- SMB Deal Hunter

- Posts

- New Deals: An asphalt & paving business, auto glass repair business, and 3 other finds

New Deals: An asphalt & paving business, auto glass repair business, and 3 other finds

Plus, an opportunity to invest alongside me in a business acquisition

Hello SMB Deal Hunters!

📣 Quick heads up: I sent out an email earlier today about a fully passive investment opportunity in the acquisition of an 80+ year old manufacturer that builds mission-critical parts for everything from Boeing rockets to AI data center turbines. I’m investing personally and bringing on a select few SMB Deal Hunter members to join me.

Now onto regular business…

I’m excited to share 5 new businesses for sale worth checking out in this Market Watch issue. Each was handpicked from hundreds of fresh listings, with our quick take on why it stands out. First up…

🔥 Community Top Picks from the Last Market Watch Issue:

#1: Tree care business with $651K in EBITDA

#2: Industrial staffing company with $938K in EBITDA

#3: Commercial painting business with $340K in EBITDA

🔎 Looking for deals in your area? We can source them for you.

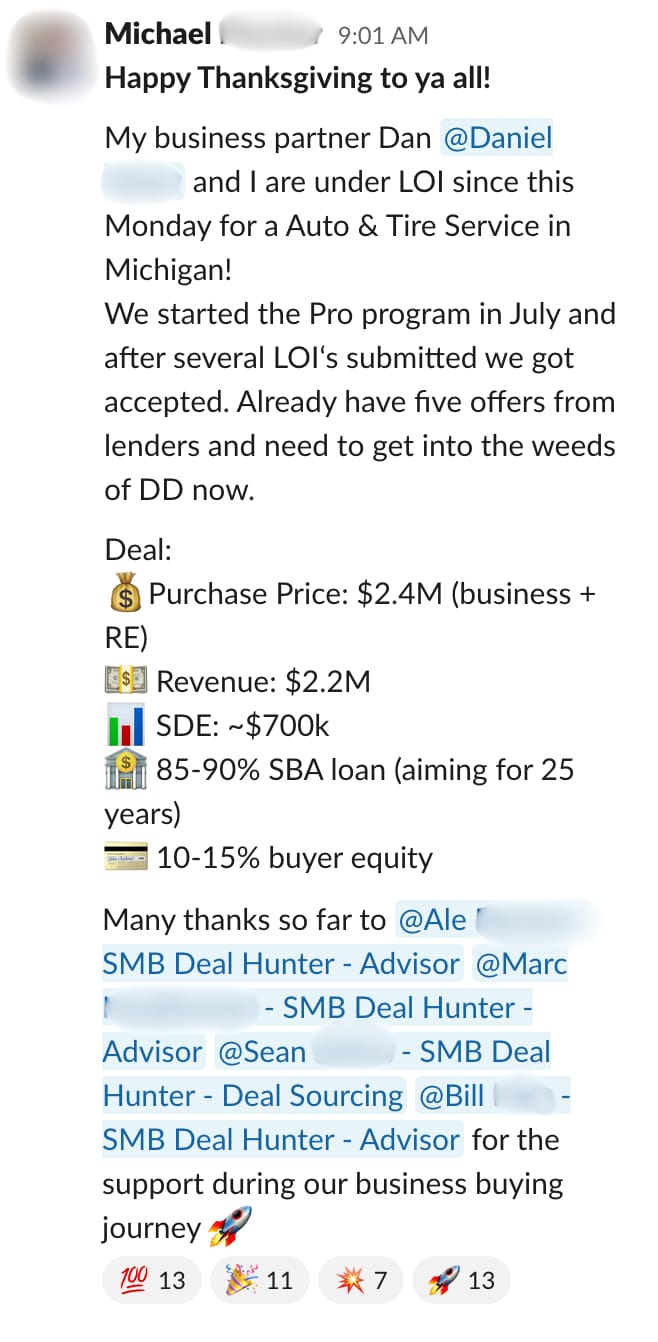

COMMUNITY WINS

Here’s what one SMB Deal Hunter Pro member shared this past week:

Want me and my team to work with you to find, finance, and acquire a million-dollar cash-flowing business in the next 6-12 months?

NEW DEALS

These deals span the country. For custom-sourced deals in your area, click here.

1/ Asphalt & Paving Business

📍 Location: Arkansas

💰 Asking Price: $4,750,000

💼 EBITDA: $877,836

📊 Revenue: $6,483,947

📅 Established: 1980

💭 My 2 Cents: This Central Arkansas paving contractor focuses almost exclusively on public-sector work, which tends to be predictable, bid-driven, and less volatile than private construction cycles. In operation for an impressive 45 years, they have built long-term municipal and Arkansas Department of Transportation relationships, ensuring a steady flow of reliable repeat business. They come with experienced supervisory staff and more than $4.45M in equipment, enough to operate two full crews. I really like how much unused capacity is sitting in their asset base, as it seems there is twice as much equipment as is currently in use, so a new owner could double the workload without needing to invest in expensive new equipment. This level of hard assets also acts as a strong downside risk mitigator, as it is nearly worth the entire asking price, meaning a buyer’s purchase goes almost entirely to tangible (theoretically resellable) assets, rather than intangible goodwill. I'd want to understand current backlog and pipeline visibility, the competitive landscape for public bids in the region, bonding capacity and how it transfers, and whether there's appetite from existing customers for expanded services like sealcoating or parking lot work. The beauty of this business is that municipal road budgets are non-discretionary line items that get funded in good times and bad, making this one of the most recession-resistant models in construction.

2/ Auto Glass Repair Business

📍 Location: Arizona

💰 Asking Price: $6,200,000

💼 EBITDA: $1,669,436

📊 Revenue: $9,873,091

📅 Established: 2013

💭 My 2 Cents: Auto glass repair rarely gets systematized beyond a scheduling spreadsheet and a shop full of technicians, which is what makes this Phoenix operation exceptional. The owner has built genuine infrastructure around automation and KPIs, enabling semi-absentee operations where vacations don't disrupt workflow, a rarity in this trades-heavy segment. Arizona is particularly attractive for auto glass, accounting for 10% of all U.S. claims despite representing just 2% of the population, driven by extreme heat, gravel roads, and highway rock chips that create relentless demand. The business operates from two facilities, each with excess capacity, meaning a new owner could layer in volume through insurance partnerships, fleet contracts, or mobile service expansion without immediate capital outlays. I'd want to understand the revenue split between insurance referrals and direct bookings, how ADAS calibration is priced and integrated into the service offering, whether the KPI software is proprietary or transferable, and technician availability in the Phoenix market given the labor constraints across skilled trades. With new vehicles increasingly requiring recalibration after windshield replacement, this business is positioned at the intersection of a high-demand geography and a service category gaining technical complexity and pricing power.

3/ Wildlife Removal and Home Renovation Company

📍 Location: Texas

💰 Asking Price: $4,900,000

💼 EBITDA: $1,344,000

📊 Revenue: $6,750,000

📅 Established: 2000

💭 My 2 Cents: Wildlife removal paired with home renovation creates a natural upsell cycle that most pest control companies never capture, and this business has built both a thriving multi-location operation in Texas and a growing franchise system spanning multiple states. What's unusual here is buying the entire franchisor entity rather than a single franchise location, which means you're acquiring both cash-flowing corporate stores and a royalty stream from franchisees across the country. The dual revenue model provides downside protection and upside optionality: corporate locations generate immediate EBITDA while franchise fees and royalties compound as the network expands with minimal capital investment. The fact that operators are willing to pay for franchise rights suggests strong brand equity, proven systems, and genuine support infrastructure that goes beyond a simple licensing agreement. I'd want to understand the split between corporate EBITDA and franchise royalties, the franchisee support stack (training, lead generation, technology platforms), and whether wildlife work naturally leads to renovation projects or if cross-selling requires deliberate effort. The wildlife removal business model itself is appealing because nuisance animal problems create urgent, emotion-driven service calls that convert at high rates and often reveal structural damage requiring immediate repair work that the company is perfectly positioned to capture.

ALUMNI SPOTLIGHT

David spent 20+ years in tech, starting from video games and ending in a program management role in FinTech.

He had decided to leave and acquire a business for multiple reasons…increasing competition from international dev talent, AI-related disruption, and layoffs.

❗️And then went on to spin his wheels alongside his business partner for 2 years searching for a business to buy on their own…

Within 6 months of joining SMB Deal Hunter Pro, our business buying accelerator, we helped them buy a 20-year-old outdoor fire effects business based in Hawaii cash-flowing $775K/year.

In this interview, David shares how we helped him break out of a 2-year cycle of treading water and finally get clear on what to buy.

4/ Commercial Cleaning Company

📍 Location: Tennessee

💰 Asking Price: $3,049,000

💼 EBITDA: $593,751

📊 Revenue: $3,296,916

📅 Established: 1986

💭 My 2 Cents: Commercial cleaning is the kind of unsexy, contract-driven business that quietly prints cash while everyone chases the next shiny thing. This nearly 40-year-old janitorial operation has built exactly the kind of recurring revenue model buyers dream about, with 89% of revenue locked into annual contracts that often renew for years. The economics are compelling: exceptionally low overhead with just $1,600 monthly rent (in a facility available for purchase) and minimal asset requirements, keeping fixed costs lean while preserving margin. Four decades of operating history in one market suggests they've figured out how to retain clients and manage the workforce challenges that sink most cleaning companies, though I'd want to confirm the strength of those client relationships and understand whether contracts are truly sticky or vulnerable to underbidding. The real diligence work here is around labor: understanding their W-2 versus 1099 mix, employee turnover rates, after-hours staffing logistics, and quality control systems that keep customers from churning. The multiple feels slightly aggressive, but if this business is truly delivering 90% recurring revenue with low capital intensity and proven client retention, it's worth exploring whether there's room to layer in higher-margin specialty services like floor refinishing or post-construction cleanup that leverage the existing client base.

5/ Commercial and Municipal Landscaping Business

📍 Location: Nebraska

💰 Asking Price: $1,700,000

💼 EBITDA: $590,000

📊 Revenue: $1,400,000

📅 Established: 1992

💭 My 2 Cents: With 90% of revenue coming from commercial and municipal accounts, this landscaping operation has built the kind of contract-driven business model that most lawn care companies chase but never quite achieve. Unlike residential services where customers bounce between providers over a few dollars, commercial clients prioritize reliability and consistency, which creates stickier relationships and more predictable cash flow across apartment complexes, office parks, and government properties. The infrastructure is solid: $400K in equipment included in the sale, a 2,500 square foot facility at just $3,000 monthly rent, and a disciplined weekly maintenance schedule that minimizes breakdowns and surprise capex. Located in a growing Omaha metro submarket with expanding commercial development, the business is positioned to capture new accounts without needing to chase work in saturated residential neighborhoods. Growth opportunities exist through natural add-ons like hardscaping, irrigation, and snow removal, which would smooth revenue seasonality and deepen wallet share with existing clients. I'd want to understand the current revenue mix between recurring maintenance contracts and project-based work, how they manage labor and equipment utilization during Nebraska winters, and whether key commercial relationships are tied to the owner or formalized through multi-year service agreements. What's often overlooked in landscape businesses is that the real competitive moat isn't the equipment or pricing, it's the reliability and trust built over years of showing up on time with trained crews, something a new entrant can't replicate quickly.

THE BEST OF SMB TWITTER (X)

The most important trait of a business owner (link)

7 cash flow myths (link)

Help employees solve problems so you don’t have to (link)

Sales involving the sudden death of the owner (link)

Buy a business or start from scratch? (link)

Tips for dealing with 10 common business problems (link)

A few reminders about wealth and building a business (link)

COMMUNITY PERKS

• Ready to buy and operate a $1M+ business? Partner with my team and get expert support at every step.

• Want to invest passively in SMB acquisitions? Get access to investment opportunities.

• Get a personal introduction to my preferred SBA 7(a) lender, non-SBA lenders, Quality of Earnings providers, or legal counsel

• Raising capital for your deal? I’ll connect you with investors from the SMB Deal Hunter Community.

• Interested in selling your business? I’ll help you connect with buyers from the SMB Deal Hunter Community.

RECENT PODCAST EPISODE

Jacky has built a portfolio of 50 online businesses over 10 years that now make a whopping $200K/month.

But here's what makes this episode even more fascinating: Only 20 of Jackie’s 50+ acquisitions make up that $200K/month. The rest have ‘died.’

This is a must-watch episode for anyone curious about online assets or just wants to understand platform risk before it bites you:

And for our audio-only listeners, jump in and listen on Spotify or Apple Podcasts!

THAT’S A WRAP

See you tomorrow!

-Helen Guo

Find Me On Twitter

Find Me On LinkedIn

P.S. I'd love your feedback. Tap the poll below or reply to this email.

How was today's newsletter? |

Disclaimer

This publication is a newsletter only and the information provided herein is the opinion of our editors and writers only. Any transaction or opportunity of any kind is provided for information only; SMB Deal Hunter does not verify nor confirm information. SMB Deal Hunter is not making any offer to readers to participate in any transaction or opportunity described herein.