- SMB Deal Hunter

- Posts

- New Deals: A hospitality staffing firm, auto parts and salvage business, and 3 other finds

New Deals: A hospitality staffing firm, auto parts and salvage business, and 3 other finds

Plus, what lenders actually look for

Hello SMB Deal Hunters!

📣 Last Call: I’m investing in the acquisition of a lighting controls and energy management systems company and opening it to a few SMB Deal Hunter members. Learn more about this fully passive opportunity.

Now onto regular business…I’m excited to share 5 new businesses for sale worth checking out in this Market Watch issue. Each was handpicked from hundreds of fresh listings, with our quick take on why it stands out. First up…

🔥 Community Top Picks from the Last Market Watch Issue:

#1: Commercial fountain design and maintenance company with $1.37M in EBITDA

#2: Site development and earthwork business with $1.28M in EBITDA

#3: Auto repair shop with $1M in EBITDA

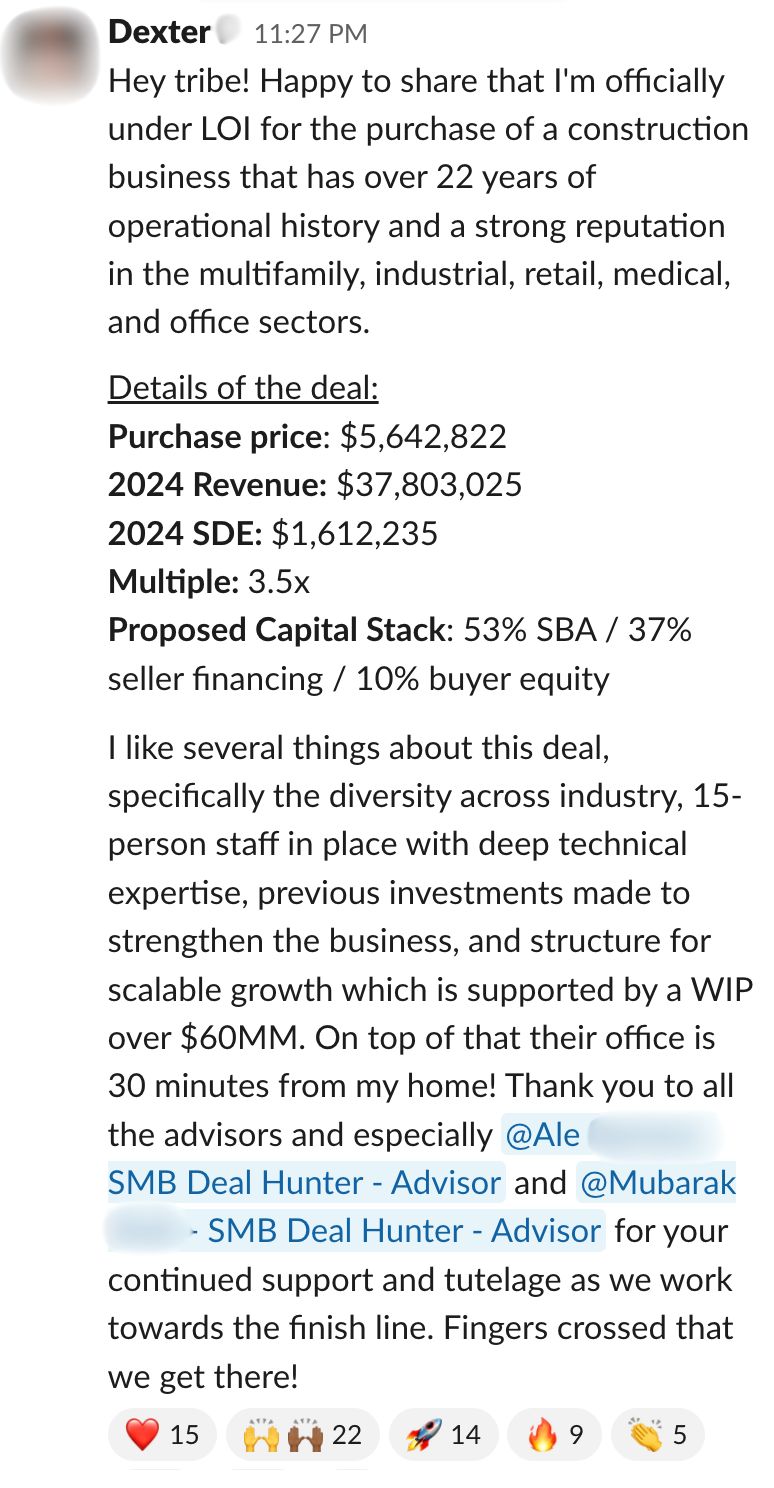

COMMUNITY WINS

Here’s what one SMB Deal Hunter Pro member shared this past week:

Want me and my team to work with you to find, finance, and acquire a million-dollar cash-flowing business in the next 6-12 months?

NEW DEALS

These deals span the country. For custom-sourced deals in your area, click here.

1/ Hospitality Staffing Firm

📍 Location: California

💰 Asking Price: $5,500,000

💼 EBITDA: $1,131,213

📊 Revenue: $19,912,039

📅 Established: 1999

💭 My 2 Cents: This Los Angeles-based hospitality staffing agency has been serving clients across California, Washington, and Nevada for over 25 years. Key end users range from hotels and universities to senior living facilities and national foodservice brands, with notable clients including Compass Group, Aramark, Sodexo, and Marriott. I really like their use of proprietary AI software, which automates their entire workflow and enables clients to request staff 24/7 through an online portal. Their revenue is well diversified, with approximately 60% from recurring clients and 40% from event-driven revenue, creating both stability and upside despite thin margins. I also like their growth potential, as they are poised to expand into New York and are well-positioned to move into Arizona, Texas, and Florida. As they continue to grow, they’ll win larger national contracts as enterprises prefer vendor consolidation. I’d need to get a handle on the status (W-2 vs. 1099) of their 2,000 active field employees and compliance risk (especially in CA), what turnover and wage inflation look like, % of revenue from top 5 clients along with renewal terms, the impact of their AI software on labor cost or client retention, the cash-flow lag between payroll and client payments, and what investment from both a corporate overhead and local sales effort will be required for the contemplated expansion. As hospitality has rebounded to full capacity post-COVID, demand for temp labor is only going to keep driving business for this company.

2/ Auto Parts & Salvage Business

📍 Location: New York

💰 Asking Price: $4,000,000

💼 EBITDA: $1,000,000

📊 Revenue: $4,866,000

📅 Established: ~1975

💭 My 2 Cents: This auto salvage business may fit the very definition of unsexy, but it’s as recession resilient as they come. When new car sales slow, demand for used parts rises. They offer both professional wrecking and scrap metal services and the sale of late-model used auto parts. What’s impressive for a ~50-year-old family business is they use a computerized inventory management system that enables rapid identification and retrieval of high-quality used auto parts, ensuring efficient operations and quick turnaround times for clients. As a result, they run on ~20% EBITDA margins whereas most peers in this industry operate at 10–15%, a sign of operational sophistication uncommon in smaller salvage yards. I’d want to know their revenue split between parts sales and salvage operations, what % of parts are sold locally vs. online, how they source both wrecked vehicles and parts customers, how scrap metal price volatility impacts margins and what mechanisms exist to mitigate it, the resale value of the land, equipment, and inventory, the systems in place for environmental compliance and hazardous material disposal, and the key family members involved in sales, procurement, and yard management. For a growth-minded buyer, thousands of small yards remain unaggregated, creating a large roll-up opportunity.

3/ Landscaping Company

📍 Location: Montana

💰 Asking Price: $5,600,000

💼 EBITDA: $1,546,844

📊 Revenue: $6,283,250

📅 Established: 1990

💭 My 2 Cents: This landscaping company checks nearly every box buyers look for: recurring revenue, strong margins, a management team in place, and year-round operations. They’ve built a top-notch reputation as a one-stop outdoor services provider, handling everything from lawn maintenance and sprinkler system installation to hydro seeding and weed control. I like how, given their harsh winter climate, they operate year-round through snow removal, Christmas light installation, and small-engine repair. With more than 2,000 active customers and a 200-client waitlist, they maintain an exceptionally high level of recurring revenue (approximately 90%), with a balanced mix of 75% commercial and 25% residential customers providing the foundation for their significant cash flow and very strong margins. They come with an experienced leadership team in two general managers and two foremen and $2.5M in equipment, providing significant hard asset value. Much of the equipment is newer, minimizing the risk of equipment failure and repair. However, I’d like more details on their standard recurring contracts, including their terms, duration, and renewal rate. I’d also want to look into what is driving their waitlist and what would be needed to address the bottleneck, how they acquire new clients (referrals, SEO, Google Ads), and what opportunities might exist to expand geographically. The owner has already confirmed everyone wants to stay and has begun transitioning his day-to-day tasks to the GMs, so this could be an interesting opportunity for a buyer that wants to work “on the business” and not in it.

ALUMNI SPOTLIGHT

After successfully starting and exiting an e-Commerce business, Francisco knew he didn’t want to jump back into the startup grind from zero again with no guarantees of success.

He wanted something recession-resistant and was ready to spend a lot less time in front of a screen. 9 months later, he bought a tree service business in North Carolina that’s bringing in about $280K a year in cash flow. In this interview, Francisco shares how he:

Bought a $650k tree service business for $60k down

Avoided closing on a restoration business that wasn’t actually right for him and his wife (even though the numbers looked great)

Kept the key people in the business from leaving after the acquisition (since he has no experience running a tree service business)

4/ Tutoring Centers

📍 Location: Texas

💰 Asking Price: $3,150,000

💼 EBITDA: $562,751

📊 Revenue: $3,211,961

📅 Established: 2007

💭 My 2 Cents: Persistent academic gaps post-COVID and parents' continued investment in academic performance have kept tutoring demand elevated nationwide, making this an attractive and stable sector. This Texas-based network of seven supplemental education centers serves students in grades K–12, providing personalized instruction in reading, math, writing, homework support, and test preparation. As part of a nationally recognized education franchise, they benefit from a proven curriculum, strong brand equity, and a reputation for measurable academic results. At the same time, it’ll be important to understand all the details of the franchise agreement, including the fees, other costs, and any restrictions. A real positive is the inclusion of real estate for three of their locations valued at $1.6M, as these assets account for more than half the list price and can significantly improve the terms of an SBA loan. I’d need to check on the relative performance of each center, how much competition they face in their local markets, what enrollment seasonality looks like, average student lifetime value, churn, and referral rates, and if there are any challenges in attracting and retaining qualified tutors. Ultimately, families continue to prioritize education spending even in economic downturns, which should create resilience for this business. Plus, supplemental education as an alternative to private school is gaining traction among middle-class families.

5/ HVAC Company

📍 Location: Colorado

💰 Asking Price: $10,500,000

💼 EBITDA: $2,425,055

📊 Revenue: $9,980,791

📅 Established: 1979

💭 My 2 Cents: This large-scale HVAC company in Western Colorado jumped out at me with its unusually balanced revenue mix across commercial, residential, and service work. They employ 25 full-time staff and operate out of an 8,150 sq ft seller-owned facility (available separately for $1.4M), with their workflow breaking down approximately 40% commercial installation, 40% residential installation, and 20% service and emergency maintenance, ensuring sustained year-round earnings. I love that their EBITDA margins (24%) are well above industry averages (typically 12–18%), and that they come with $464K in FF&E and $1.5M in working capital and inventory. I also really like that the seller, who is responsible for strategic oversight and customer relations, is open to remaining involved for an extended period to ensure a smooth transition. However, I’d need to dig into who their key clients typically are and if there’s any potential concentration risk, what their current backlog and pipeline look like, how they source new business, how they attract and retain skilled technicians, the condition and projected lifespan of their equipment, and how much additional work they could handle with their current assets. While installation work can fluctuate with construction activity, the Western Colorado area is projected to grow steadily, and tax incentives and sustainability mandates in Colorado should continue to encourage HVAC modernization.

THE BEST OF SMB TWITTER (X)

Things that do and don’t kill deals (link)

The McKinsey AI report (link)

What lenders actually look for (link)

Remote work can be a great option for a business (link)

Are single service contractors going out of style? (link)

Cash flow is king (link)

Evaluating addbacks in SMB transactions (link)

COMMUNITY PERKS

• Ready to buy and operate a $1M+ business? Partner with my team and get expert support at every step.

• Want to invest passively in SMB acquisitions? Get access to investment opportunities.

• Get a personal introduction to my preferred SBA 7(a) lender, non-SBA lenders, Quality of Earnings providers, or legal counsel

• Raising capital for your deal? I’ll connect you with investors from the SMB Deal Hunter Community.

• Interested in selling your business? I’ll help you connect with buyers from the SMB Deal Hunter Community.

RECENT PODCAST EPISODE

Devin acquired 2 declining home healthcare businesses and successfully turned them around…with only $50k down (and zero healthcare experience).

In this episode, he tells his almost unbelievable story:

Prefer audio only? Click here to listen on Spotify, Apple Podcasts, or wherever you get your podcasts.

THAT’S A WRAP

See you tomorrow!

-Helen Guo

Find Me On Twitter

Find Me On LinkedIn

P.S. I'd love your feedback. Tap the poll below or reply to this email.

How was today's newsletter? |

Disclaimer

This publication is a newsletter only and the information provided herein is the opinion of our editors and writers only. Any transaction or opportunity of any kind is provided for information only; SMB Deal Hunter does not verify nor confirm information. SMB Deal Hunter is not making any offer to readers to participate in any transaction or opportunity described herein.