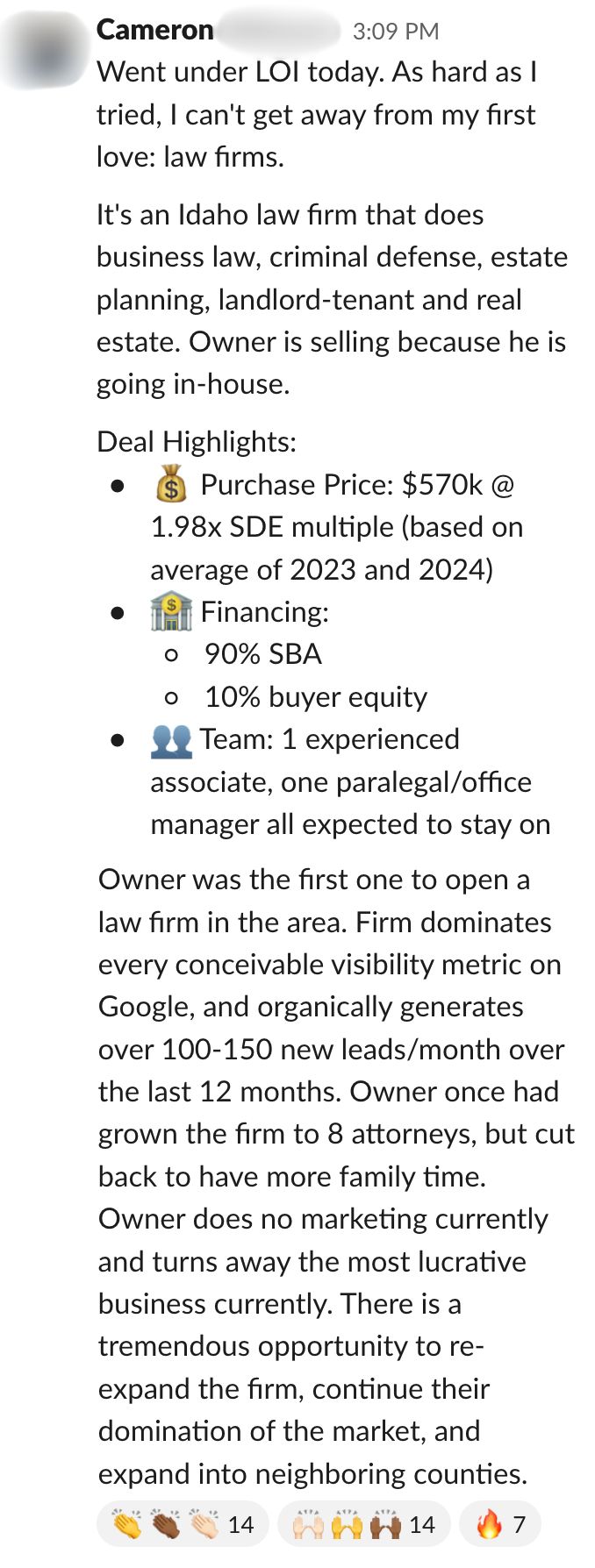

COMMUNITY WINS

Here’s what one SMB Deal Hunter Pro member shared this past week:

Want me and my team to work with you to find, finance, and acquire a million-dollar cash-flowing business in the next 6-12 months?

NEW DEALS

These deals span the country. For custom-sourced deals in your area, click here.

1/ Commercial Facility Services Business

📍 Location: Pennsylvania/New Jersey

💰 Asking Price: $2,500,000

💼 EBITDA: $604,850

📊 Revenue: $2,745,613

📅 Established: 20+ Years Ago

💭 My 2 Cents: While most people never notice who keeps their office buildings spotless, the companies behind that work generate some of the stickiest revenue streams in small business, and this Mid-Atlantic operation demonstrates why. They offer a full spectrum of janitorial, maintenance, and commercial cleaning services, serving a diverse client base that likely includes office buildings, retail centers, and industrial facilities where cleanliness and upkeep aren't optional. What stands out is the operational depth: 60 employees, many with over a decade of tenure, suggest strong culture and low turnover in an industry notorious for churn, while dual hubs in Pennsylvania and New Jersey enable efficient logistics and resilient client retention. I see clear potential to scale by expanding service offerings among current customers, targeting neighboring metros, or layering in specialized services like disinfection or facilities management. I’d want to know their average contract terms and renewal rates, how concentrated their client base is across their top five accounts, how they manage scheduling and quality control, whether pricing has kept pace with wage inflation given rising labor costs across the service sector, and what would be involved in expanding regionally or taking on new clients in current service areas. In a fragmented market where most competitors are small, single-location operators, a business with this scale, geographic reach, and employee stability offers a platform for aggressive roll-up potential.

2/ Crane Servicing & Repair Company

📍 Location: Northern California

💰 Asking Price: $6,400,000

💼 EBITDA: $1,463,000

📊 Revenue: $4,800,000

📅 Established: 35+ Years Ago

💭 My 2 Cents: Few service businesses can claim both mandatory recurring revenue and 30% margins, but crane servicing delivers exactly that through the combination of regulatory inspections and high switching costs. This San Francisco operation has spent over three decades becoming the go-to provider for installations, repairs, preventive maintenance, and Cal/OSHA inspections, serving clients who cannot afford downtime or compliance failures in industries like construction, manufacturing, and logistics. I really like how their maintenance contracts and mandated inspections drive steady recurring revenue, while their asset-light model (no office facility required) enables impressive 30% EBITDA margins on nearly $5M in revenue. The 35-year track record suggests deep institutional knowledge and long-standing customer relationships that would be difficult for competitors to replicate, especially given the specialized certifications required and the risk clients face switching providers mid-contract. I'd want to understand who holds the critical inspector certifications beyond the owner and if there’s redundancy, dig into customer concentration across construction versus industrial clients (construction is more cyclical), and assess whether manufacturer-direct service programs are eating into the independent market. What’s exciting for a growth-oriented buyer is the potential to expand into complementary verticals, such as forklift and commercial door servicing.

3/ Paving Company

📍 Location: New Mexico

💰 Asking Price: $1,200,000

💼 EBITDA: $509,070

📊 Revenue: $750,000

📅 Established: 2002

💭 My 2 Cents: Paving contractors typically grind out single-digit margins on commodity work, which makes this New Mexico operation's 68% EBITDA margin almost too good to be true and worth understanding in detail. This profitability level suggests either highly specialized services like microsurfacing or slurry seal applications, minimal subcontractor reliance, or exclusive relationships with municipal clients that provide steady, high-margin maintenance contracts. With $500K in equipment and inventory included in the sale, you're buying real assets that provide immediate operational capacity and reduce upfront capital needs, though I'd want to understand equipment age, maintenance history, and whether any major replacements are on the horizon. The seller's willingness to stay on for six months and offer 30% financing shows confidence in the transition, but I'd dig into the breakdown between public bidding and private commercial work, crew management depth, and whether these margins reflect sustainable pricing power or deferred equipment maintenance and below-market labor costs. Given ongoing infrastructure spending at federal and state levels and New Mexico's harsh climate that accelerates road deterioration, demand for quality paving should remain strong. The real question is whether this margin profile represents a truly differentiated operation with proprietary client relationships, or accounting that will normalize significantly under new ownership once hidden costs surface.

ALUMNI SPOTLIGHT

Michael was a corporate accountant who’d seen firsthand how valuable small businesses could be, but struggled to figure out how to break in.

Two months into joining SMB Deal Hunter Pro, we found the off-market deal Michael ended up closing on, a niche digital marketing agency primarily servicing law firms with:

✅ $400k/year in cashflow

✅ 3+ year average customer lifetime

✅ Fully remote operations

4/ Custom Mirror & Glass Fabrication, Sales & Installation Business

📍 Location: Florida

💰 Asking Price: $6,400,000

💼 EBITDA: $996,000

📊 Revenue: $3,226,000

📅 Established: 1983

💭 My 2 Cents: The mirror and glass business is surprisingly fragmented despite consistent demand, which gives established players with in-house fabrication capabilities a meaningful edge over the mom-and-pop shops that dominate most local markets. Operating from a fully renovated 7,425 sq. ft. facility that houses showroom, fabrication, and warehouse space, the business has built a vertically integrated model that controls everything from custom cutting and fabrication to installation and post-sale service, which protects margins and creates sticky customer relationships across residential, commercial, and contractor channels. What's particularly compelling is the 40-year track record in one of Florida's fastest-growing regions, where population influx, hurricane building codes requiring impact-resistant glass, and steady home renovation activity create sustained tailwinds that most local competitors can't capitalize on at scale. The inclusion of the real estate (valued at $2.4M) in the asking price adds meaningful stability and protects against rising lease costs, though I'd want to understand the breakdown between new construction versus replacement and repair revenue, the capacity utilization of the fabrication equipment, and whether the business has exclusivity or preferred vendor agreements with builders or property management companies. With the shift toward energy-efficient windows and smart glass technology gaining traction, this business is positioned to ride both renovation spending and the premium upgrade cycle that coastal Florida properties command.

5/ Digital Marketing Agency

📍 Location: Remote

💰 Asking Price: $8,500,000

💼 EBITDA: $1,649,641

📊 Revenue: $2,892,049

📅 Established: 2011

💭 My 2 Cents: What separates this digital marketing agency from the crowded field of freelancers and boutique shops is its ability to serve enterprise clients like NBA teams while maintaining the cost structure of a lean, remote-first operation. They have built a diversified service offering spanning website design, custom software development, and marketing execution for B2B clients across e-Commerce, SaaS, and sports entertainment, with the 57% EBITDA margin reflecting the scalability of selling expertise without the drag of physical infrastructure. What's particularly compelling is that 80% of revenue is recurring or contract-based, providing predictable cash flow and reducing the volatility typical of project-based agencies, while recent contract wins and a strong pipeline suggest momentum heading into a sale. I'd want to understand how much revenue is tied to the founder's relationships versus the broader team, the average contract length and renewal rates, and whether the custom software work creates ongoing maintenance revenue or is primarily one-time builds. Given the agency's remote structure, a buyer could tap into global talent pools to scale delivery capacity without geographic constraints, turning what was once a lifestyle business into a platform for aggressive growth across verticals where digital presence remains non-negotiable.

THE BEST OF SMB TWITTER (X)

In evaluating a business, focus on cash flow (link)

Consider raising equity to buy the right-sized company (link)

Why working capital is super important for a searcher (link)

How to know if you’re growing at the right pace (link)

10 KPIs every SMB owner should track (link)

The invisible SMB recession (link)

Difference between IOI and LOI (link)

COMMUNITY PERKS

• Ready to buy and operate a $1M+ business? Partner with my team and get expert support at every step.

• Want to invest passively in SMB acquisitions? Get access to investment opportunities.

• Get a personal introduction to my preferred SBA 7(a) lender, non-SBA lenders, Quality of Earnings providers, or legal counsel

• Raising capital for your deal? I’ll connect you with investors from the SMB Deal Hunter Community.

• Interested in selling your business? I’ll help you connect with buyers from the SMB Deal Hunter Community.

RECENT PODCAST EPISODE

Nathan lost everything on his first deal. Four deals later, and he now makes over $13M/year.

In this episode, he breaks down how he went from broke to a massively successful HVAC rollup:

Prefer audio-only? Listen on Spotify or Apple Podcasts.

THAT’S A WRAP

See you tomorrow!

-Helen Guo

Find Me On Twitter

Find Me On LinkedIn

P.S. I'd love your feedback. Tap the poll below or reply to this email.

How was today's newsletter? |

Disclaimer

This publication is a newsletter only and the information provided herein is the opinion of our editors and writers only. Any transaction or opportunity of any kind is provided for information only; SMB Deal Hunter does not verify nor confirm information. SMB Deal Hunter is not making any offer to readers to participate in any transaction or opportunity described herein.